The Peninsula

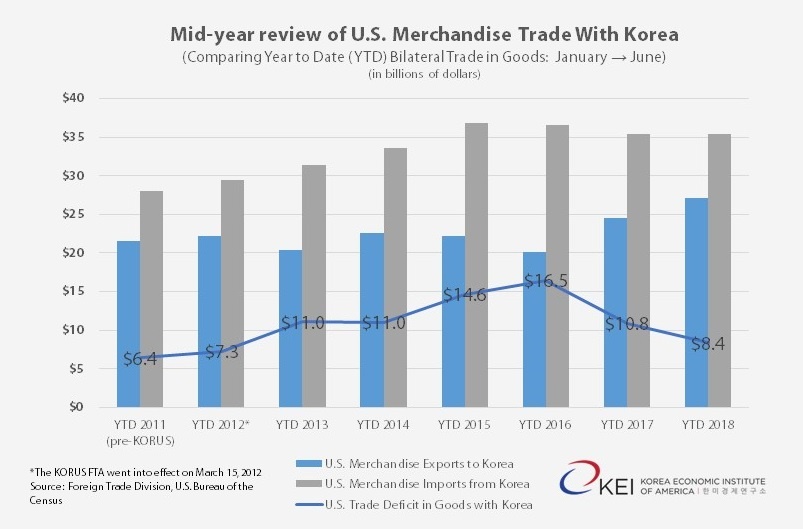

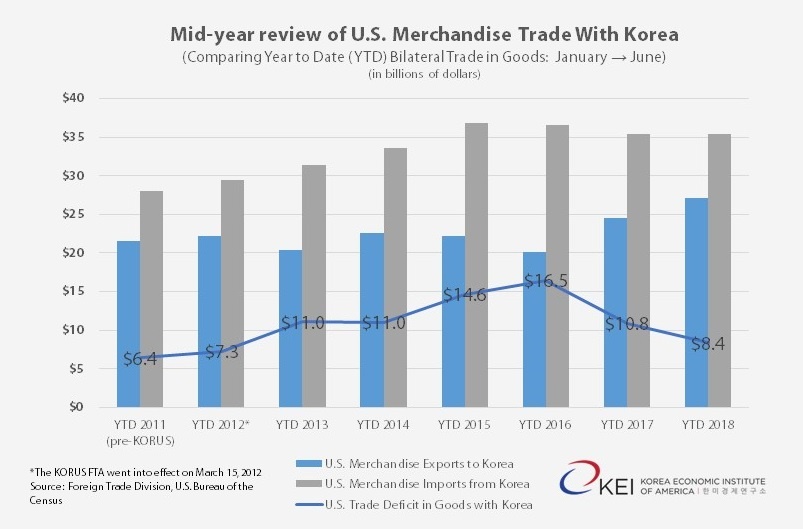

U.S. Merchandise Trade Deficit with South Korea Continues to Decline

By Phil Eskeland

Earlier this morning, the Foreign Trade Division of the U.S. Census Bureau revealed the latest set of monthly trade statistics. The August release of June trade figures provides an opportunity for a mid-year review on trends in U.S. goods trade with all nations of the world, including South Korea. Next month, Census will released the 2nd Quarter data with respect to services trade, so that will be another opportunity to obtain a more complete mid-year view of the overall trade relationship in both goods and services with various countries. For example, for the first three months of this year, the U.S. almost had a balanced goods and services trade relationship with South Korea, with only a modest $83 million cumulative deficit, in contrast to the $9.1 billion 1st Quarter trade deficit the U.S. ran with Italy.

While America’s overall merchandise trade deficit with the world went up by 6.7 percent for the first six months of this year, the trend with South Korea continued its downward trajectory, declining 23 percent. There one major reason for this trend: in 2018, U.S. exports to Korea have greatly expanded, averaging over $4.5 billion each month (a record was set in March at $5.1 billion). This may be a “Trump effect,” but it is mostly due to more favorable domestic market conditions, particularly as Korea continues to buy more energy resources from the United States.

This news is on top of recent release of updated information from the Bureau of Economic Analysis from the Commerce Department documenting the growing amount of foreign direct investment (FDI) by Korean firms into the United States, reaching a record high of $50.6 billion in 2017, up over 23 percent since 2016 or 150 percent since 2011, the year before the Korea-U.S. Free Trade Agreement (KORUS FTA) went into effect. Over 51,000 American workers at U.S. subsidiaries of wholly-owned Korean companies earned an average compensation package of over $91,000 per year (2015). In contrast, overall FDI into the U.S. declined by 32 percent in 2017.

Factors such as a declining bilateral U.S.-ROK merchandise trade deficit and increased FDI from Korea into the U.S. must be taken into consideration as the Trump Administration contemplates further action on the trade front. South Korea has been a constructive and valuable partner of the U.S., not just in the military alliance and in diplomatically dealing with North Korea, but also on trade. South Korea could also take an indirect hit to its economy if higher U.S. tariffs are contemplated against more consumer-oriented products made in China, particularly if the duties are aimed at goods assembled in China containing semiconductor components made in Korea. There is no need to open up new areas of friction in the U.S.-Korea trade relationship, such as levying a 25 percent tariff on U.S. imports of Korean-made autos and parts, when other countries posed larger challenges to U.S. economic and security interests.

Phil Eskeland is Executive Director for Operations and Policy at the Korea Economic Institute of America. The views expressed here are his own.

Photo from Wilson Hui’s photostream on flickr Creative Commons.