The Peninsula

What the New IRA Guidance Means for Korean EV Suppliers

The latest guidance for electric vehicle (EV) subsidies doubles down on National Security Advisor Jake Sullivan’s vision for a “small yard, high fence.” On Monday, the Treasury Department in conjunction with the Internal Revenue Service (IRS) and the Department of Energy (DOE) issued proposed regulation defining what it means to be a foreign entity of concern (FEOC) in the Inflation Reduction Act (IRA), partially addressing uncertainty over what it may mean for Korean EV companies and battery makers who maintain partnerships with Chinese entities.

Under the updated guidance published in the Federal Register, for a new clean vehicle to be eligible for the whole $7,500 IRA purchase credit and applicable battery manufacturing grant programs, it must not have any battery components manufactured or assembled by a FEOC beginning in 2024 and no critical minerals and their associated materials extracted, processed, or recycled by a FEOC in 2025, which manufacturers will be responsible for tracking.

The DOE’s guidance exactly defined what it means to be a “foreign entity” while Treasury and the IRS provided clarity on which specific battery materials would have to be FEOC compliant and gave tracing exemptions to “non-traceable battery materials” which typically make up less than 2 percent of the total battery. For the “foreign” and “entity” components, the proposed DOE interpretation mirrors that of the 2021 National Defense Authorization Act (NDAA) and was proposed by the DOE to include “a natural person who is not a lawful permanent resident of the United States, citizen of the United States, or any other protected individual…[or] a partnership, association, corporation, organization, or other combination of persons organized under the laws of or having its principal place of business in a foreign country.” Similarly, Treasury interprets an FEOC as it was presented in the Infrastructure Investment and Jobs Act (IIJA) (also known as the Bipartisan Infrastructure Law) which served as the original guidance to define a FEOC in April 2023.

In the IIJA, an FEOC is one that is defined as “owned by, controlled by, or subject to the jurisdiction or direction of” a government of a foreign country that is a covered nation under Title 10 of U.S. Code—namely Russia, China, North Korea, or Iran—on the specially designated national (SDN) list, have convictions under a number of different federal violations, or be determined to be engaged in unauthorized conduct “detrimental to the national security or foreign policy of the United States.” The last category also gives Treasury and the DOE what appears to broad discretion in determining what constitutes those entities, pending consultation with the Director of National Intelligence and the Secretary of Defense.

After publishing previous notices of proposed rulemakings (NPRMs), such as in April 2023, IRS and Treasury had indicated that they would issue updated guidance on what exactly defined an FEOC at a later date. In response, Korean battery companies urged Treasury to keep in mind the realities of global battery supply chains and to avoid one-size fits all regulations. Some comments submitted included considering IPEF member countries under the free trade agreement (FTA) partner supply chain provision, a grace period for companies to replace existing suppliers, and to consider the volatility of sourcing critical minerals and batteries.

On the opposite end, before the new guidelines were released, others called for Treasury to involve a strict interpretation of the FEOC requirement. Senator Joe Manchin (D-WV) derided the IRA’s FTA partner component as aiding China by allowing them to take advantage of the IRA by using places such as Korea as offshore hubs to engage in “mineral laundering” to export their batteries to the United States. Senator John Barrasso (R-WY) and Congresswoman Cathy McMorris Rodgers (WA-05) similarly authored a report calling out the IRA for not having enough safeguards in place to prevent the subsidies from funding Chinese competitors.

Chinese companies control the market for many of the key battery materials covered by IRA subsidies and are often a major partner for Korean companies both for their specialization of battery precursor minerals and the desire from Chinese companies to navigate export controls. Under the new IRA provisions, it is likely that Korean companies that have joint ventures with Chinese companies will have to adjust their ownership structure to decrease Chinese investment stakes. This will inarguably require greater investment by Korean companies to keep their momentum in driving IRA investment.

According to the Wall Street Journal, in 2022, Chinese companies invested more than $4.5 billion into Korea to form joint ventures and other interest stakes to gain FTA partner production incentives doled out by the IRA. Similarly, a majority of IRA funded projects in the United States involve foreign companies, such as from Korea and Japan, who are spending big to gain from the IRA subsidies and could be targets of FEOC scrutiny. Already, the FEOC guidelines to include Chinese companies have been enough to stop billions of dollars of IRA subsidized battery projects in the United States, such as Ford halting its $3.5 billion battery project with Chinese battery manufacturer CATL in October after Congressional inquiries into its partnership agreement.

Under the new guidance, a Korean company could be classified as an FEOC if 25 percent or more of their board seats, voting rights, or equity interest are held by a FEOC or if it has entered into a licensing arrangement or contract with FEOCs engaged in extraction, processing, recycling, manufacturing, or assembly of critical minerals or batteries.

Similarly, if a Korean company’s parent company (50 percent or more of a joint venture) is 25 percent held by a company defined as an FEOC, then it would be ineligible for the subsidy under the DOE’s “tiered ownership” provision. Affiliation with former senior political figures from China would also constitute elements of control or define “government of a foreign country” and the definition of “senior political figure” was also expanded to include immediate family members.

While Korean companies are waiting for further guidance after additional comments are considered by the DOE and IRS in January to determine, for example, whether any company from China that has no links to the government might constitute an FEOC, by using U.S.C. Title 10 as a metric, any Chinese company that a Korean entity has a 25 percent or more affiliation with will likely be considered one. Similarly, even licensing agreements could be enough to scuttle projects, as could have been the case with the Ford-CATL plant shutdown. Accordingly, the United States will have to determine a balance between the need for robust supply chains of critically needed materials like batteries alongside the vision it has for “strategic de-risking” from China.

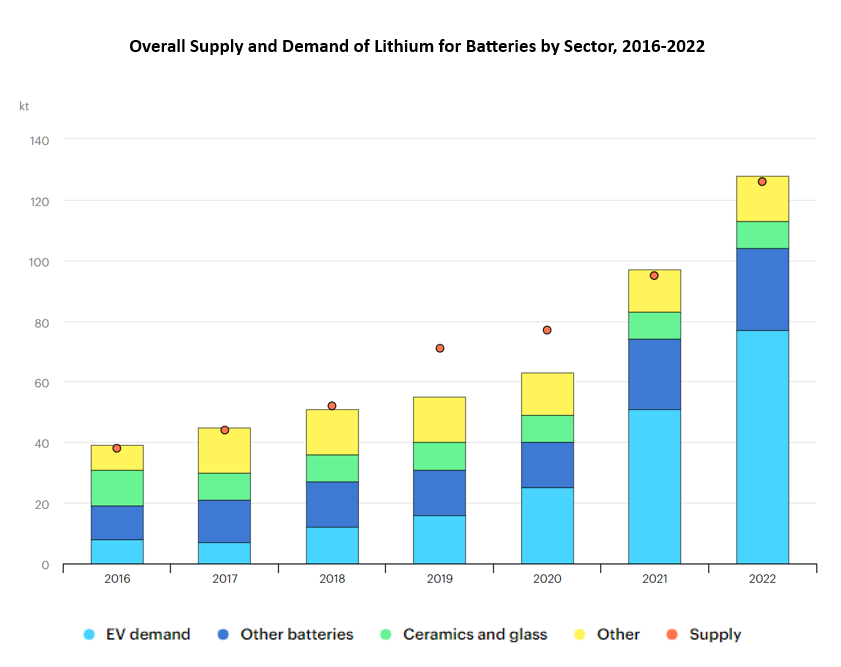

Source: International Energy Agency

The Biden administration’s push for electric vehicles indicates that two out of every three new cars and trucks sold will need to be EVs by 2032. This calls for millions of batteries to be produced—and 44 million if the United States uses EVs as part of its strategy to hit net zero emissions. Already, demands for vehicle fleet electrification are causing battery shortages. This will eventually have to be addressed through policy changes or increased investment. To do so, the United States should consider its economic allies when determining how to expand supply chains. If you have a small yard with a high fence, the barbeque better be good if you want people to come by.

Tom Ramage is an Economic Policy Analyst at the Korea Economic Institute of America. The views expressed here are the author’s alone.

Photo from Mario Roberto Durán Ortiz on Wikimedia Commons.