The Peninsula

Has the Kaesong Industrial Complex Bounced Back from the 2013 Shutdown?

By Troy Stangarone

When North Korea withdrew its workers from the Kaesong Industrial Complex in 2013, confidence in the inter-Korean venture was severely damaged. Firms in the complex lost not only production and revenue, but contracts as well. Over the last year, South Korea has sought to make the complex more resilient in the face of political turmoil on the Korean peninsula with efforts to attract foreign investors. Given the uncertainty of the complex, only the German firm Groz-Beckert has agreed to set up a sales office. While the process of internationalization may be slow, production seems to be bouncing back to normal levels.

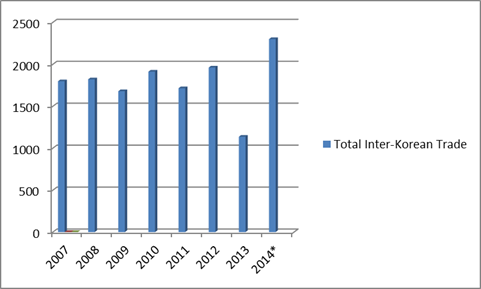

According to new figures released by the Korea International Trade Association, inter-Korean trade rose to $2.3 billion last year. While the numbers are almost double the amount of trade from 2013 when the complex was closed for nearly half a year after North Korea withdrew its workers, more impressively inter-Korean trade is up more than 15 percent from 2012, the last full year of trade before the shutdown.

Inter-Korean Trade Since 2007

Source: Author’s calculations from Ministry of Unification and the Korea International Trade Association. Figures in $100,000.

While inter-Korean trade is up, the question remains if this is a positive new trend or merely an aberration. Political tensions have often lead to slowdowns in Kaesong and a number of factors could continue to constrain growth at the complex. Access for the goods abroad is limited due to sanctions. Because most countries consider goods from the complex to be North Korean products they are not eligible for most favored nation status which would entitle them to a country’s lowest tariff. The complex still lacks the modern telecommunications access to cell phones and the internet, which modern businesses require. There also remains political risk in setting up in the complex as North Korea continues to try to arbitrarily change the rules on issues such as wages and its ability to detain South Koreans.

Despite these and other challenges, there is one significant factor that could help the complex to grow in the future. The soon to be concluded Korea-China FTA will provide access to products produced in Kaesong to the growing Chinese market. There are a few ways this could help boost Kaesong. As China shifts to more domestic consumption, duty free goods from Kaesong could become increasingly competitive in the Chinese market and thereby provide producers with a larger overall market in which to sell goods. Second, access to the Chinese market could make the complex more attractive for South Korean and international investment. However, this comes with caveats. In the case of South Korean firms, the May 24 sanctions would have to be at least partially lifted to allow further South Korean investment, and in the case of international firms the issues previously mentioned regarding communications as well as how labor is handled and wages are paid, among others, may need to be addressed before substantial international investment occurs. Lastly, depending on how the provisions in the FTA are written, collaboration between Kaesong and China’s Special Economic Zones in North Korea may become attractive.

However, if the Korea-China FTA is to help serve as a platform for expanding Kaesong, the political tensions that have held back progress in the past will need to be minimized. If North Korea truly seeks to engage in economic development and make the Kaesong Industrial Complex successful, it will need to refrain from the types of political actions it has taken in the past that have inhibited the complex’s growth.

Troy Stangarone is the Senior Director for Congressional Affairs and Trade at the Korea Economic Institute of America. The views expressed here are the authors alone.

Photo from Times Asi’s photostream on flicker Creative Commons.