The Peninsula

Trump’s Truck Tariff Straw Man

In his speech at a non-union auto workers’ facility last week in lieu of a Republican debate performance, former President Donald Trump again made U.S.-Korea trade the focus of his protectionist rhetoric. In outlining what he called his vision for the “revival of economic nationalism,” he boasted over what he believed was “saving American auto manufacturing” in his first term with the renegotiation of the U.S.-Korea free trade (KORUS) agreement and vowed to engage in a day one “made in America” policy for automobiles if elected for a second term.

Speaking on the KORUS agreement, which he labeled “[Obama’s] atrocious Korean trade deal,” he put forth an argument that his renegotiation of the agreement in 2018 to extend the protective tariffs on Korean pickup trucks prevented Michigan jobs from being exported. According to Trump, had it not been for him, “millions and millions of foreign cars would have flooded American streets.” Trump was referring to the all-around 25 percent tariff on global truck imports to the United States—a relic of the United States’ retaliatory “Chicken Tax,” which arose out of disputes over European tariffs on U.S. chicken in the 1960s. The tariff, as applied to Korea, was set to be phased out in 2021 under the KORUS agreement but was subsequently extended until 2041 with Trump’s 2018 renegotiation.

The effects of the Chicken Tax writ-large have been the subject of scrutiny. The economist Robert Z. Lawrence posits that the tariff has made U.S. automakers uncompetitive to the point of being the driver of Detroit’s economic demise. Similarly, it is doubtful that Trump’s extension of the protective tariff on Korean pickup trucks had that much of an effect on the American market and accordingly Michigan jobs. The U.S. International Trade Commission (ITC) analysis on the expected effect of the tariff on U.S. imports of Korean trucks was found to be negligible due to the fact that there was a virtual absence of a Korean light truck market in the United States at the time of the signing of the renegotiations.

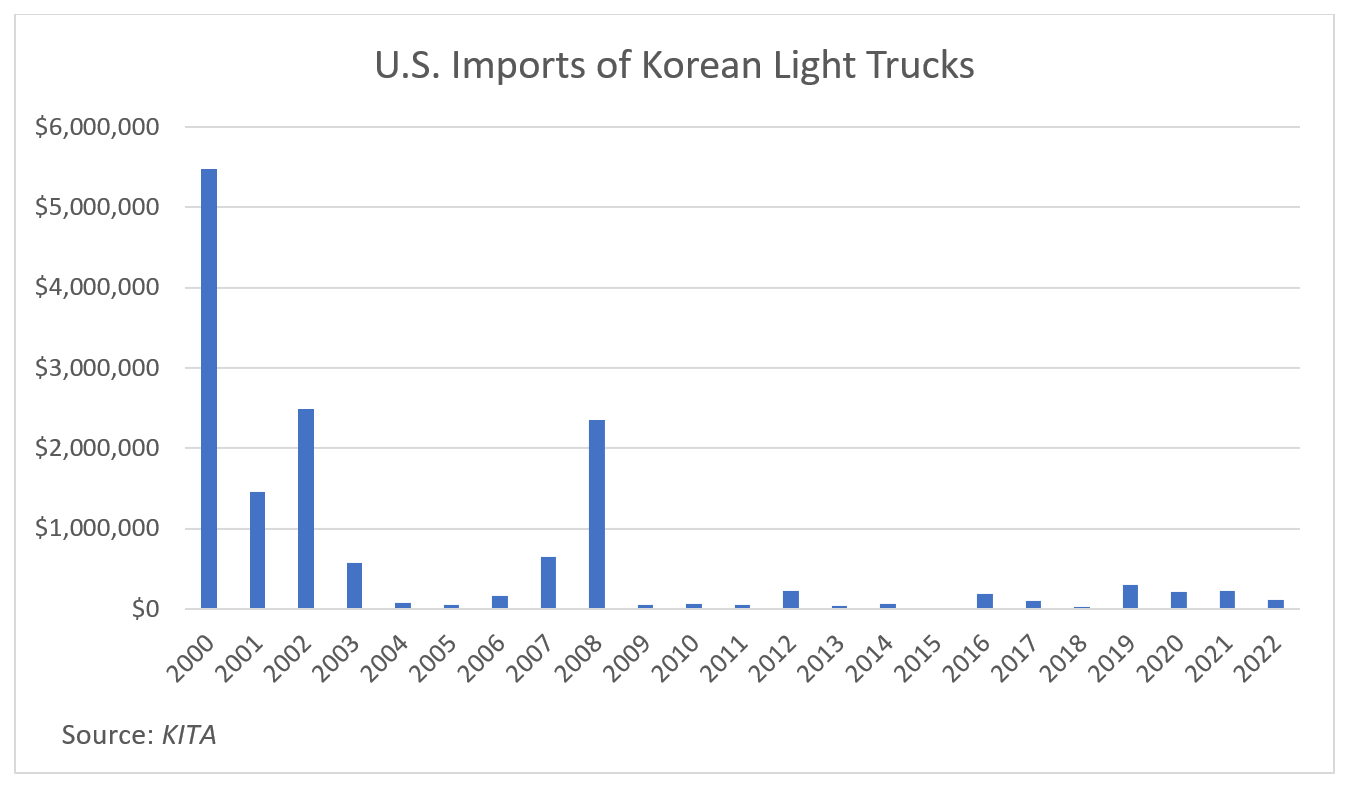

While Korean automakers do export pickup trucks abroad, at the time of Trump’s renegotiations they primarily consisted of diesel trucks to developing countries, with no Korean light truck models being sold in the United States. Light truck sales comprised 18.6 percent of total vehicle sales in the United States at the time of the renegotiation, of which 83 percent were supplied by U.S. firms. The remainder were, in fact, mostly dominated by Japanese firms, namely, Honda and Nissan. Korea would barely comprise those ranks. According to data from the Korea International Trade Association (KITA), in the past twenty years the United States has only imported a peak amount of roughly $2.3 million of light trucks from Korea in 2008 and only marginal amounts in the years afterwards.

The ITC additionally found that the economic effects of the 25 percent tariff on light and medium/heavy trucks from Korea would be hard to quantify given the fact that the United States “import[ed] few to none of the motor vehicles in question from Korea.” Accordingly, the intended effects of the continued tariff were thought to only affect a future U.S. market for Korean truck imports. Hyundai’s unveiling of its Santa Cruz pickup vehicle for the U.S. market in 2020 may be the only such example of a Korean light truck in the United States, but it is produced at Hyundai’s Montgomery, Alabama production facility and accordingly supports American jobs. The ITC additionally found that even with the tariffs removed, as was originally planned under the 2021 phaseout, the competitive nature of the U.S. truck market is such that Korean firms could still voluntarily choose to not enter it as U.S. trucks are often larger, more expensive, and include more personalized features than are found in light trucks in other parts of the world.

The ITC additionally found that the economic effects of the 25 percent tariff on light and medium/heavy trucks from Korea would be hard to quantify given the fact that the United States “import[ed] few to none of the motor vehicles in question from Korea.” Accordingly, the intended effects of the continued tariff were thought to only affect a future U.S. market for Korean truck imports. Hyundai’s unveiling of its Santa Cruz pickup vehicle for the U.S. market in 2020 may be the only such example of a Korean light truck in the United States, but it is produced at Hyundai’s Montgomery, Alabama production facility and accordingly supports American jobs. The ITC additionally found that even with the tariffs removed, as was originally planned under the 2021 phaseout, the competitive nature of the U.S. truck market is such that Korean firms could still voluntarily choose to not enter it as U.S. trucks are often larger, more expensive, and include more personalized features than are found in light trucks in other parts of the world.

In a scenario where Korean light truck firms enter the U.S. market at the levels postulated in scenarios presented in the ITC report by both exporting from Korea and using transplant production in the United States, it is likely that their share of the light truck market would be roughly equal to their share of the combined passenger vehicle and SUV market share, which in 2022 accounted for roughly 10 percent. Even in a scenario where Korean firms immediately gained a share of the U.S. light truck market equal to the share of comparable foreign firms in the United States, thought of as the most likely situation out of the five different possible scenarios examined in the report, the ITC calculated that the tariff would prevent the annual import of approximately 59,000 light trucks from Korea—a far fetch from the millions and millions of foreign cars that Trump alluded would flood American streets.

Tom Ramage is an Economic Policy Analyst at the Korea Economic Institute of America. The views expressed here are the author’s alone.

Photo from Flickr