The Peninsula

2025 Year in Review: Old Trade Order, Meet the New Trade Order

Published December 29, 2025

Author: Tom Ramage

Category: Economic Security, Economics, South Korea, US-Korea alliance

The following is part of a new miniseries from KEI surveying the most important developments and trends in the U.S.-South Korea relationship in 2025. You can read all year-in-review pieces by clicking here.

2025 saw a paradigm shift in how the United States conducts trade with South Korea. New presidents in both Washington and Seoul not only meant an entirely reconfigured economic policy, but new approaches and methods to how they are negotiated. While going into the president’s inauguration the Donald Trump administration set clear expectations about its tariff-based “economic nationalism” trade policy, the more than five months between the beginning of Trump’s second term in January and South Korea’s June 3 special elections meant that it would take until mid-summer for U.S.-South Korea trade policy to enter the “Trump Round” of negotiations.

In the interim, the trade actions the new U.S. administration took were manifold. Section 232 tariffs on autos and auto parts as well as steel and aluminum (which were readjusted to an even higher rate) were some of the first actions that fundamentally altered the way the United States and South Korea engaged in commerce. On April 2, the president unveiled the new “Liberation Day” tariff rates, initially targeting South Korea at 25 percent. And on the economic security front, South Korea lost its “tier 1” status to access U.S. chips in May under the previously drafted AI Diffusion Rule, with some South Korean companies later losing their validated end user status to continue exporting equipment to facilities in China—a casualty of increasing U.S.-China competition. Pending Section 232 investigations on semiconductors, pharmaceuticals, and other such industries also cast a shadow over future flows of trade.

Although the United States and South Korea had previously traded virtually tariff-free under the Korea-U.S. Free Trade Agreement (KORUS FTA), April 2 made clear that the old way of doing things was no longer in effect. Instead, the new trade order would be defined by where South Korea’s industries had strength in the U.S. market and where industrial cooperation was indispensable. As other trading partners such as the United Kingdom, the European Union, and Japan made their own deals with the United States into the summer, they made a framework for what a competitive deal with the United States would look like for South Korea. Liberation Day also served as an accelerant for other countries to pursue their own trade blocs between each other—for instance, renewed progress on a South Korea, Japan, China FTA, or an APEC-focused FTA for the Asia-Pacific—seeking to reform the power centers which previously carried goods across the Pacific.

In any case, South Korean negotiators’ efforts ultimately paid off in securing a 15 percent tariff rate—including for autos—at a level aligned with South Korea’s other trade competitors, such as Japan. This was made possible by a USD 350 billion investment fund constructed in a way that is sensitive to South Korea’s foreign exchange position, to be committed toward investments in seven different strategic industries, including shipbuilding. The bargain is that South Korea, for the foreseeable future, secures continued engagement in the U.S. market, preserves its own red lines on its agricultural sector, and gets treated no worse than significant competitors in autos and semiconductors.

However trade between the United States and South Korea shapes out as a result of the “Trump Round” deal, what is certain is that the world has departed from the expectations and cadence of the previous status quo trade order. It will likely take some time before the effects of the tariffs and tariff deals can be fully ascertained. The new way of doing trade is now largely conditional, transactional, and leveraged by strategic industries. It remains to be seen how this may ultimately change the economic direction of the United States, its foreign trading partners, and global trading blocs as a whole.

Tom Ramage is Economic Policy Analyst at the Korea Economic Institute of America (KEI). The views expressed are the author’s alone.

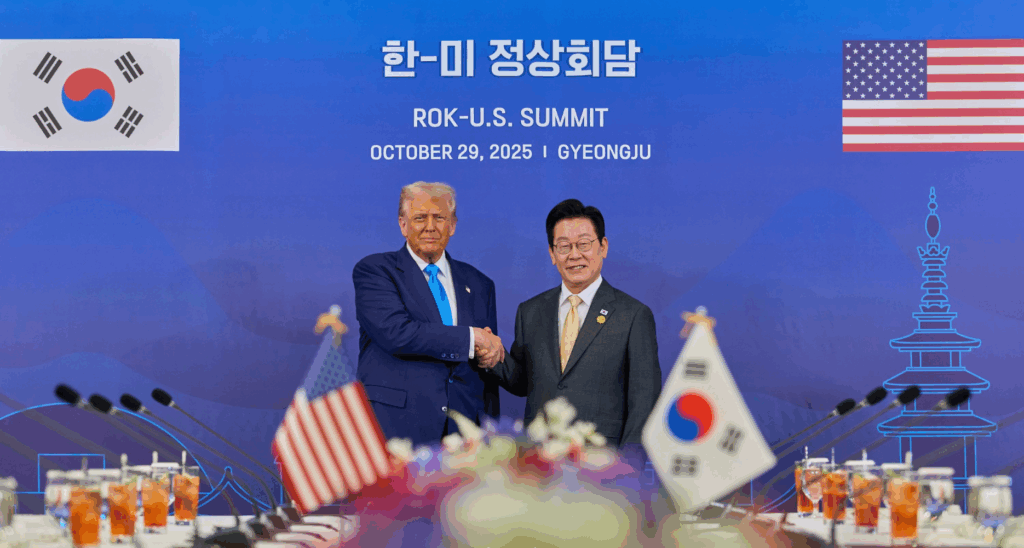

Feature image from the South Korean Presidential Office.

KEI is registered under the FARA as an agent of the Korea Institute for International Economic Policy, a public corporation established by the government of the Republic of Korea. Additional information is available at the Department of Justice, Washington, D.C.