The Peninsula

South Korea’s Exposure to the Iran-Saudi Proxy War

By Troy Stangarone

Since Japan’s decision at the beginning of July to place national security restrictions on three chemical components critical for the production of semiconductors and display screens much of the focus has been on the South Korea’s dependence on Japan for certain critical technologies. But South Korea’s petroleum supplies also have significant exposure to Middle Eastern geopolitics in the proxy war between Iran and Saudi Arabia.

For the last four years, Yemen has been caught in a civil war where Saudi Arabia has backed the nominal government while Iran has supported the Houthi rebels. At times the conflict has spilled over into Saudi Arabia as the Houthi respond to Saudi strikes in Yemen, but in their latest strike the Houthi damaged two critical oil facilities in Saudi Arabia.

The attacks have knocked out about half of Saudi Arabia’s production capacity, which accounts for 5 percent of global oil supplies. Early estimates are that it could take weeks to restore production to full capacity.

In initial trading after the attack, the price of crude jumped 20 percent to over $70 a barrel before falling to around $66 a barrel, the highest single day increase since Iraq’s invasion of Kuwait in 1990. Some analysts expect prices could rise to $100 per barrel.

While U.S. shale gas might be able to replace some of the supply, it may be of limited help outside of the United States. It would take 90-180 days to drill new wells and the infrastructure may not be in place to get the shale gas to overseas markets.

Despite the Houthi taking responsibility for the attack, the United States has suggested that the strike pattern on the Saudi facility suggests that the attacks came from Iran rather than Yemen. It has indicated that it is considering a retaliatory strike. Saudi Arabia has also suggested that Iranian weaponry was used in the attack, while a strategist for Iran’s Revolutionary Guard has also suggested that the Houthi likely were not capable of undertaking this attack, perhaps adding a degree of credibility to U.S. assertions.

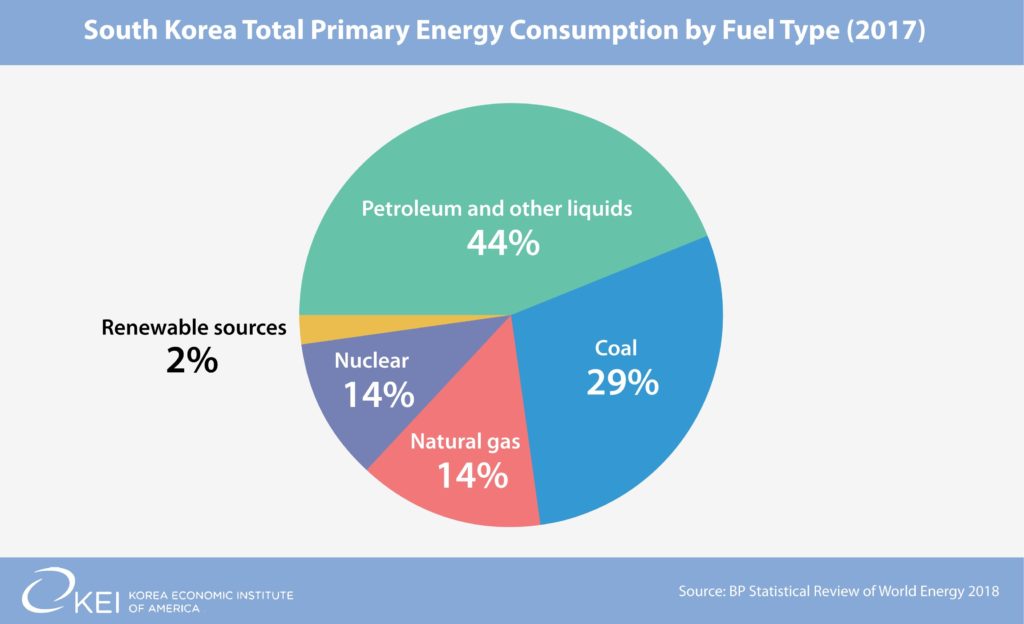

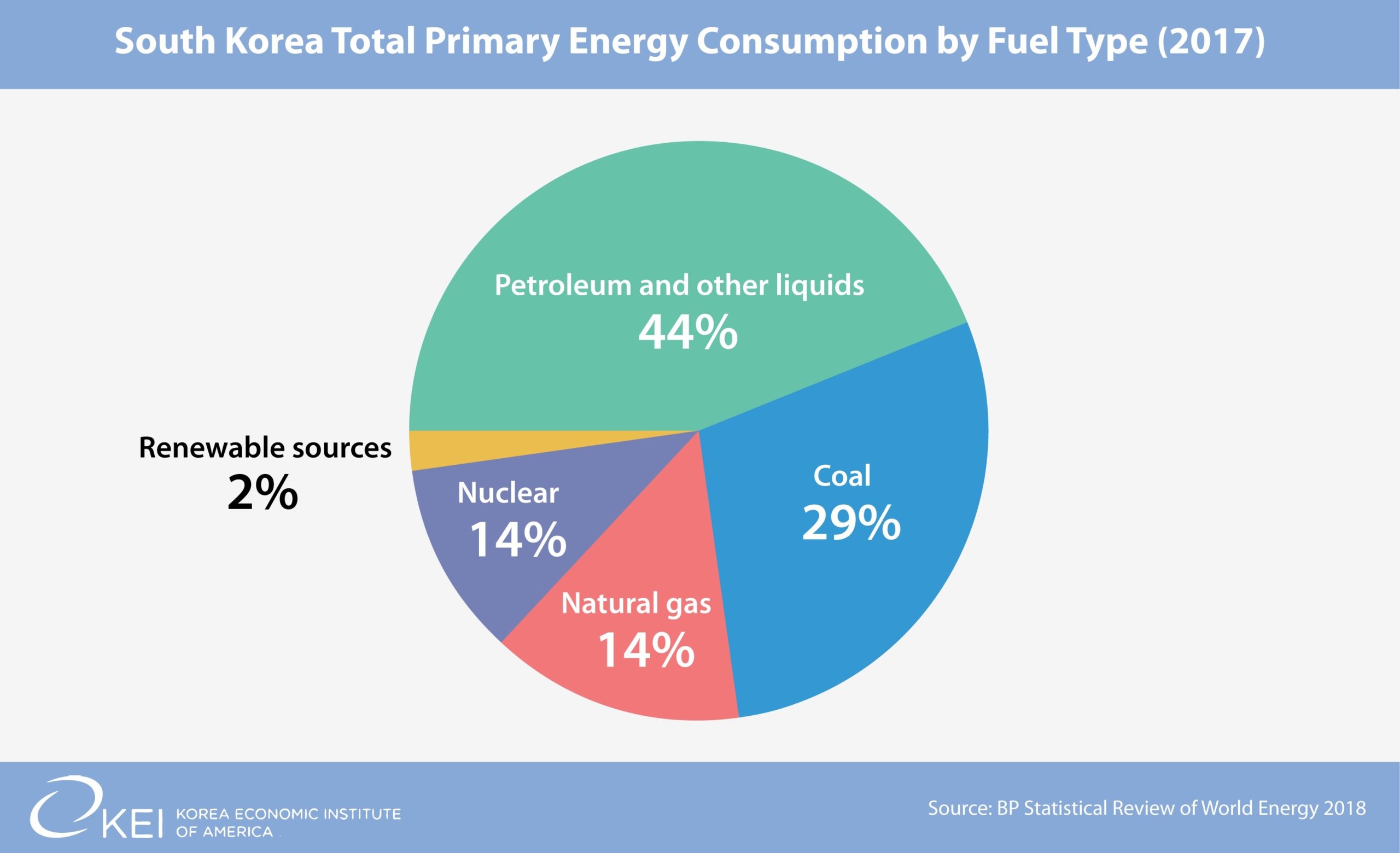

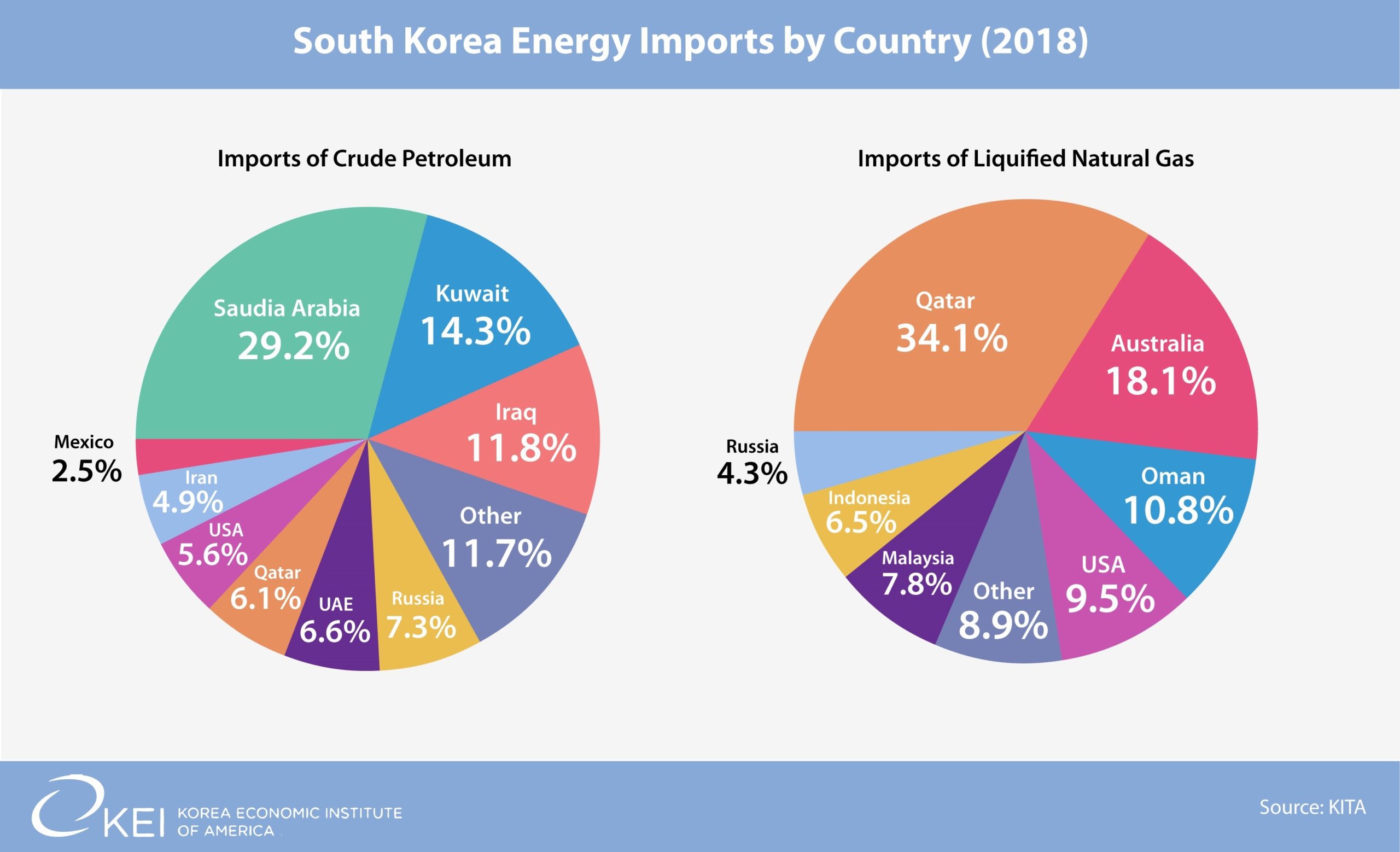

Disruption of Middle Eastern oil supplies has implications for South Korea. Nearly 45 percent of South Korea’s energy consumption is petroleum based and more than 70 percent of those supplies come from inside the Strait of Hormuz. Nearly 30 percent of South Korea’s imports of crude petroleum come from Saudi Arabia.

In the short-to-medium term South Korea should not feel much effect. Some 90 percent of South Korea’s oil imports from Saudi Arabia are under long-term contracts and Saudi Arabia has indicated that it will release oil from its 27 days of reserves to maintain exports. Saudi Arabia has also strategically placed reserves in countries such as the Netherlands, Egypt and Japan, protecting them from potential additional attacks. South Korea which also has 90 days of reserves has indicated that it will release them, if necessary. However, if there were more significant disruptions S-Oil Corp., which imports most of its crude from Saudi Arabia, would be the major South Korean firm to feel an effect.

Regardless of whether Iran or the Houthi are responsible for the attack, there is an increasing danger for South Korean supply lines should the conflict escalate from either further Houthi attacks on Saudi facilities or the escalation of a conflict with Iran. The Houthi have already suggested that further strikes could be in the works, while an attack by the United States or Saudi Arabia against Iran could further endanger oil supplies in the region.

Until South Korea is able to further diversify its suppliers and shift to other energy sources, its economy is vulnerable to the increasingly unstable geopolitics of the Middle East.

Troy Stangarone is the Senior Director for Congressional Affairs and Trade at the Korea Economic Institute of America. The views expressed here are the authors alone.

Graphics by Juni Kim, Program Officer at the Korea Economic Institute of America.

Photo by lawepw on WikiCommons.