The Peninsula

The Impact of the War in Ukraine on the Outlook for the Korean Economy

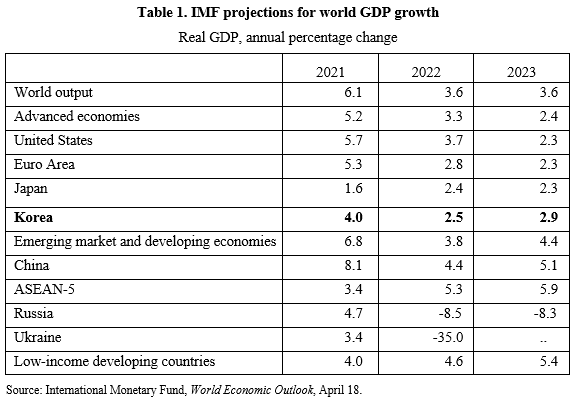

Russia’s invasion of Ukraine is having a serious impact on the global economic recovery from the COVID-19 pandemic. After a 3.6% drop in 2020, world GDP rebounded with 6.1% growth in 2021 (Table 1), reflecting progress in controlling the coronavirus and exceptionally strong fiscal and monetary measures to offset the impact of the pandemic. In January 2022, the IMF projected that the global recovery would strengthen from the second quarter of this year as the impact of the Omicron variant faded, leading to 4.4% world GDP growth in 2022.

However, the prospects for the global economy have been disrupted by Russia’s invasion of Ukraine. Although Russia and Ukraine together account for only about 2% of world GDP and trade, the war is having a serious impact on the global economy:

- Russia and Ukraine are major producers and exporters of key food items, minerals and energy. Together they account for about 30% of global exports of wheat, 20% for corn, mineral fertilizers and natural gas, and 11% for oil. A severe drop in wheat exports from Russia and Ukraine would result in serious shortages in many emerging-market and developing economies, raising the risk of economic crises and humanitarian disasters. In some countries in the Middle East, such as Turkey, Egypt and Israel, Russia and Ukraine account for more than half of their wheat imports. Moreover, the disruption in the supply of fertilizer risks reducing the 2023 agricultural supply.

- Inflation is spiking. Already by mid-March, there were sharp increases in the prices of key commodities, such as wheat (86%), corn (49%) and gasoline in Europe (33%), since their January levels. The OECD projected in February that if the commodity and financial market shocks experienced during the first few weeks of the war continue for one year, global inflation would rise by 2½ percentage points.

- The war in Ukraine has created a new negative supply shock for the world economy, just when some of the supply-chain challenges seen since the beginning of the pandemic appeared to be easing.

- Financial market conditions have deteriorated, reflecting greater risk aversion and uncertainty, with higher risk premia and currency depreciations also occurring in many emerging-market economies.

The IMF’s World Economic Outlook that was released on April 19th projects that the world GDP growth will slow to 3.6% in 2022 (Table 1), while global trade growth drops from 10.1% in 2021 to 5.0% this year.

The direct impact of the war in Ukraine on the Korean economy

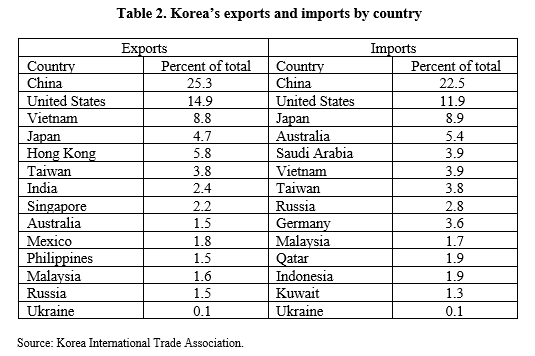

The marked deceleration of world trade is negatively impacting the Korean economy. In addition, Korea implemented the U.S. and European sanctions on Russia, its tenth-largest trading partner, which accounts for 1.5% of Korea’s exports and 2.8% of its imports in 2021 (Table 2). Although Russia is not a major trading partner, Korean exports to Russia have been on an upward trend, rising by 45% in 2021. Korea’s top exports to Russia — semiconductors, electronics, and automobiles — could be affected by the latest export controls, which require that companies using U.S.-origin technology in their exports receive U.S. approval before sending them to Russia. President Biden stated that “Between our actions and those of our allies and partners, we estimate that we will cut off more than half of Russia’s high-tech imports.”

Korea’s trade with Ukraine is very small at less than 0.1% for both exports and imports. However, Korea is dependent on Ukraine for gases that are used in lasers that print circuits on semiconductor chips, Korea’s single largest export item. Korea currently purchases 31% percent of its krypton gas, 23% percent of its neon gas and 18% of its xenon gas from Ukraine. If the war disrupts Ukraine’s production of these gases, finding a substitute will be difficult. For example, Ukraine currently accounts for 70% of the global production of neon gas. Establishing domestic capacity to substitute imports would also be challenging as these gases are often byproducts of processes within heavy and chemical industries.

Korea is taking steps to limit such risks. In February, its trade minister, Yeo Han-koo, stated that Korea is “trying to identify all these critical raw materials which could disrupt our supply chain.” Korea is also developing an “early warning system” that flags risks to some of these key materials. If necessary, Minister Yeo said, a stockpiling system or some sort of swap system could be developed with other countries.

Korea is most vulnerable to the rise in energy prices, as imports provide 92% of its energy. Despite President Moon’s call for a phase-out of nuclear power, he has urged the full use of current nuclear power plants to cope with the crisis.

The outlook for the Korean economy

The IMF downgraded its GDP growth projection for Korea in 2022 from 3.3% in its October 2021 outlook to 2.5% in 2022, with a rebound to 2.9% in 2023. The Bank of Korea (BoK) recently said the growth this year may be less than its earlier estimate of 3%.

The Ministry of Finance and Economy’s April “Green Book” stated that the “economy has sustained its momentum based on exports and an improvement in the job market.” Indeed, exports of information and communication technology (ICT) products jumped 34% (year-on-year) in March, driven by strong demand for chips and displays. Employment increased for the 13th consecutive month in March, though at a slower pace as in-person services were hit by the surge in COVID-19 cases.

The Green Book also stated that the spread of the COVID-19 is feared to “constrain the recovery of domestic demand.” The latest indicators, though, suggest that the risk from COVID-19 has diminished. With the number of daily infections falling from more than 600,000 in mid-March to around 125,000 in mid-April, the government unveiled its “post-omicron” road map. The government announced it will lift all COVID-19 social distancing rules, except the mask mandate, starting April 18. The end of the curfew for restaurants, cafes and other small businesses and the ten-person limit on the size of private gatherings should promote service-sector activities. The seven-day mandatory quarantine for COVID-19 patients will be lifted in late May after a four-week transition period.

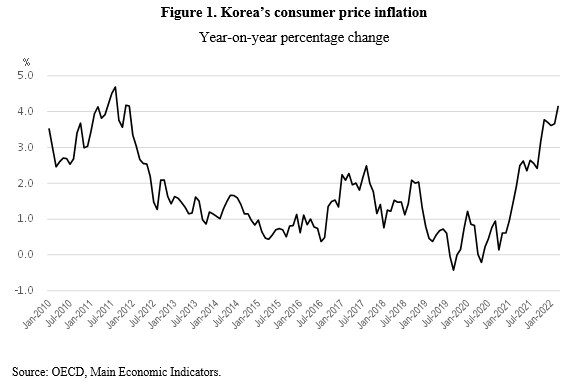

As in many countries, inflation poses a risk to the Korean economy. The rise in consumer price inflation to more than 4.1% (year-on-year) in March for the first time in more than ten years (Figure 1) amid surging energy costs poses a larger threat, although it is far below the 8.5% rate in the United States. The BoK has acknowledged that inflation could exceed its 3.1% projection in February. Indeed, import prices increased 7.8% in March, as oil import prices jumped 72.1%. The IMF’s April Outlook projected that Korea’s inflation would spoke at 4.0% in 2022 before easing to 2.4% in 2023. The BoK raised its policy rate by a quarter percentage point to 1.5% in April, the fourth hike since August last year, to contain inflation and household debt. Higher interest rates will particularly impact consumption by highly-indebted households and the real estate sector.

External threats of disruptions to the world economy due to the war in Ukraine are perhaps the biggest risk to the Korean economy. The largest vulnerabilities are related to China. Sanctions on China could disrupt Korea’s trade with China, given that 80% of its exports to China are intermediate goods, many of which are inputs to products exported elsewhere. Supply chain disruptions are also a concern. China supplies more than half of Korea’s imports of 604 products, compared to 475 products for Japan and 185 for the United States.

Randall S. Jones is a Non-Resident Fellow at the Korea Economic Institute of America. The views expressed here are the author’s alone.

Photo from Shutterstock.