The Peninsula

Korean Firms Navigate Japanese Export Restrictions

Published October 5, 2021

Author: Korea View

Category: South Korea, Japan, China, Economics, Current Events

What Happened

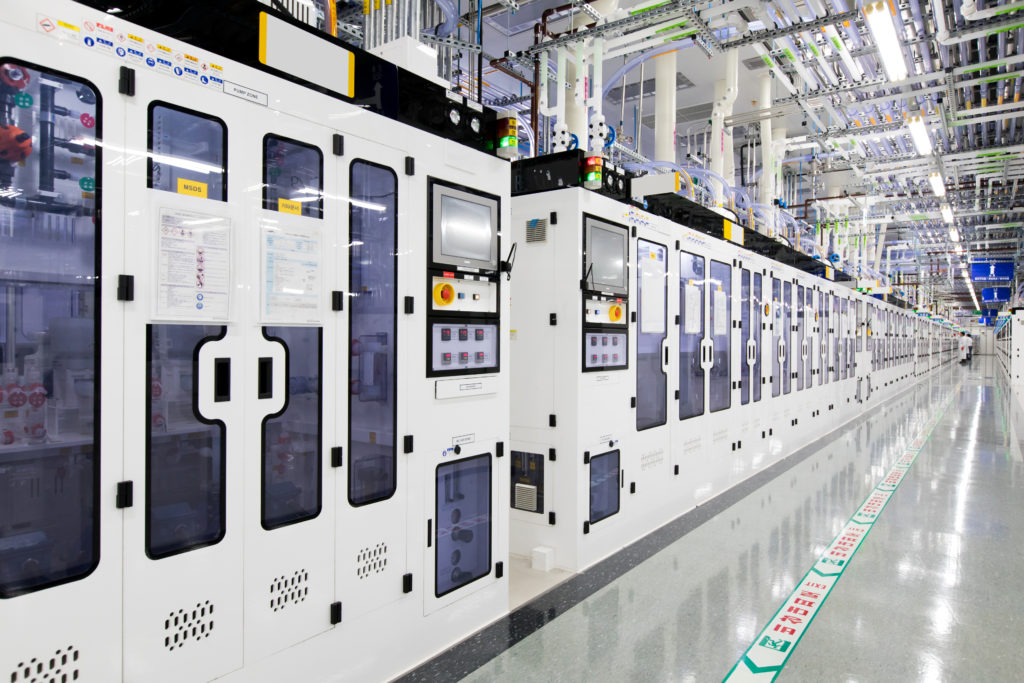

- In 2019 July, Japan imposed export restrictions on sensitive chemicals which South Korean industries need to produce semiconductors and electronic gadgets.

- Japan’s export restrictions by Japan and retaliatory public boycotts on Japanese products from Korean consumers have persisted longer than any other disputes before.

- Two years after the start of this dispute, Korea is less dependent on Japan for semiconductor input materials.

Implications: Korean corporations’ perception of supply chain resilience includes moving away from single-source suppliers. Case in point, South Korean semiconductor manufacturers were reducing their reliance on Japanese suppliers even before the trade dispute. The data from the Korean government suggests that the overall import of chemicals from Japan has gradually fallen from USD 17.4 billion in 2011 to USD 11.6 billion by 2019. Instead of importing from Japan, South Korea has been either establishing new partnerships with producers from countries like Belgium or developing its own manufacturing capacity. These existing moves help explain how Korea was able to adapt relatively quickly to the Japanese export restrictions.

Context: Korean corporations may have become more aware of their external vulnerabilities after Chinese retaliation against Seoul’s installation of U.S.-operated anti-ballistic missile system called THAAD in 2017. Unlike the case with Japan, the unofficial retaliation from China against South Korean firms did not affect their ability to manufacture goods. However, Chinese clients began excluding Korean products and services such as batteries and department store chains. This exposed Korea’s heavy reliance on merchandise exports to China and pushed firms to diversify their international clientele.

This briefing comes from Korea View, a weekly newsletter published by the Korea Economic Institute. Korea View aims to cover developments that reveal trends on the Korean Peninsula but receive little attention in the United States. If you would like to sign up, please find the online form here.

Korea View was edited by Yong Kwon with the help of Janet Hong and Yubin Huh. Picture from the flickr account of Samsung Newsroom