The Peninsula

2025 Year in Review: Policy Uncertainty and Global Economic Resilience

Published January 14, 2026

Author: Sunhyung Lee

Category: Economics, Indo-Pacific, South Korea, United States, US-Korea alliance

The following is part of a new miniseries from KEI surveying the most important developments and trends in the U.S.-South Korea relationship in 2025. You can read all year-in-review pieces by clicking here.

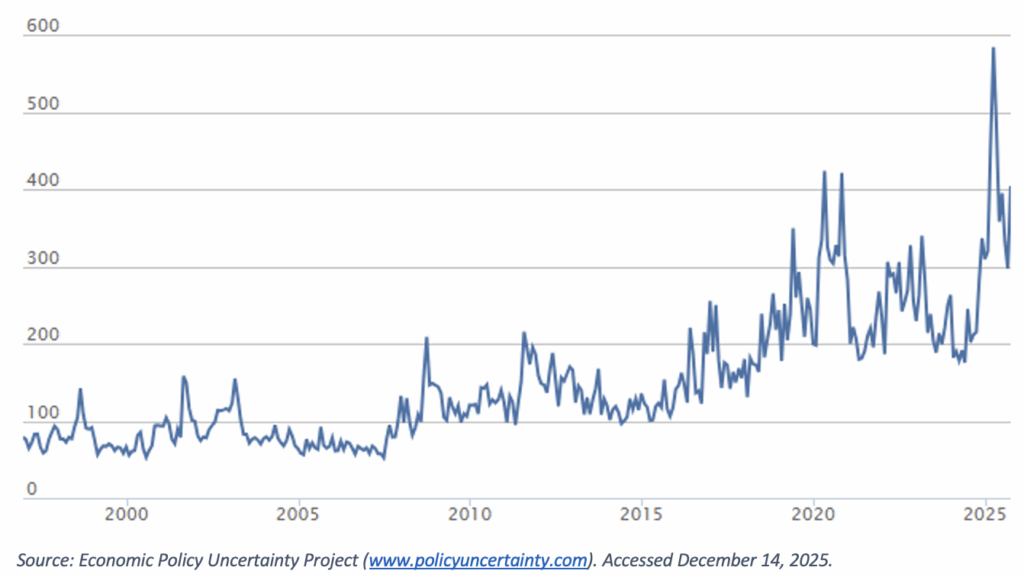

If one theme dominated the global economic narrative in 2025, it was policy uncertainty. From trade and monetary policy to geopolitics and fiscal sustainability, economic policy uncertainty repeatedly surged into the news cycle, shaping investor sentiment and policymaker caution. The monthly Global Economic Policy Uncertainty Index (see Figure 1) climbed to levels rarely seen outside crisis periods, reflecting a world grappling with shifting political leadership, unresolved conflicts, and an evolving global economic order.

Figure 1. Monthly Global Economic Policy Uncertainty Index

Source: Economic Policy Uncertainty Project

Economic policy uncertainty weighed heavily on expectations throughout the year. Governments signaled tougher trade stances, central banks sent mixed messages about future interest rate paths, and geopolitical tensions created an atmosphere of constant risk reassessment. On the market side, firms delayed some investments, financial markets reacted sharply to policy headlines, and exchange rates reflected heightened sensitivity to global spillovers.

Evidence of Global Economic Resilience

Yet despite this persistent uncertainty, the most striking feature of the global economy in 2025 was resilience.

The real economy proved more adaptable than many forecasts had anticipated. Global trade volumes remained remarkably robust. Rather than collapsing under tariff threats and strategic decoupling, trade patterns adjusted. China’s experience was emblematic: faced with sustained U.S. tariffs, Chinese exporters increasingly redirected trade toward emerging markets and non-U.S. partners, preserving overall trade momentum even as bilateral flows shifted. This reconfiguration, rather than retrenchment, became a defining feature of global trade in 2025.

South Korea’s experience mirrored this broader resilience. The U.S.–South Korea trade deal provided a stabilizing anchor amid broader trade uncertainty, offering firms clarity and reinforcing confidence in bilateral economic ties. Similar agreements across regions helped cushion global trade against escalating rhetoric. For an open economy like South Korea’s, diversification proved key to navigating uncertainty.

Policy Uncertainty and Economic Resilience in 2026

Looking ahead to 2026, uncertainty will not disappear. In fact, trade policy uncertainty is likely to intensify as governments face pressure to honor new trade commitments while simultaneously responding to domestic calls to push back. Tariff threats from the United States may resurface as bargaining tools, testing the credibility of existing agreements.

Monetary policy divergence will add another layer of complexity. Japan’s expected rate hikes contrast sharply with a likely easing cycle in the United States, particularly with the upcoming appointment of a new Federal Reserve chair who is expected to align more closely with U.S. President Donald Trump’s preference for lower rates. For South Korea, managing capital flows and exchange rate pressures will be critical as the won navigates these environments.

Fiscal policy uncertainty will also loom large. South Korea’s expansionary budget plans raise questions about debt sustainability and policy space, even as budgetary support remains essential for growth. The direction of U.S. fiscal policy is also in question given the upcoming midterm election next year.

Overlaying all of this are geopolitical risks that increasingly blur the line between economic policy and national security, with the deepening U.S.-China tensions as a central focus.

And yet there is reason for cautious optimism. Investment in artificial intelligence, digital infrastructure, and next-generation technologies continues to surge, offering new engines of growth. Firms and governments alike are adapting to a more fragmented global economy.

If 2025 taught us anything, it is that uncertainty no longer signals paralysis. Instead, it has become a permanent feature of a global economy that is learning to bend, adjust, and endure. Next year is unlikely to be calmer, but if recent history is any guide, resilience will once again define the outcome.

Sunhyung Lee is a Non-Resident Fellow at KEI and an Assistant Professor of Economics at the Feliciano School of Business, Montclair State University. The views expressed here are the author’s alone.

Feature image from The White House.

KEI is registered under the FARA as an agent of the Korea Institute for International Economic Policy, a public corporation established by the government of the Republic of Korea. Additional information is available at the Department of Justice, Washington, D.C.