The Peninsula

What the U.S.-South Korea Summit Means for Investment and Trade

Months of U.S.-South Korea negotiations in areas across trade, energy, and security reached their crescendo with President Lee Jae Myung’s first meeting with President Donald Trump at the White House in August. In addition to an Oval Office meeting, Lee’s visit included a speech at a major DC think tank, participation in a roundtable with business representatives, and travel to Philadelphia for a ship christening at the Hanwha Philly Shipyard.

Lee’s visit came just weeks after the United States and Korea inked an economic and trade deal after months of negotiations leading up to the August 1 tariff deadline. The summit provided some further clarification on where things stand between the countries, although negotiations on the economic agreement between the United States and Korea appear to still be ongoing. Nonetheless, after leaving the summit, President Trump told reporters that “[Korea] is going to make the deal that they agreed to make,” indicating his view that the preliminary agreement on tariffs and bilateral investment is set for now.

The central takeaway from the Oval Office discussion is that it served as an opportunity to highlight the U.S.-Korea economic relationship. In the public portion, the two leaders highlighted energy purchases, shipbuilding cooperation, and Korean investments as areas of strengthening cooperation between the two countries. Following the meeting, a Korean presidential office spokesperson also indicated that “there was no talk” of further opening Korea’s agricultural markets, for example, on beef and rice, boding well for the redline that Korean officials had drawn in the lead-up to negotiations.

The core components of the discussion on trade likely occurred during a closed-door luncheon that took place on the same day. Aside from a reported handwritten letter given to Trump during the lunch, stating that “Korea has a tremendous future with you at the helm!” little information seems to have been publicly disclosed from that portion of the meeting.

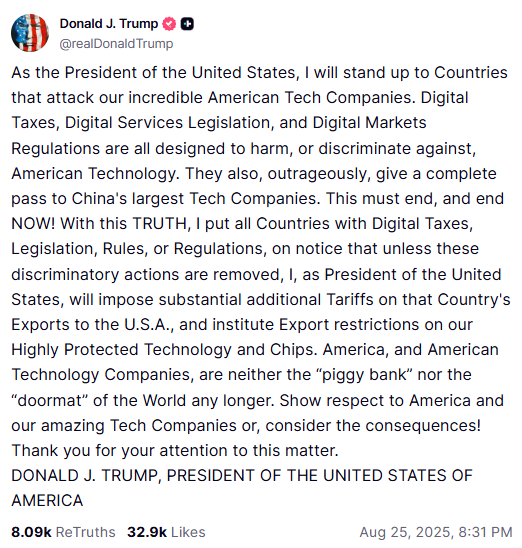

Later in the evening, however, there were some hints as to its policy contents. Trump posted on Truth Social that the United States would impose tariffs on countries with digital services legislation that he claimed were “designed to harm” U.S. technology companies, likely to some extent aimed at Korea’s policies.

Unlike the fact sheet for the U.S.-EU deal, digital services—a growing feature of discussion in U.S.-Korea relations—went absent from the “Trump Round” deal with Korea. Local policy regarding the export of location-based data, as well as competition policy, were both issues cited as non-tariff barriers in the 2025 National Trade Estimate Report put out by the Office of the U.S. Trade Representative (USTR), and U.S. representatives in Congress had been pressing the Trump administration to consider pushback as part of a deal with Korea.

For example, regulations and proposals on technology companies in Korea have drawn considerable pressure from international firms and U.S. regulators, who view many of their rules as discriminatory. It is unclear if any of these laws or proposals—for example, the Monopoly Regulation and Fair Trade Act (MRFTA), the Platform Monopoly Act (PMA), or the Online Platform Fairness Act—may have been the intended targets of the president’s post. Nonetheless, apparently as a result of U.S.-Korea negotiations, Korea has since walked back the PMA. Korean government officials have also indicated that other proposals could be eased, signaling digital policies likely cast a significant shadow over the talks between the leaders and served as an effective lever to influence Korea’s policy direction.

Korean Company Investment Pledges

Alongside the White House exchange came the investment pledges. This includes an additional USD 150 billion in Korean company investments in the United States, which is separate from the USD 350 billion investment fund announced in the July 31 deal with Korea. In total, U.S. and Korean companies signed eleven contracts and MOUs as part of the activities between the two countries that week, with collaboration pledges forming across a range of U.S.-Korea cooperation in strategic industries.

Korean Air announced the purchase of USD 50 billion in aircraft, engines, and service contracts from Boeing. Hyundai pledged to increase its USD 21 billion investment in the United States to USD 26 billion, including for a new robotics innovation hub. On energy, pursuant to the USD 100 billion Korean purchase commitment for U.S. liquified natural gas (LNG) made as part of a July agreement, Korea Gas Corporation (KOGAS) signed an LNG supply agreement with Trafigura to get gas delivered from U.S. producers over a ten-year period, starting in 2028. Outside of additional agreements in the shipbuilding sector, other pledges included a long-term germanium supply agreement between Korea Zinc and Lockheed Martin, geared toward shifting critical mineral supply chains away from China, as well as nuclear energy cooperation agreements between Korea Hydro & Nuclear Power, Doosan Enerbility, and U.S. companies.

Korean Presidential adviser Kim Yong-beom also indicated U.S. and Korean plans to create a “non-binding agreement” for the operation and structure of the USD 350 billion fund, which Korea made for investments in the United States. Given speculations about how this fund could be ultimately used—President Trump has previously stated that investments from the fund would be “selected by [him]self, as president”—this provides some further clarity as to its nature and the ultimate direction that it could take.

Shipbuilding Cooperation

Trump stated in the Oval Office meeting that the United States is “going to be buying ships from South Korea” and that the United States is “going to have [Korea] make ships here with our people, using our people,” likely alluding to the use of U.S. shipyards. Along these lines, Lee gifted Trump a model of a metal turtle ship used by Korean Admiral Yi Sun-sin in the fifteenth century as a symbol of Korea’s shipbuilding specialization.

Accordingly, the day after the summit, President Lee visited the Hanwha Philly Shipyard in Pennsylvania, which Hanwha acquired last year for USD 100 million, and participated in a christening ceremony for a U.S. Maritime Administration (MARAD) training vessel. In tandem was a USD 5 billion investment by Hanwha for the shipyard to support Korea’s USD 150 billion shipbuilding investment, including for two new docks and three quays for the shipyard. Hanwha’s subsidiary, Hanwha Shipping, also announced the purchase of ten oil and chemical tankers from Hanwha Philly—the first of which is set to be delivered in 2029—as well as an LNG tanker. The deal strengthens the shipyard’s order book, which Hanwha Philly aims to fill at a pace of twenty vessels per year.

Other shipbuilding pledges from the week included HD Hyundai and Korea Development Bank signing an MOU with Cerberus Capital for a multibillion-dollar joint investment fund to go toward U.S. shipbuilding investments and a maintenance, repair, and overhaul (MRO) agreement between Samsung Heavy Industries and Vigor Marine Group to support the U.S. Navy.

What’s Left Unsaid

Despite the positive direction of President Trump and President Lee’s first in-person meeting, the two countries still appear to have a lot to finalize on trade. Additional information on energy investment, digital service agreements, or alliance costs did not appear to make their way into the public side of the meeting between the leaders, and this leaves questions about how they may be ultimately settled. Given that foreign exchange policy and the specific details of the USD 350 billion investment fund are key bargaining points in the ongoing negotiations, these issues may need to be finalized before an official term sheet deal can be released.

With this in mind, it is possible that more could emerge from subsequent meetings or discussions. At the very least, as part of the Oval Office meeting, Trump responded in the affirmative that he will be in Korea for the Asia-Pacific Economic Cooperation (APEC) Summit, and this could be a major opportunity for the leaders to refine the specifics of their trade and security deals, should Trump’s visit take place as planned.

Further engagement, whether through the upcoming APEC summit or otherwise, would do well to create greater policy alignment. As more details emerge from the deals and policies of both capitals, the recent leader-level summit will likely be seen as the first step toward a stronger U.S.-Korea partnership under the new administration, as well as a historical baseline for future discussions.

Tom Ramage is Economic Policy Analyst at the Korea Economic Institute of America (KEI). The views expressed are the author’s alone.

Photo from the White House Flickr Account.

KEI is registered under the FARA as an agent of the Korea Institute for International Economic Policy, a public corporation established by the government of the Republic of Korea. Additional information is available at the Department of Justice, Washington, D.C.