The Peninsula

Korean Battery Producers Build New Renewable Supply Chains

Published May 2, 2022

Author: Sarah Marshall, Korea View

Category: South Korea, Korea Abroad, Economics, Current Events

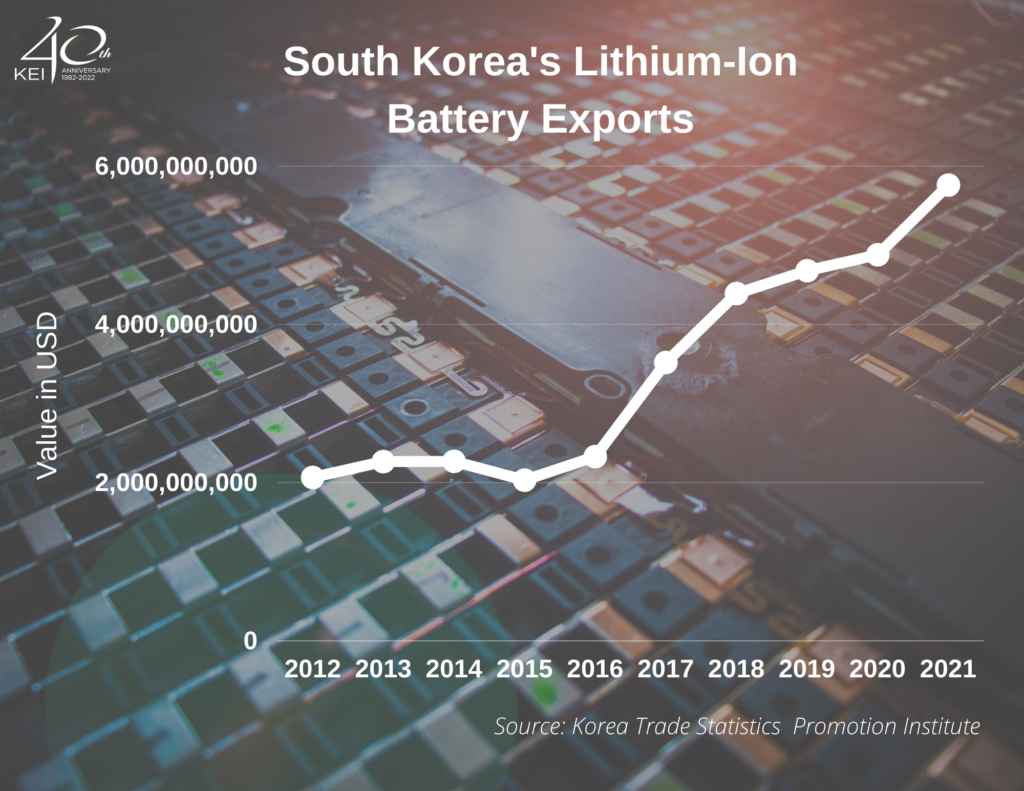

Korean firms dominate 30% of the global electric vehicle battery market. But with the procurement of key raw material inputs for these batteries threatened by geo-strategic rivalries, the government and manufacturers are pushing to diversify both sourcing and processing of minerals like cobalt, nickel, and lithium.

In February, the Australian government signed a “Memorandum of Understanding on Cooperation in Critical Mineral Supply Chains” with the South Korean government, with an eye to shifting their reliance away from China for critical mineral procurement and processing. This promises to be a boon to Korean manufacturers as Australia is the world’s top lithium producing and exporting country, with significant reserves of cobalt and nickel.

Similarly, LG Energy Solution signed a deal with Indonesian state-owned companies in April to invest USD 9 billion into a mine-to-manufacturing electric vehicle battery supply chain. Korean steelmaker POSCO also secured a USD 4 billion investment in a lithium mining operation in Argentina in March.

These actions hedge against potential disruptions that might arise as a consequence of relying too heavily on raw materials that are currently sourced directly from China or acquired through Chinese-controlled supply chains. China’s export ban on rare earth metals to Japan over the Senkaku Islands dispute and its unofficial embargo on South Korea over the installment of a U.S. missile defense system in 2016 may have prompted the ongoing push for diversification by the Korean government and firms. Moreover, Beijing’s strict coronavirus lockdown measures create additional risks for businesses that rely on material inputs from Chinese producers or mines.

This briefing comes from Korea View, a weekly newsletter published by the Korea Economic Institute. Korea View aims to cover developments that reveal trends on the Korean Peninsula but receive little attention in the United States. If you would like to sign up, please find the online form here.

Korea View was edited by Yong Kwon with the help of Kayla Harris, David Lee, Sarah Marshall, and Mai Anna Pressley. Picture from the flickr account of Andrew O’Brien.