The Peninsula

The OECD Projects that Korea’s Recovery will Continue

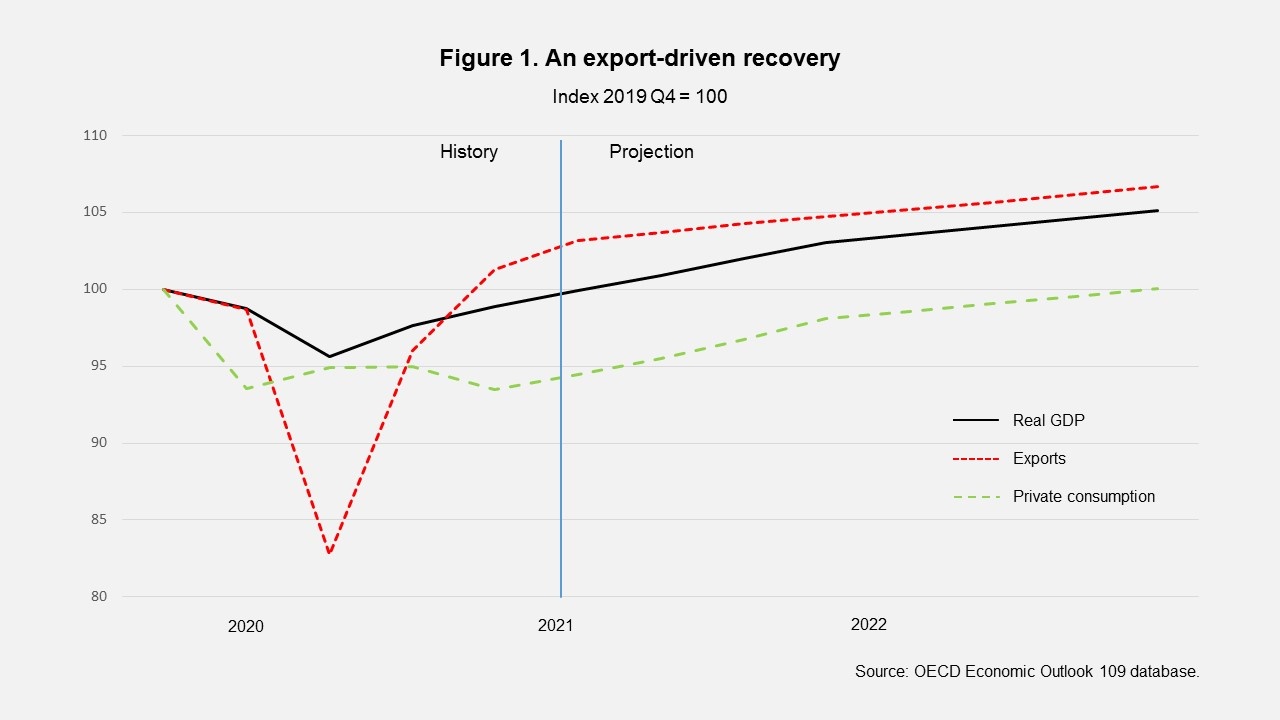

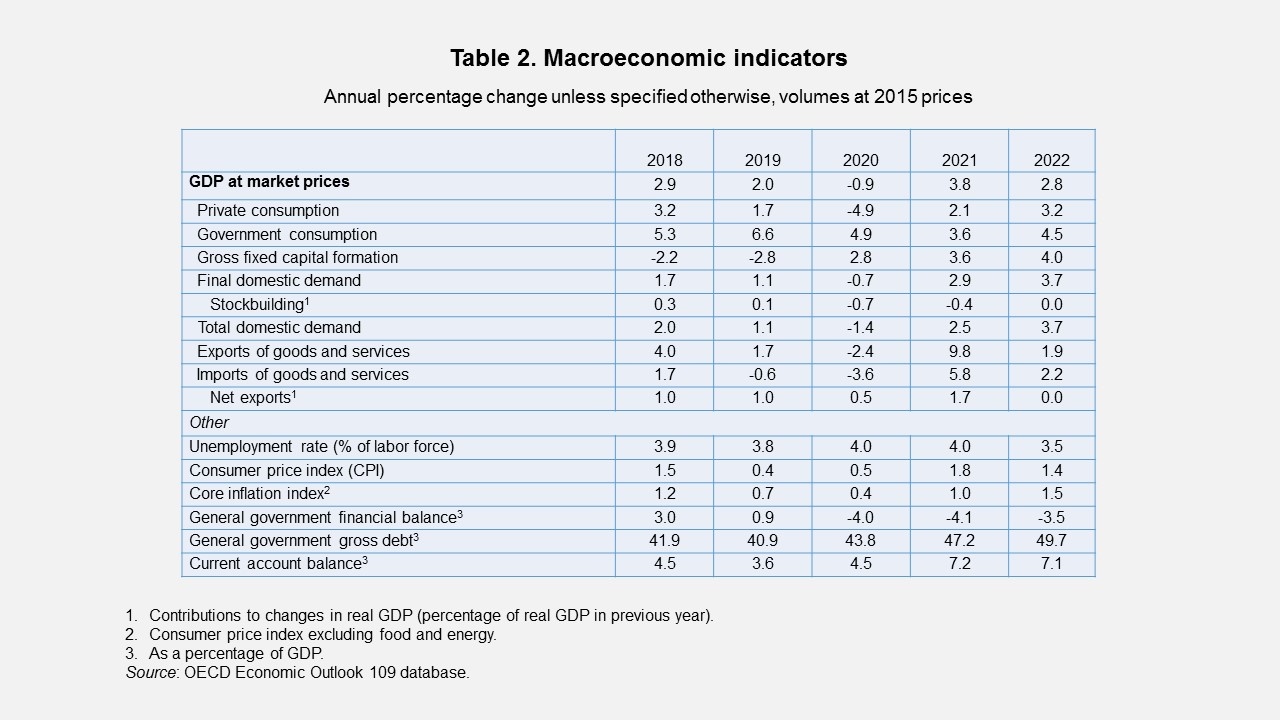

Korea’s real GDP grew 6.6% (seasonally-adjusted annual rate) in the first quarter of 2021, bringing it back to its pre-pandemic peak level (Figure 1). The May OECD Economic Outlook projects that it will increase 3.8% in 2021, significantly faster than its March outlook of 3.3%. The new projection is consistent with forecasts by the Bank of Korea (4.0%) and the IMF (3.6%). The OECD downgraded its projection for 2022 from 3.1% to 2.8%.

Korea’s rebound from a 1.0% contraction in 2020 is expected to be driven by exports in 2021 (Table 1). Export growth is expected to reach nearly 10%, boosted by global demand for IT products, which account for about one-fifth of Korea’s exports, and cars. The current account surplus is projected to surpass 7% of GDP.

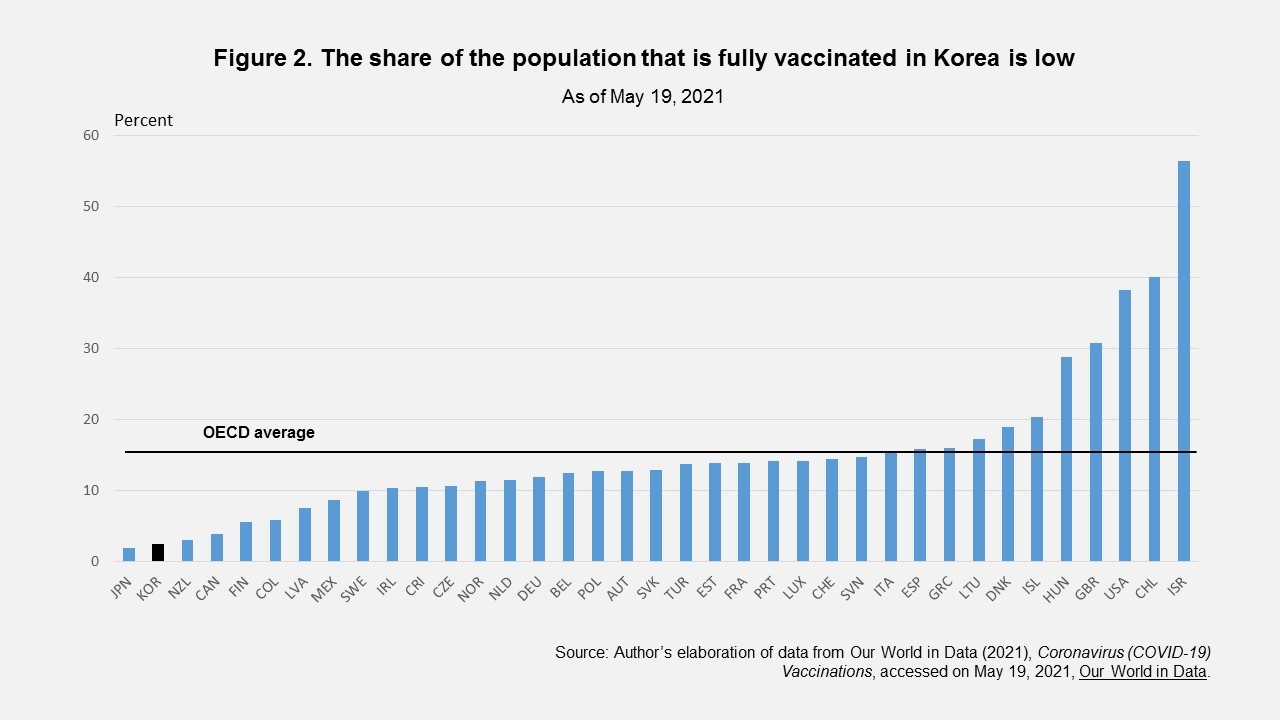

However, Korea is experiencing a two-speed recovery as domestic demand is less robust. With the number of new COVID-19 cases steady at around 500 per day, nationwide social distancing measures remain in effect. Progress in vaccinations has lagged behind other countries, reflecting a shortage of vaccines. As of May 19th, only 2.5% of the population had been fully vaccinated, the second lowest among OECD countries (Figure 2). The OECD stated “This slow vaccination pace tends to postpone the lifting of distancing restrictions and the recovery in private consumption and employment.” While exports have surpassed their peak at the end of 2019, private consumption is 4.5% below, despite some easing of COVID-19 restrictions and government support for vulnerable households and firms.

The OECD projects that expansionary macroeconomic policy, a gradual lifting of COVID-19-related restrictions and pent-up demand will support private consumption and revive the service sector. The government’s goal is to vaccinate about a quarter of the total population by June, and achieve herd immunity by November. A government poll in late April found that 69% of unvaccinated persons are willing to receive the vaccine. Nevertheless, the OECD does not expect private consumption to regain its pre-pandemic peak until the end of 2022 (Figure 1). Weak service-sector activity is keeping the unemployment rate relatively high.

Monetary policy is supporting Korea’s recovery. The Bank of Korea has kept its policy rate at a record-low 0.5% since May 2020 and provided abundant liquidity. Consumer prices in May rose 2.6% (year-on-year), their fastest pace in nine years, but this primarily reflects higher food and energy prices. Core inflation, which excludes food and energy, was lower at 1.2% in May. With the OECD projecting that inflation will remain below the 2% target, it argues that monetary policy should remain accommodative as Bank of Korea Governor Lee Ju-yeol agrees. In late March, he stated “As oil prices pick up quickly and food prices soar, there are growing worries about inflation. If the quick containment of Covid-19 brings pent-up demand, there may be temporary inflation, but it is not likely to last.”

Fiscal policy continues to provide large-scale support, including cash payments to households, financial assistance to businesses and job retention schemes. However, a study by the Korea Development Institute found that only 30% of government support was spent, with the remainder used to repay debt or increase savings. Moreover, the impact was short-lived: more than 90% of the spending was concentrated in two months. The March 2021 supplementary budget of 15 trillion won (0.8% of GDP), the fifth since the beginning of the pandemic, is better targeted at vulnerable households and small businesses than previous relief packages, which will strengthen its impact.

The supplementary budgets and negative impact of the recession on tax revenue resulted in government budget deficits of around 4% of GDP in 2020-21 and boosted government debt, which was 36% of GDP in 2017 to 47% in 2021. While that is still far below the OECD area at 130% of GDP, exceptionally rapid population aging in Korea raises concern about government debt. The OECD recommended that “Policy support should continue to be targeted to vulnerable households and businesses until the economy is on a firmer recovery path, and vaccination should be accelerated.” The government is considering a sixth supplementary budget. Finance Minister Hong Nam-ki said an extra budget would not require new debt, but would be funded by unexpectedly high tax revenues.

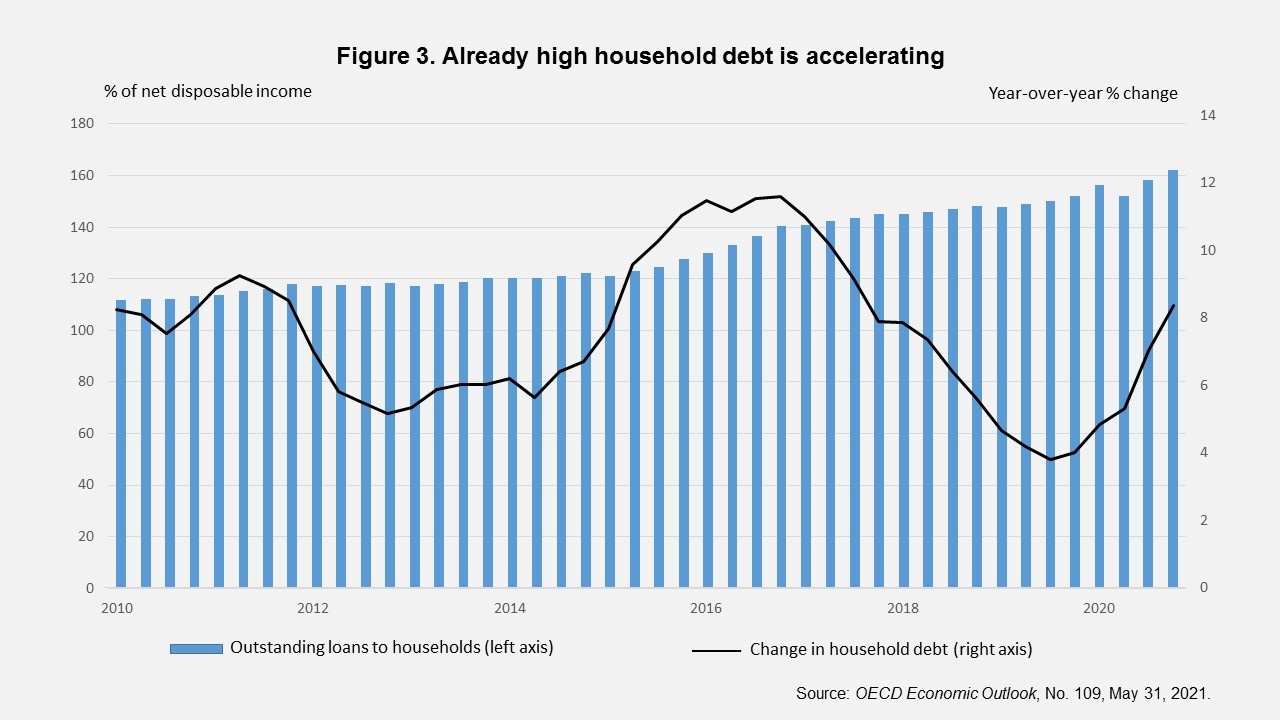

The OECD cited volatile house prices and high household debt as risks to the economic expansion. Household debt, at more than 160% of net household disposable income (Figure 3), could threaten financial and macroeconomic stability. The rise in household debt, which was 4% in 2019, has accelerated to 8% (year-on-year). The government aims to slow its growth to 6% in 2021 and 4% in 2022 by tightening lending rules and strengthening risk management of financial institutions.

Randall Jones is a Non-Resident Fellow at the Korea Economic Institute of America. The views expressed here are the author’s alone.

Image from Park Keun Hyung’s photostream on flickr Creative Commons.