The Peninsula

South Korean Losses from China’s THAAD Retaliation Continue to Grow

By Troy Stangarone

After more than a year of China taking steps to pressure South Korea over its decision to deploy the United States’ Terminal High Altitude Area Defense (THAAD) system, it looked as though China was changing its tactics on the issue. While Beijing continued to maintain its opposition to the deployment of THAAD, China and South Korea reached an agreement in November to restore normal economic relations. That no longer appears to be the case.

China’s retaliation over THAAD took place in industries ranging from automobiles to tourism, the one area where China’s THAAD retaliation has perhaps hurt the most. After the November agreement, China eased the ban on group tours slightly by lifting the restrictions on tour agencies in Beijing and Shandong Province. However, online sales restrictions remained and the tours were not allowed to visit Lotte Duty Free stores, maintaining the retaliation on Lotte who provided the land for the THAAD deployment. However, at the end of December there were suggestions that the ban was put back in place. Even if the recent suggestions of the ban being reinstated are unfounded, the original ban has only been cracked open.

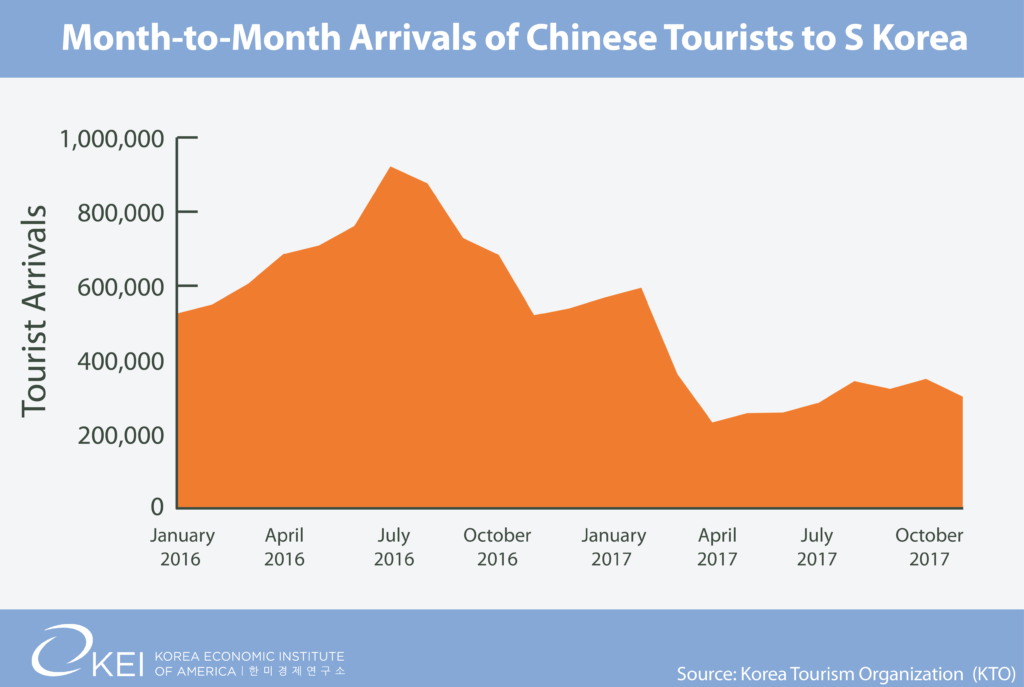

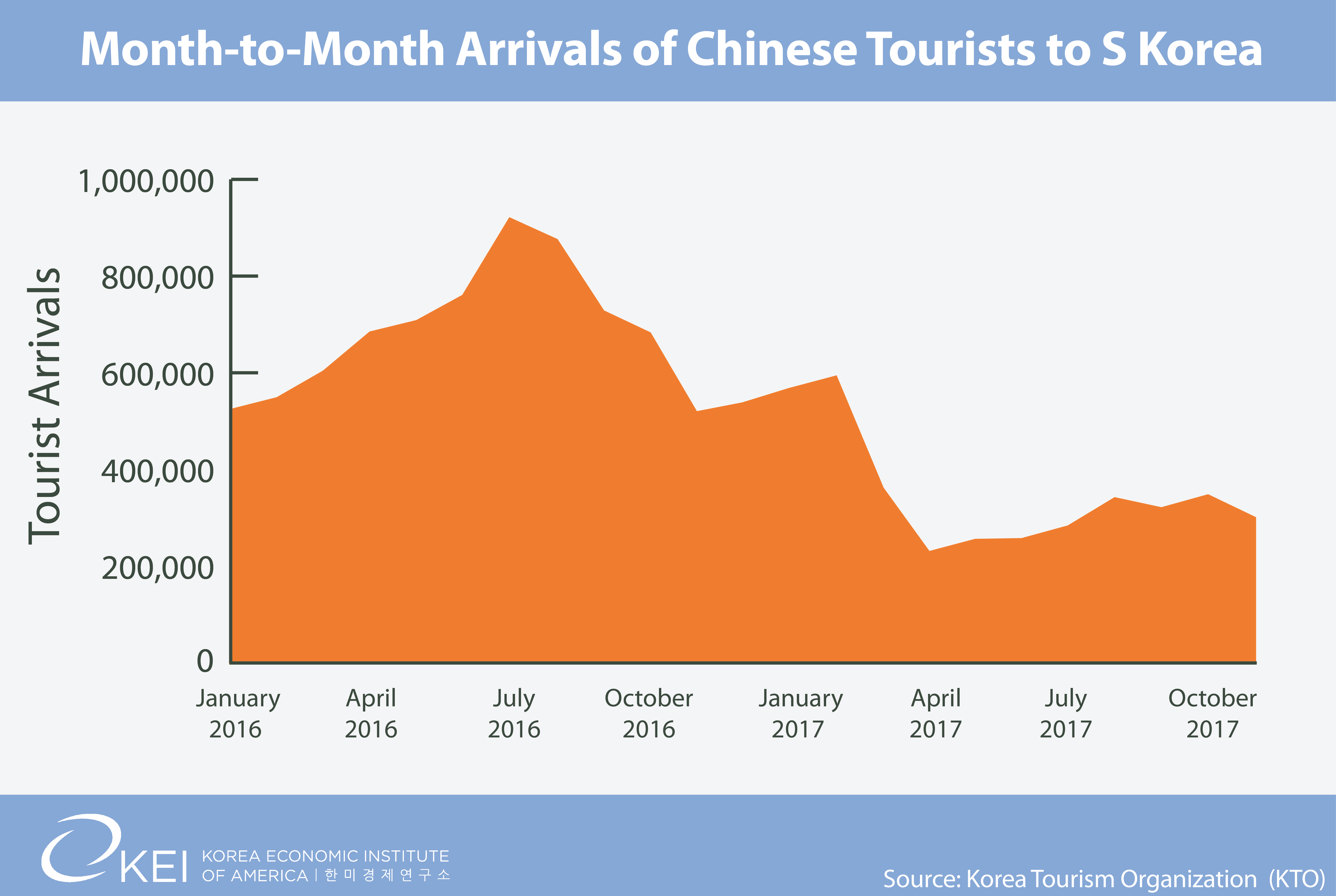

Either way, the ban has had a significant effect on Chinese tourism in South Korea. Through November of 2017, 3.7 million fewer Chinese tourists had traveled to South Korea compared to 2016 as a result of the ban according to data put out by the Korea Tourism Organization. As a result, the South Korean tourism industry has seen an approximate loss of $7.7 billion.

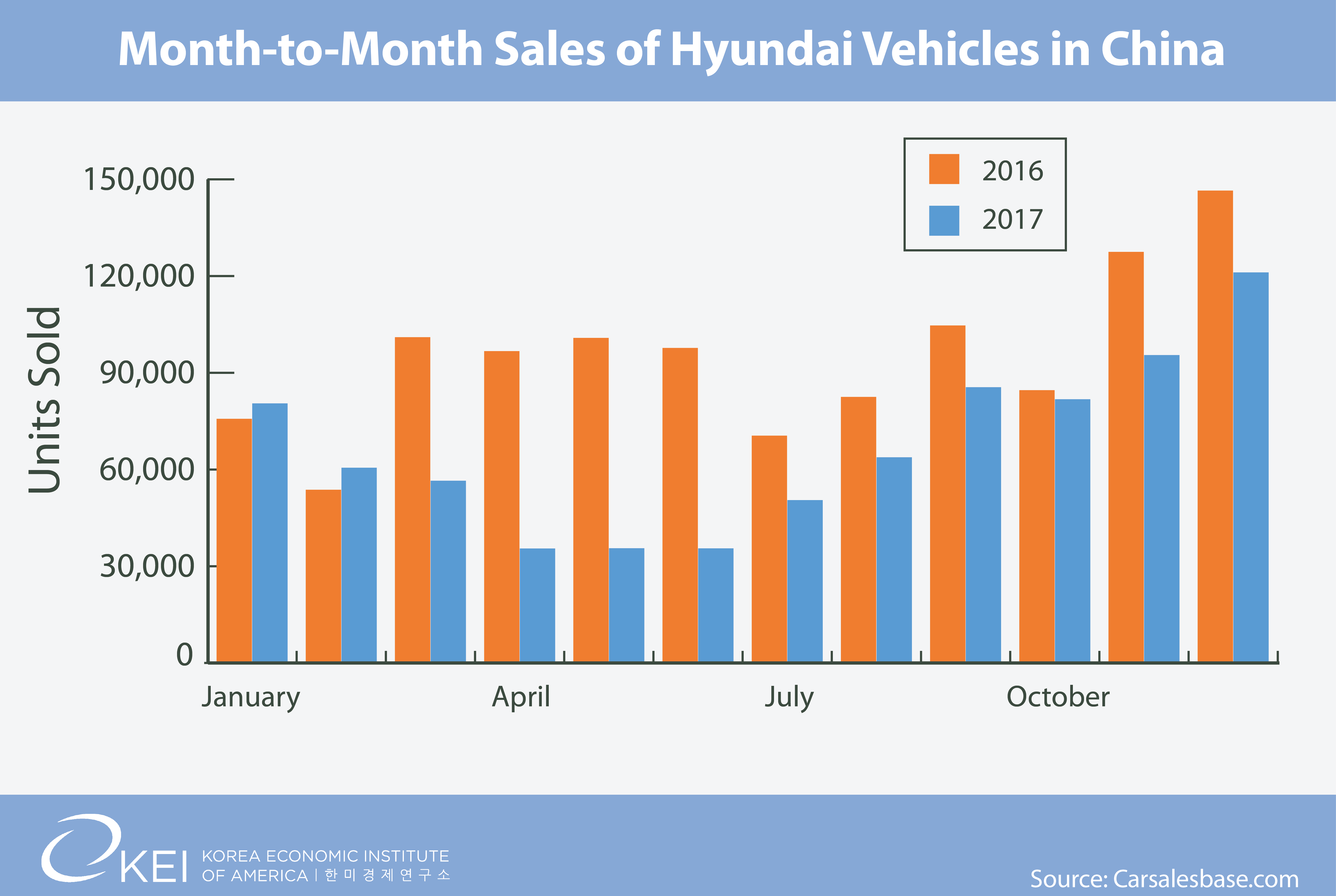

Another area hit by THAAD has been South Korean automobile sales in China. Similar to the South Korean tourism industry, Hyundai saw a sharp decline in sales in March of 2017 when THAAD initially arrived in South Korea. In contrast to the tourism industry, sales began to recover in July but still remain between 17 and 28 percent below 2016 sales with the exception of October[1]. While Hyundai doesn’t release sales revenue by region, the drop in volume has been significant with over 300,000 fewer vehicles sold in 2017 compared to 2016.

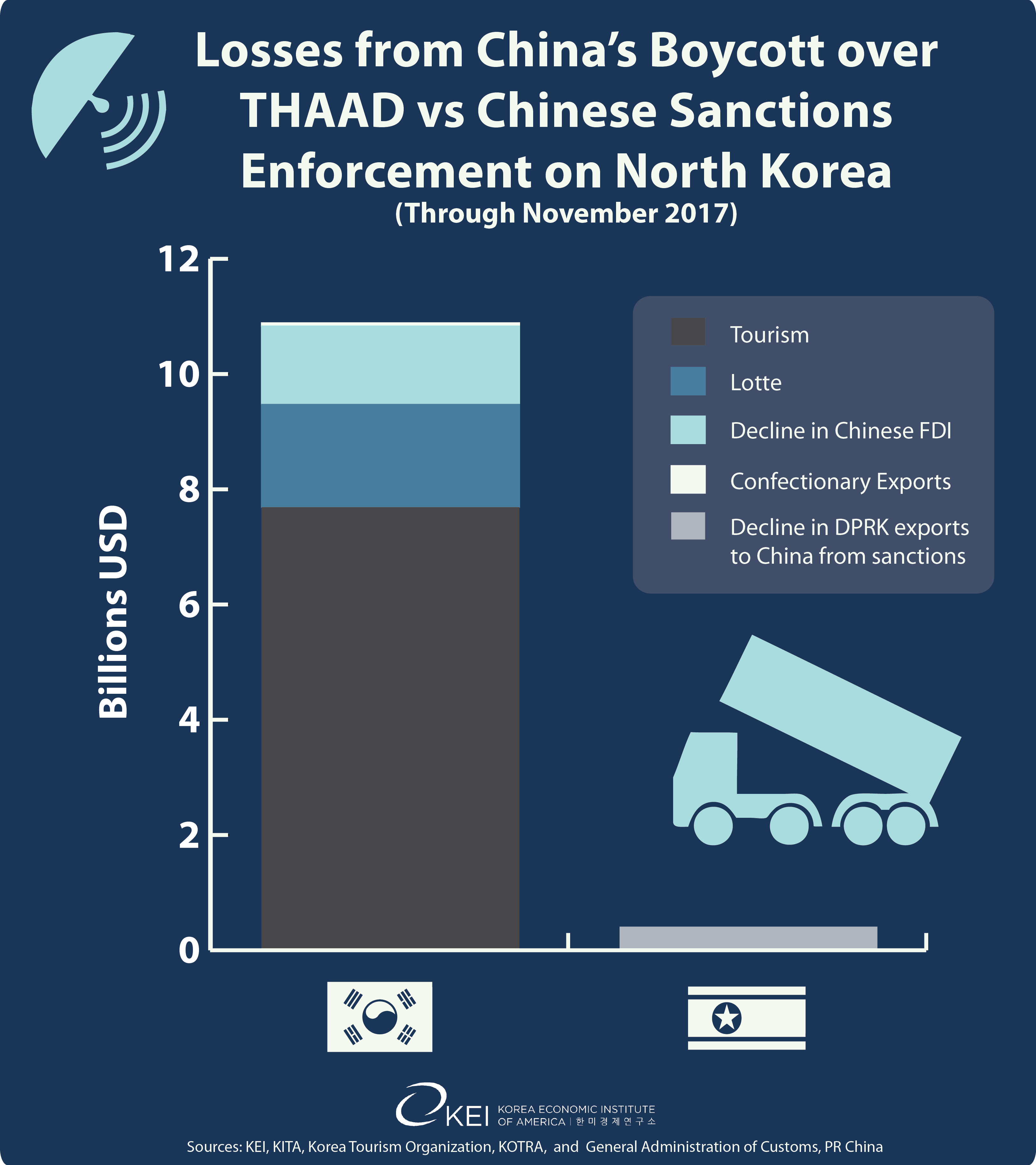

Not all of the industries that China has targeted can easily be converted into estimated losses in revenue or trade. However, the estimated losses to Lotte, tourism, confectionary exports, and the decline in Chinese FDI account for a loss to date of over $10 billion for South Korea. In contrast, North Korean exports to China had declined by only $573 million through November of 2017 as a result of increasing UN sanctions.

Given the opaque nature of Chinese actions against South Korea it will be difficult to tell when all of the sanctions have been lifted, but one good indicator will be when month-to-month visitors to South Korea and auto sales in China begin to exceed their 2016 figures. Until then, South Korean firms will likely continue to experience losses from China’s unjust actions.

Troy Stangarone is the Senior Director for Congressional Affairs and Trade at the Korea Economic Institute of America. The views expressed here are the author’s alone.

Photo from Warren R.M. Stuart’s photostream on flickr Creative Commons.

[1] Sales figures exclude sales of vehicles exported to China.