The Peninsula

South Korea’s Important Role in Vietnam’s Rapid Development

In the mid-1980s, Vietnam adopted a series of economic and political reforms to transition its economy from a centrally planned system to more of a market economy. These Doi Moi reforms laid the foundation for Vietnam’s transformation from a virtually closed agrarian economy to a major exporter and destination for foreign direct investment (FDI).

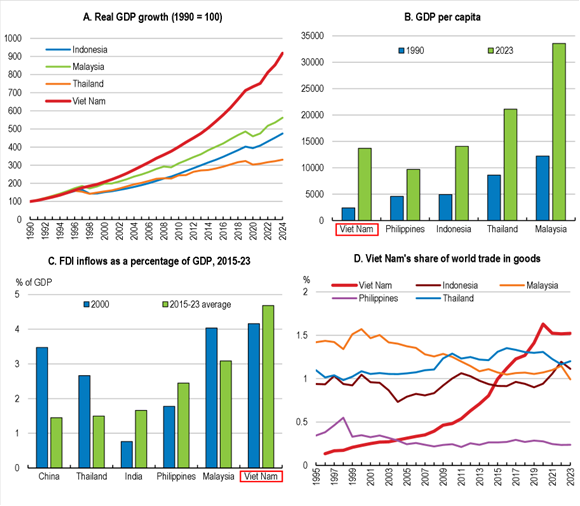

Real GDP rose at a 6.7 percent annual average rate between 1990 and 2024 (Figure 1, Panel A). On a per capita basis, it rose by 5.6 times over that period (Panel B). Economic growth enhanced well-being, as reflected in the rise in life expectancy from sixty-nine to seventy-five years over the same period.

Figure 1. Vietnam’s output growth has outpaced its ASEAN peers

FDI has driven Vietnam’s transformation. Inflows amounted to 4.8 percent of GDP between 2015 and 2023, exceeding those of its ASEAN peers, as well as India and China (Figure 4.1, Panel C). Over the past decade, FDI has accounted for 15 percent of Vietnam’s total investment, exceeding domestic private investment at 14 percent. FDI inflows were encouraged by trade liberalization that has made Vietnam one of the most open markets in Southeast Asia.

Vietnam joined the World Trade Organization (WTO) in 2007 and has implemented sixteen bilateral and multilateral free trade agreements (FTAs), covering fifty-three countries that account for 87 percent of global GDP. These agreements helped to cut Vietnam’s average applied tariff on manufactured goods from 16.6 percent to 1.1 percent. Vietnam is now Asia’s most trade-dependent economy after Singapore, with total trade flows (the sum of imports and exports) rising from 19 percent of Vietnam’s GDP in 1988 to 184 percent in 2022. The country’s share of world trade rose from 0.1 percent in 1996 to 1.5 percent in 2023 (Figure 4.1, Panel D), making it the nineteenth largest exporter globally. Foreign-owned firms operating in Vietnam produce nearly three-quarters of the country’s exports.

South Korea’s Contribution to Vietnam’s Rapid Growth

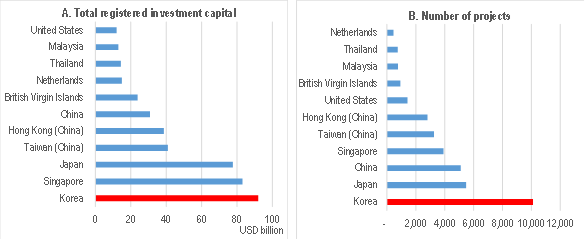

South Korea is the largest foreign direct investor in Vietnam, with investments totaling USD 92 billion at the end of 2024, surpassing Singapore, Japan, and Taiwan (Figure 2, Panel A). Moreover, it invested in more than ten thousand projects by the end of last year, about double that of Japan and China (Panel B).

Figure 2. Korea is the largest foreign direct investor in Vietnam (2024)

Large-scale FDI has made the Korean and Vietnamese economies increasingly interdependent. Samsung is the largest foreign investor in Vietnam, with investments totaling USD 22 billion in 2023. Moreover, it is one of the largest employers in Vietnam with 112,000 workers. Samsung has also been a catalyst for additional FDI inflows to Vietnam from major suppliers in its global supply chains. In 1996, Samsung began producing color television sets for the Vietnamese market. Its Vietnamese operations have grown significantly since 2009, following the creation of four wholly-owned subsidiaries in mobile phone manufacturing.

Today, Vietnam accounts for about half of Samsung’s global mobile phone production, making it the second-largest exporter of smartphones in the world. Samsung alone accounted for about one-fifth of Vietnamese exports in 2023. The share rises to 30 percent when all Korean enterprises operating in Vietnam are included.

Korean FDI in Vietnam has stimulated bilateral trade. In 2023, Korea was Vietnam’s third-largest export market, accounting for 6.6 percent of its total exports (Figure 3, Panel A). Vietnamese exports to Korea consist primarily of products manufactured by Korean enterprises—notably phones and components, computers, electronic products, and components and machinery. As for Vietnam’s imports, Korea—at 16.1 percent—was second behind China (Figure 3, Panel B). Korea’s exports to Vietnam are concentrated in components and machinery that serve as inputs for Vietnam’s export-oriented manufacturing.

Trade between Korea and Vietnam may be adversely affected by rising protectionism. A tentative U.S.-Vietnam trade agreement was reached on July 2, a week before the 46 percent “reciprocal” tariff on Vietnam, announced by U.S. President Donald Trump in April, was to take effect. Under the agreement, the United States would impose a 20 percent baseline tariff on Vietnamese goods, which is double the 10 percent rate set for the United Kingdom in one of the few other trade agreements reached thus far.

Higher tariffs would likely have a significant impact on Vietnam, given that its exports to the United States comprise nearly one-third of its GDP. In return, Vietnam would eliminate all tariffs on U.S. products.

Figure 3. Korea is a major trading partner for Vietnam

In addition, goods that are “transshipped” through Vietnam would be subject to a 40 percent U.S. tariff. This provision aims to prevent third countries, notably China, from circumventing high U.S. tariffs by shipping products to Vietnam and then re-exporting them to the United States under a Vietnamese label in order to benefit from Vietnam’s more favorable trade status with the United States. The U.S.-Vietnam agreement is likely to tighten rules of origin to close loopholes that enable tariff evasion.

Harnessing Trade and FDI to Boost Economic Growth

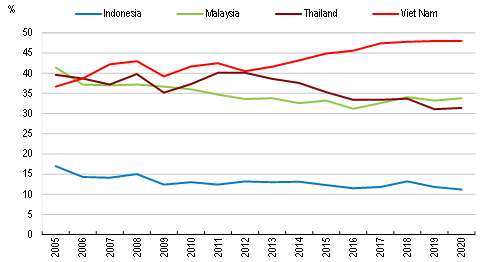

Foreign-owned firms in Vietnam tend to operate in enclaves that import much of the intermediate inputs or invite their global suppliers to establish affiliates. Imports account for about four-fifths of the inputs into Vietnam’s finished exports. Taking account of assembly and other processing, the foreign value-added accounted for 48 percent of Vietnam’s gross exports in 2020, significantly higher than other ASEAN countries (Figure 4). The high and rising share of foreign value-added reflects the increasing importance of higher technology products in Vietnamese exports.

The weak integration of foreign-owned firms with Vietnam’s domestic economy limits their impact on economic growth. Strengthening their linkages with the domestic economy would bring greater benefits to Vietnam and help it achieve its goal of attaining high-income status by 2045.

Increasing the skills of local firms and workers

According to foreign investors, a key obstacle to the greater integration of foreign-owned firms and Vietnam’s domestic economy is the lack of necessary skills in local firms and workers, reflecting insufficient investment in technical and vocational education. Consequently, about 85 percent of manufacturing jobs in the export sector were lower-skilled production jobs, a substantially higher share than in other ASEAN countries.

For example, Samsung had sixty-seven tier-one suppliers in Vietnam in 2014; sixty-three were foreign firms, of which fifty-three were Korean. By 2017, Samsung had twenty-five tier-one Vietnamese suppliers, but none produced parts and components for Samsung’s final products. Instead, they provided services such as packaging, meal catering, cleaning, and security.

Figure 4. Foreign value-added accounts for about half of Vietnam’s exports

Samsung has made important investments in education and training, whose benefits extend beyond its employees. These efforts include the “Samsung Smart School” program in rural and remote areas, “New Hope Schools” in impoverished areas, Samsung’s “Innovation Campus” to provide information and communications technology (ICT) education, a program to embed digital resources in schools, and an investment of USD 220 million to create a research center in Hanoi in 2022.

Conclusion

The cooperative relationship between Samsung and Vietnam provides significant benefits for both countries. Korean companies have enhanced their international competitiveness, while their operations in Vietnam have provided a strong economic boost for Vietnam. Maintaining open international trade and removing obstacles to FDI are essential to maintain this symbiotic relationship.

Randall S. Jones is Distinguished Fellow at the Korea Economic Institute of America. The views expressed here are the author’s alone.

Photo from Shutterstock.

KEI is registered under the FARA as an agent of the Korea Institute for International Economic Policy, a public corporation established by the government of the Republic of Korea. Additional information is available at the Department of Justice, Washington, D.C.