The Peninsula

The OECD’s 2020 Survey of Korea Focuses on Policies to Overcome the Pandemic

By Randall S. Jones

The 2020 OECD Economic Survey of Korea released last month stressed that Korea’s economic contraction in 2020 is relatively mild compared to other advanced countries. Nevertheless, it will leave durable scars that heighten the need to tackle the challenges of population aging and low productivity. To address these challenges, the Survey focuses on raising employment, enhancing job quality and promoting the diffusion of technology. This is the 17th OECD Economic Survey of Korea, including two that were published before Korea joined the OECD in 1996.

The economic outlook and macroeconomic policies to support growth

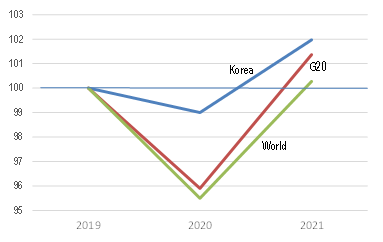

The OECD now projects that Korea’s real GDP will decline 1.0% in 2020, a mild contraction compared to the United States (-3.8%), Japan (-5.8%) and the euro area (-7.9%). This compares to a 1.1% decline most recently projected by KDI and to a 1.3% decline in the central scenario published by the Bank of Korea. A decline of more than 4% is projected for G20 countries and the world economy (Figure 1). Korea’s swift and effective policy response to the coronavirus has enabled it to “avoid the extensive lockdowns of many other countries.” In addition, a wide range of government measures have been implemented to protect households and firms. These measures thus far total 277 trillion won (14.4% of GDP), including three supplementary budgets amounting to KRW 59.0 trillion (a fourth supplementary budget was passed by the National Assembly on September 22). Loans and guarantees to households, SMEs and affected industries accounted for the remainder of public support.

Figure 1. Real GDP Index, 2019 = 100

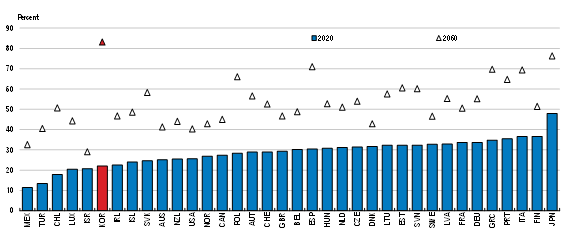

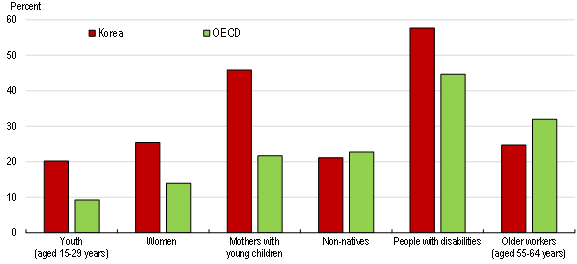

Note: The 2020 projection for Korea was slightly revised downward from the 0.8% decline projected in the 2020 OECD Economic Survey of Korea to 1.0% in the OECD Interim Economic Assessment, on account of the resurgence of infections in the third quarter and the measures taken to contain them. Source: OECD Interim Economic Assessment, 16 September 2020. Fiscal support was accompanied by two cuts in the Bank of Korea’s policy rate by 75 basis points in total to a record low 0.5%. In addition, the central bank injected liquidity in financial markets to promote financial stability and encourage lending to small and medium-sized enterprises. The Survey projects that domestic-oriented activities will normalize gradually in 2021, boosting real GDP by 3.1% (Figure 1). Private consumption is expected to rebound following its 2020 drop, while government consumption remains strong. However, weak global demand will hold back exports and investment, even assuming no major resurgence of the pandemic. The main risk is the coronavirus: “A second global wave of infections would delay the recovery in consumption and exports, further depress investment and push up unemployment.” The reliance on fiscal policy was projected to shift the government balance (general government basis) from a surplus of 0.9% in 2019 to deficits of nearly 3% in 2020 and 2021. Consequently, gross government debt would jump from 38% of GDP in 2019 to 48% in 2022, though still well below the 109% for the OECD area. This projection was made before the fourth supplementary budget in late September, which may push the deficit up to close to 4%. The Survey argues that sound public finances provide room to increase spending in the current downturn. It recommends that the government “continue to provide support to households and businesses until the economy is recovering,” while ensuring that fiscal plans preserve long-term fiscal sustainability. Consumer price inflation is projected to remain low at 0.3% in 2020 and 2021, well below the 2.0% target. The Survey recommends that the Bank of Korea maintain its accommodative monetary policy stance while monitoring concerns about financial imbalances, notably rising housing prices in an increasing number of areas and an acceleration in lending to households. Moreover, the central bank should stand ready to adopt unconventional monetary policy measures, such as the purchase of government bonds to lower long-term interest rates. Policies to raise per capita income and achieve inclusive growth Korea faces the most rapid population aging in the OECD area. In 2020, its elderly dependency ratio was the sixth lowest in the OECD at 22%, well below Japan’s 48% (Figure 2). By 2060, Korea is projected to have the highest ratio among OECD countries at 83%, surpassing Japan at 76%. The Survey notes that rapid aging is “clouding economic growth prospects and generating risks of widening inequality and weakening well-being, as well as challenges for public finances and the welfare system.” Raising employment Although Korea’s overall employment rate of 71% is close to the OECD average of 73%, significant employment disparities exist between socio-economic groups. The Survey points out that the employment gap between prime-age males (aged 25-54) and disadvantaged groups is high at 31.8% compared to the OECD average of 24.7%. Employment gaps relative to the OECD average are particularly large for youth and women, particularly those with young children (Figure 3), underscoring the importance of tailored measures to improve outcomes. To increase the female employment rate, the Survey stresses a number of policies. First, increase the share of women who take maternity leave from its current level of 76.5% in the private sector. A key obstacle is the large number of firms that are reluctant or unable to fill temporary vacancies. Second, raise the share of parents, particularly men, who take parental leave, in part by offering a higher replacement rate for shorter leaves. Third, improve the quality of childcare. Fourth, reduce Korea’s gender wage gap, which is the highest in the OECD area at 34%, in part by increasing transparency about factors determining pay.

Note: The 2020 projection for Korea was slightly revised downward from the 0.8% decline projected in the 2020 OECD Economic Survey of Korea to 1.0% in the OECD Interim Economic Assessment, on account of the resurgence of infections in the third quarter and the measures taken to contain them. Source: OECD Interim Economic Assessment, 16 September 2020. Fiscal support was accompanied by two cuts in the Bank of Korea’s policy rate by 75 basis points in total to a record low 0.5%. In addition, the central bank injected liquidity in financial markets to promote financial stability and encourage lending to small and medium-sized enterprises. The Survey projects that domestic-oriented activities will normalize gradually in 2021, boosting real GDP by 3.1% (Figure 1). Private consumption is expected to rebound following its 2020 drop, while government consumption remains strong. However, weak global demand will hold back exports and investment, even assuming no major resurgence of the pandemic. The main risk is the coronavirus: “A second global wave of infections would delay the recovery in consumption and exports, further depress investment and push up unemployment.” The reliance on fiscal policy was projected to shift the government balance (general government basis) from a surplus of 0.9% in 2019 to deficits of nearly 3% in 2020 and 2021. Consequently, gross government debt would jump from 38% of GDP in 2019 to 48% in 2022, though still well below the 109% for the OECD area. This projection was made before the fourth supplementary budget in late September, which may push the deficit up to close to 4%. The Survey argues that sound public finances provide room to increase spending in the current downturn. It recommends that the government “continue to provide support to households and businesses until the economy is recovering,” while ensuring that fiscal plans preserve long-term fiscal sustainability. Consumer price inflation is projected to remain low at 0.3% in 2020 and 2021, well below the 2.0% target. The Survey recommends that the Bank of Korea maintain its accommodative monetary policy stance while monitoring concerns about financial imbalances, notably rising housing prices in an increasing number of areas and an acceleration in lending to households. Moreover, the central bank should stand ready to adopt unconventional monetary policy measures, such as the purchase of government bonds to lower long-term interest rates. Policies to raise per capita income and achieve inclusive growth Korea faces the most rapid population aging in the OECD area. In 2020, its elderly dependency ratio was the sixth lowest in the OECD at 22%, well below Japan’s 48% (Figure 2). By 2060, Korea is projected to have the highest ratio among OECD countries at 83%, surpassing Japan at 76%. The Survey notes that rapid aging is “clouding economic growth prospects and generating risks of widening inequality and weakening well-being, as well as challenges for public finances and the welfare system.” Raising employment Although Korea’s overall employment rate of 71% is close to the OECD average of 73%, significant employment disparities exist between socio-economic groups. The Survey points out that the employment gap between prime-age males (aged 25-54) and disadvantaged groups is high at 31.8% compared to the OECD average of 24.7%. Employment gaps relative to the OECD average are particularly large for youth and women, particularly those with young children (Figure 3), underscoring the importance of tailored measures to improve outcomes. To increase the female employment rate, the Survey stresses a number of policies. First, increase the share of women who take maternity leave from its current level of 76.5% in the private sector. A key obstacle is the large number of firms that are reluctant or unable to fill temporary vacancies. Second, raise the share of parents, particularly men, who take parental leave, in part by offering a higher replacement rate for shorter leaves. Third, improve the quality of childcare. Fourth, reduce Korea’s gender wage gap, which is the highest in the OECD area at 34%, in part by increasing transparency about factors determining pay.

Figure 2. Korea faces the most rapid population aging in the OECD

Note: Ratio of population aged 65 and over to population aged 15-64. Projections are based on the medium fertility variant of the United Nations World Population Prospects 2019. Source: 2020 OECD Economic Survey of Korea.

Figure 3. Disadvantaged groups face large employment gaps Employment gap relative to prime-age men in percent

Note: Average difference in the prime age men’s (25-54 years) employment rate and the rates for the five disadvantaged groups as a percentage of the prime-age men’s rate. Youth excludes those in full-time education or training. Mothers with young children concern working-age mothers with at least one child aged 0-14 years. Non-natives refers to all foreign-born people with no regards to nationality. Data refer to 2016. Source: 2020 OECD Economic Survey of Korea.

While the employment rate of older persons is relatively high, the quality of their jobs is relatively low. Many employees are forced to retire from their career job in their fifties, reflecting the large weight of seniority in wage-setting. Older persons tend to move to lower-skilled jobs, resulting in a waste of human resources. In addition, it exacerbates poverty among older persons. The relative poverty rate for those above age 65 is 44%, more than three times the average of 14% in the OECD area. The Survey notes that “the ultimate objective should be a flexible wage system based on performance and job content and skills” rather than seniority, although this has proven to be difficult in practice. Another problem is mandatory retirement. The minimum mandatory retirement age that firms can set was raised to 60 in 2016-17. The Survey states that it is necessary to analyze the employment effects of the 2016-17 hike and then gradually increase the age in the long run. Given the link between seniority-based wages and mandatory retirement, raising the retirement age – or abolishing it as many countries have done – would help achieve the goal of a flexible wage system based on performance and job content and skills.

Raising productivity

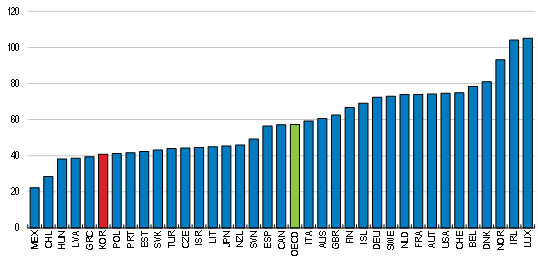

Productivity per hour worked in Korea was $41 in 2018, well below the OECD average of $57 (Figure 4). Moreover, Korean productivity is only about half of the top half of OECD countries, suggesting considerable scope for convergence. Wide productivity gaps between large firms and SMEs and between manufacturing and services weigh on economy-wide productivity. Indeed, average productivity in Korean SMEs is only about a third of large companies, compared to the OECD average of one-half. Moreover, productivity in the service sector, where SMEs are most prevalent, is about 45% of that in manufacturing, far below the 85% OECD average.

Figure 4. Labor productivity in Korea lags behind the most advanced countries U.S. dollar (purchasing power parity exchange rates) per hour in 2018

Source: 2020 OECD Economic Survey of Korea.

Source: 2020 OECD Economic Survey of Korea.

The Survey notes that “Korea is a top player in emerging digital technologies, with an outstanding digital infrastructure and a dynamic ICT sector.” Moreover, the pandemic demonstrated the benefits of digitalization to contain the spread of the virus, by allowing quick testing and tracing of infected people. It also spurred the development of the “untact economy,” enabling many people to continue working remotely, thereby mitigating the economic impact of the pandemic. Digital technologies offer opportunities to raise firms’ productivity and narrow the gap between leading and lagging firms.

The Survey identifies obstacles to digitalization and recommends policies to narrow the digital divide by enhancing the diffusion of digital technologies among firms and individuals. First, a wide skills gap between youth and older generations prevents a significant share of the population from participating in a digitalized economy. Expanding quality ICT education and training for students, teachers, SME workers and older people is essential to ensure adequate skills. Second, given the small share of R&D taking place in SMEs, it is important to promote innovation networks between SMEs, academia and large firms through vouchers or platforms to support SMEs. Third, waiving stringent regulations through regulatory sandboxes can help identify and alter regulations that hinder the adoption and diffusion of digital technologies.

Large potential gains from reform

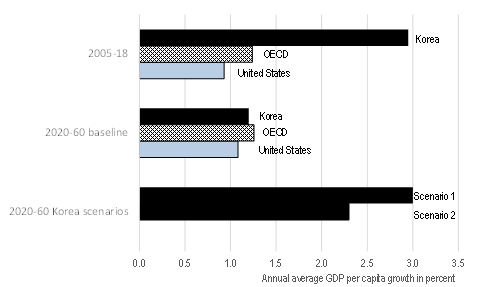

Korea’s annual average GDP per capita growth over 2005-18 was nearly 3%, more than double the OECD area (Figure 5). In the OECD’s long-term model, Korea’s per capita growth slows to 1.2% annually over 2020-60, a rate more in line with the OECD average. The baseline incorporates a reduction of the gender employment gap from about 18 percentage points at present to 6 points in 2060.

A simulation in the Survey suggests that Korea could maintain per capita growth at close to 3% per year through 2060. In its most optimistic scenario: i) the employment rates in each age group for men and women rise to the highest rate in the OECD; and ii) labor productivity in the service sector increases from 45% of the manufacturing sector (its current level) to 85% (the OECD average). In the second, less optimistic scenario, Korea’s employment rates reach those in Japan and SME productivity converges to the OECD average. In this scenario, GDP per capita would rise at an annual rate of 2.3%, still double the 1.1% rate in the US baseline reported in the OECD’s long-term model.

Maintaining 3% annual growth in GDP per capita would allow Korea to surpass the United States by 2040, assuming that it followed the baseline path in the OECD long-term model. In scenario 2, Korea’s GDP per capita would surpass the United States by 2050. Sustaining such high growth through reforms to boost labor inputs and productivity would be an exceptional outcome, given that GDP per capita growth typically slows as a country’s income gap with the top OECD countries shrinks, thereby reducing opportunities for rapid catch-up.

Figure 5. Simulations suggest that reforms can lead to large income gains Annual average GDP growth in percent

Sources: 2005-18: OECD Economic Outlook Online, https://stats.oecd.org/Index.aspx?DataSetCode=EO. 2020-60: Guillemette, Y. and D. Turner (2018), “The long view: scenarios for the world economy to 2060”, OECD Economic Policy Papers, Vol. 2018/22, http://dx.doi.org/10.1787/b4f4e03e-en 2020-60 Korea Scenarios: 2020 OECD Economic Survey of Korea.

Randall S. Jones is a Visiting Fellow at Columbia University and a Non-Resident Fellow at the Korea Economic Institute of America. The views expressed here are the author’s alone.

KEI will also be hosting an event on this topic on October 6, 2020 at 10:00am. You can register for the event here.

Photo from Stanley Young’s photostream on flickr Creative Commons.