The Peninsula

The Outlook for the Korean Economy: Will Stagflation Curb Growth?

The OECD Economic Outlook, released on June 8th, projected that real GDP growth in OECD countries would drop by half from 5.5% in 2021 to 2.7% in 2022. The new projection is a sharp reduction from its December 2021 Outlook, which projected growth of 4.5% growth this year. With inflation expected to rise from 3.7% in 2021 to 8.5% in 2022 in OECD countries, many forecasters warn that the global economy may be entering a period of stagflation characterized by slow economic growth and high inflation, as occurred in the 1970s following the 1973 oil price shock. There is also concern in Korea about the economic risks. In early June, President Yoon Suk-yeol said “Our lawn currently lies in the path of a typhoon that includes an economic crisis”.

Korea’s growth outlook

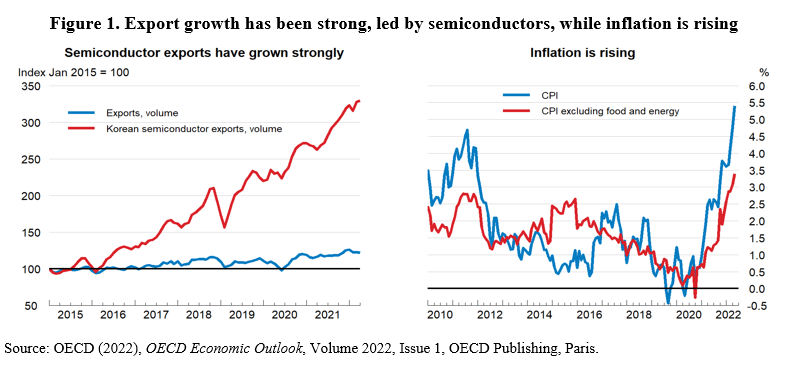

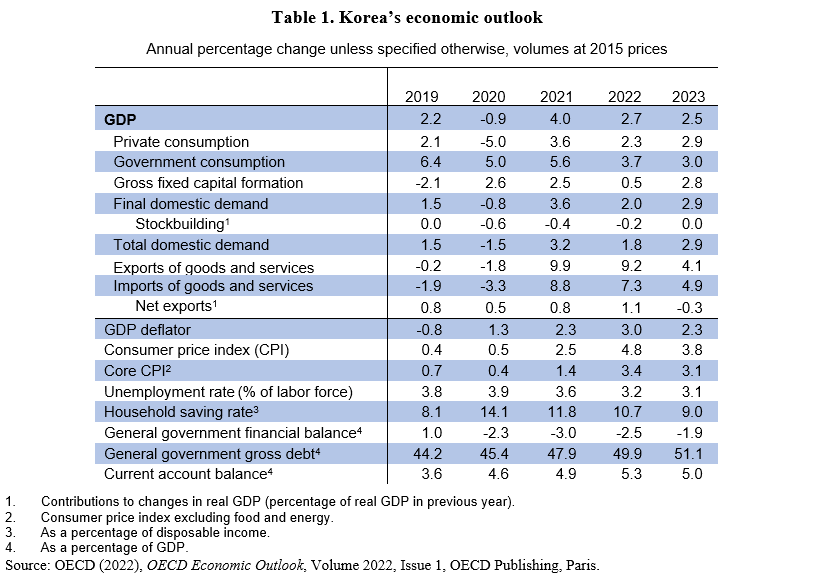

Real GDP growth reached 4.0% in 2021, thanks in part to strong demand from Korea’s trading partners. Exports increased 9.9% in 2021 (see table), led by semiconductors (Figure 1, left-hand panel). Fiscal policy also contributed to Korea’s rebound. However, private consumption in 2021 remained below pre-pandemic levels, reflecting COVID-19 related restrictions, and business investment was subdued.

In April 2022, three key economic indicators all fell for the first time in two years due in part to higher raw material prices and supply chain disruptions. Industrial output in April fell 3.3% from March, although output in the service sector rose, while facility investment dropped for the third consecutive month and retail sales for the second consecutive month. In its June 2022 Economic Outlook, the OECD projected that Korea’s real GDP would grow 2.7% in 2022, down from the 3.0% that it forecast last December. The downward revision is in line with the government’s revised forecast announced on June 11th, which was reduced from 3.1% to 2.6%. The OECD expects private consumption to strengthen during the remainder of 2022, as COVID-related distancing measures are phased out, despite headwinds from higher inflation (see below). Fiscal policy remains supportive, as pandemic-related employment retention subsidies have been extended until the end of 2022. Moreover, a supplementary budget of KRW 16.9 trillion (0.8% of GDP) in February 2022 to help small companies was followed by a second supplementary budget, the largest ever at 62 trillion (2.9% of GDP), which is to be financed primarily by excess tax revenue.

The economic outlook, though, is clouded by the war in Ukraine. The direct consequences have been limited thus far, reflecting Korea’s relatively weak trade and financial links with Russia and Ukraine. However, Korea’s export orders index in April recorded its biggest drop in two years, in part due to the Ukraine war and COVID-19 lockdowns in China. Moreover, the price of neon gas, which is essential for Korean semiconductor production, tripled in early 2022 compared to a year earlier. Ukraine accounts for 70% of world production of neon gas. Korea has been able to avoid shortages thus far thanks to its stockpile of neon gas and by diversifying imports and increasing neon gas production in Korea. While the war’s direct effect on Korea has been mitigated, the surge of energy and commodity prices is having a strong headwind to economic growth.

The inflation outlook in Korea

Consumer price inflation jumped to 5.4% (year-on-year) in May, the highest rate since 2008 and well above the Bank of Korea’s 2% inflation target (Figure 1, right-hand panel). Even after taking out food and energy, inflation was 3.4%. The central bank has raised its policy interest by five time since last August, boosting it from 0.5% to 1.75%. Nevertheless, the monetary authorities expect inflation to remain above 5% in June and July and raised its forecast for 2022 to 4.5%. The BoK governor Rhee Chang-yong declared that the central bank would focus on inflation, as it is “more important than anything to stably manage inflation expectations”.

Rising interest rates and concern about the U.S. Federal Reserve’s aggressive tightening of monetary policy has heightened market volatility in Korea as elsewhere. The KOSPI stock price index has fallen more than 10% thus far in June. In addition, a survey by the Korea Real Estate Board found that apartment prices in Seoul have fallen for three consecutive weeks.

With the 75 basis-point hike by the U.S. Fed on June 15, the U.S. benchmark funds rate now stands at a range of 1.5% to 1.75%, virtually matching that in Korea. The conventional wisdom in Korea is that Korean interest rates should be higher than those in the United States to avoid destabilizing capital outflows. However, Governor Rhee stated that “It is true that the pace of interest rate hikes in the U.S. is faster than ours. But rather than just focusing on the gap, we will make a comprehensive decision based on the impact on the foreign exchange and bond markets”. Given the high level of household debt in Korea, a significant rise in interest rates poses significant risks. More than 80% of total new loans were floating rate in late 2021, implying that households’ debt servicing burden will increase significantly as interest rates rise. The next monetary policy board meeting takes place on July 13.

The OECD projects that Korea’s inflation will moderate to 3.8% in 2023 (see table). However, tight labor market conditions may lead to sustained inflation pressure. Korea’s seasonally adjusted-unemployment rate fell to 2.8% in May 2022, well below the historical norm of mid-3%. Although the labor supply is rising, wage growth is increasing along with core consumer inflation, which may make it difficult to reduce inflation. The government is trying to accelerate the inflow of foreign workers to alleviate labor shortages. Small firms and farms, which have relied on foreign workers, have faced shortages as COVID-19 reduced the inflow of workers. The government expects to have 73,000 foreign workers enter Korea in 2022.

Can stagflation be avoided?

The OECD is optimistic that the world economy will not enter a period of slow growth and inflation. For Korea, it projects that growth of 2.5% in 2023, well above Korea’s potential growth rate of 2.0% according to the Bank of Korea. The OECD argues that although the world economy is facing sharp hikes in oil and food prices, economic conditions are significantly different than in the 1970s (OECD, 2022):

- The advanced economies have become less energy-intensive after the oil-price shocks of the 1970s and early 1980s, which may reduce the impact of higher oil prices. Moreover, the share of industrial output in total economic activity has fallen.

- Central banks are now independent and have stronger monetary policy frameworks, with a stronger focus and understanding of the importance of maintaining well-anchored inflation expectations than was the case in the 1970s.

- The advanced economies are more flexible, reflecting changes in labor market institutions that reduce the risk that a negative supply shock results in a wage-price spiral.

- Many consumers have excess savings accumulated during the pandemic that can be used to offset income shortfalls.

- Supply pressures should moderate as borders reopen and more people join the labour force.

Randall S. Jones is a Non-Resident Distinguished Fellow at the Korea Economic Institute of America. The views expressed here are the author’s alone.

Image from 한국은행’s photostream on flickr Creative Commons.