The Peninsula

What U.S.-Iran Tensions Mean for South Korea

By Troy Stangarone

Last week two oil tankers were attacked in the Gulf of Oman. The attack comes after four tankers were attacked in the Persian Gulf in May. While the United States has argued that Iran is behind the most recent attacks, the growing confrontation between the United States and Iran has deeper implications for South Korea.

As a country without substantial domestic energy resources, South Korea is highly dependent upon foreign imports for its energy supplies whether it be oil and natural gas, coal, or the nuclear fuel to run its nuclear power plants.

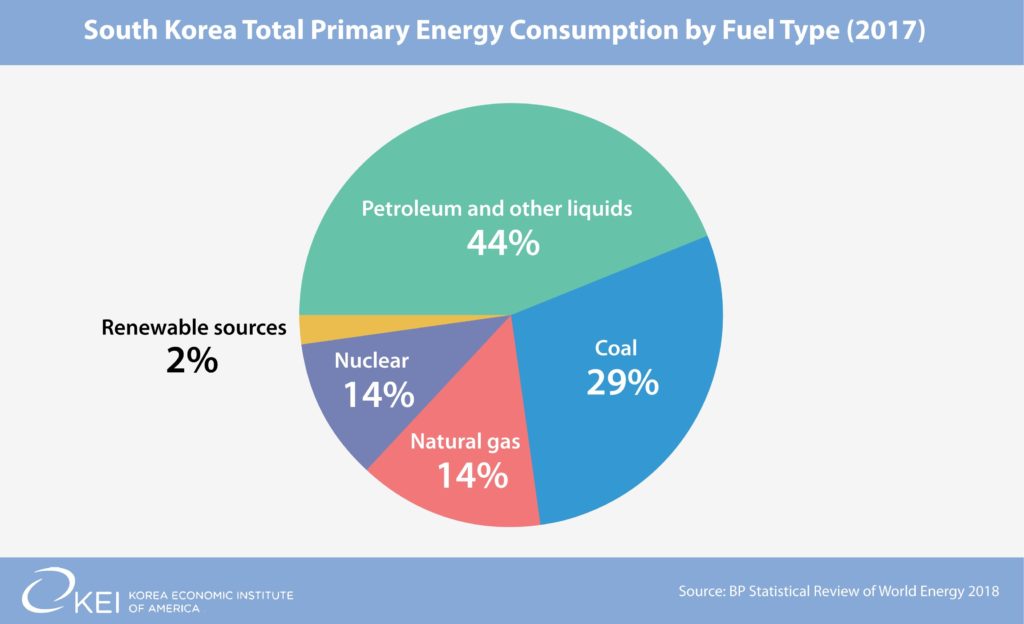

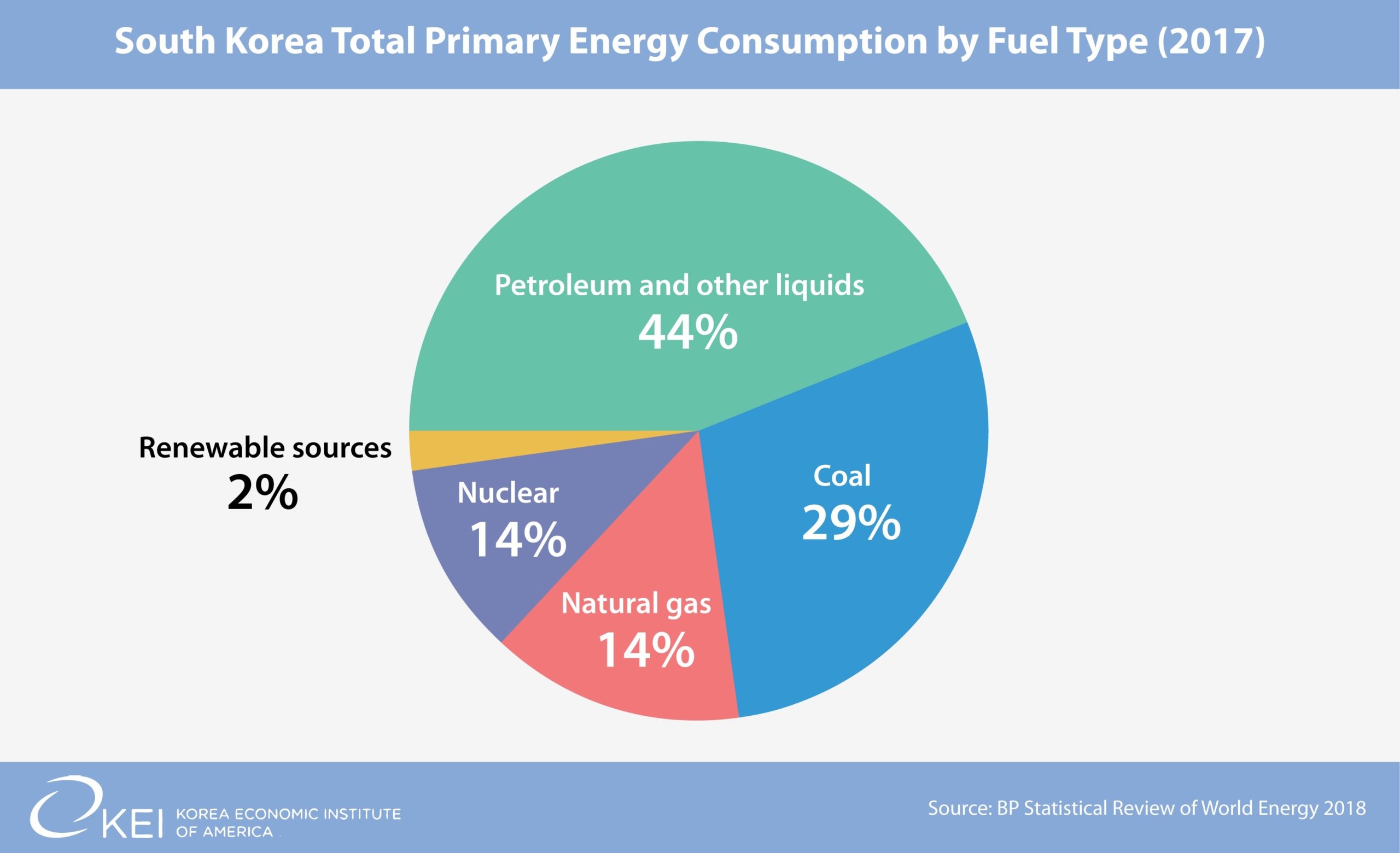

South Korea uses petroleum and other liquid based fuels for 44 percent of its energy consumption, including for fuel for transportation, power generation, and its petrochemical sector. Liquefied Natural Gas (LNG) accounts for another 14 percent of South Korea’s energy consumption and is used in power generation, transportation, and other sectors.

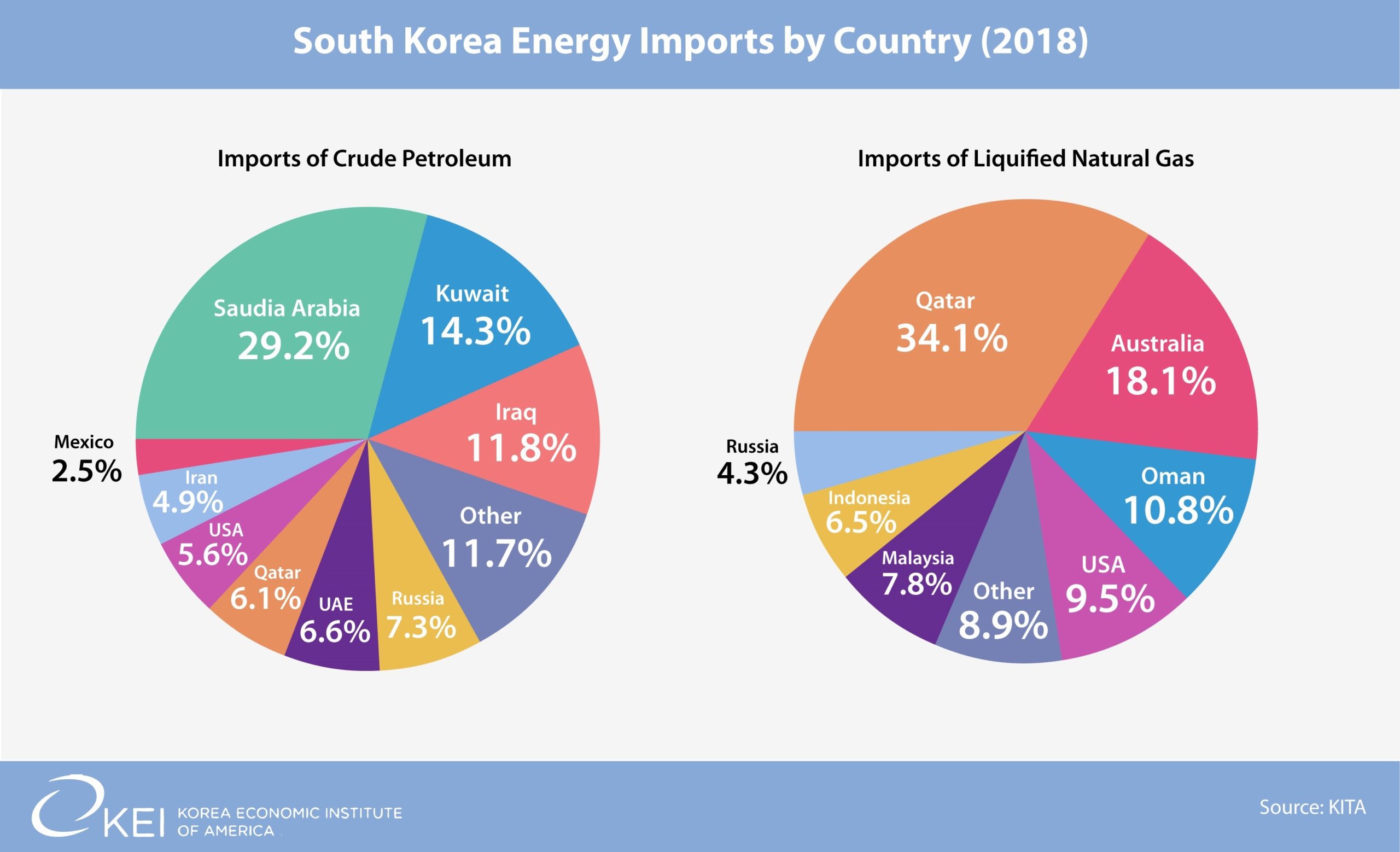

South Korea’s dependence on imports for energy is also a dependence on the Middle East for imports of petroleum. In 2018, 72.9 percent of South Korea’s crude petroleum imports by value came from inside the Strait of Hormuz. South Korea’s purchases of LNG tend to be more diversified, about 45 percent are also from the Middle East.

With imports from Iran in 2018 beginning to decline from the resumption of U.S. sanctions, to increasing imports from the United States, Russia, and few others outside of the Middle East, South Korea’s imports from the region 2018 were down from 82 percent in 2017.

The significance of the Strait of Hormuz, and South Korea’s dependence on suppliers inside it, is that it is the narrow passage way which divides the Persian Gulf and the Gulf of Oman. This is a critical transit point for global energy exports as 30 percent of the world’s oil exports come from the Middle East. It also boarders Iran, which has threatened to close if the U.S. tries to block Iran’s access to the strait. Iran has also threatened to close the strait in the past.

If Iran attempted to close the Strait of Hormuz, it would have significant implications for South Korea.

South Korea’s dependence on the region for such a significant amount of its energy consumption makes it susceptible to the current tensions in the Middle East in terms of price and supply. After an initial spike in the price of Dubai crude, the benchmark for South Korean oil imports from the Middle East, after the most recent attack on oil tankers markets seem to have calmed. However, some analysts have suggested that prices of Brent crude, the benchmark for the United States, could rise to $100 a barrel from its current price of around $62 today[1].

The prospect for the current tensions between the United States and Iran to grow into a wider conflict will only be one factor on global energy prices. With the current U.S.-China trade tensions dampening global growth, demand for petroleum could decline and act as a counter weight on prices to U.S.-Iran tensions.

If current tensions between the United States and Iran were to escalate to a wider conflict, the supply of oil on global markets would play an important role in maintaining prices, but with the U.S. also trying to cut off Venezuelan oil exports global oil markets could be tighter than expected.

The ability of the United States to build a coalition to protect ships transiting near Iranian territory would also play a factor in the availability of supply and the stability of price. If the United States was unable to build a coalition to defend oil and LNG shipments from the Middle East, South Korea could find itself facing both rising energy prices and an energy shortage if supplies from the Middle East were disrupted.

In the short-term there is little that South Korea can do to insulate itself from instability in the region, but that also means it has a significant interest in the United States and Iran avoiding a wider conflict in the dispute over Iran’s nuclear program. Over time continuing to diversify its supply and moving more towards renewable energy would help to reduce South Korea’s susceptibility to the unpredictability of the Middle East.

Troy Stangarone is the Senior Director for Congressional Affairs and Trade at the Korea Economic Institute of America. The views expressed here are the authors alone.

Graphics by Juni Kim, Program Officer at the Korea Economic Institute of America.

Photo from the Official U.S. Navy Page’s photostream on flickr Creative Commons.

[1] Dubai crude tends to be more expensive than Brent crude, but most of the analysis is done in Brent crude prices.