The Peninsula

Samsung Diversifies into Automotive Chips

By Troy Stangarone

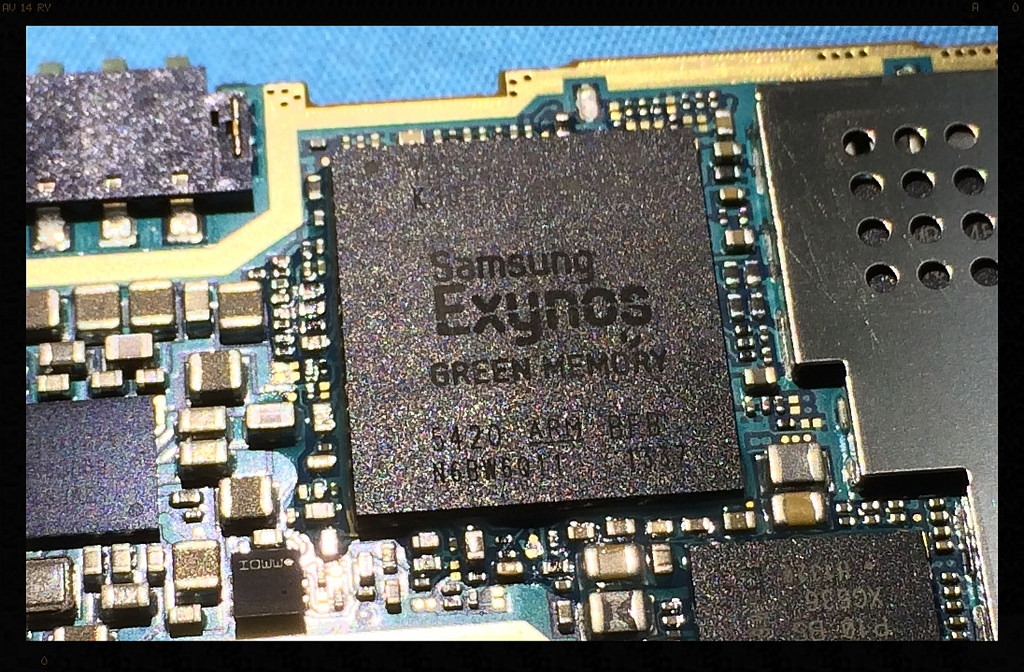

After years of success in designing and producing memory chips for cell phones, data centers, and other memory storage functions, Samsung has taken a step toward supplying processing chips for next-generation vehicles. From 2021, Samsung’s first automotive branded processor, the Exynos Auto V9, will power Audi’s infotainment system.

While the partnership with Audi has been in place since 2017, the announcement could not have come at a better time for Samsung. A few days after announcing that it would supply the Exynos Auto V9 for Audi’s infotainment system, Samsung also announced that its fourth-quarter profits would be down due to slowing demand for semiconductors and increasing competition for smartphones. Operating profits are down more than 38 percent, with memory chip shipments expected down 10 percent for the quarter due to declining demand from data centers.

Slowing memory chip sales are not confined to data centers. As U.S.-China trade tensions continue, the slowing economy in China will also likely be a headwind for Samsung in the coming quarters. According to data by the Korean Customs Service, memory chip exports in November (the latest data available) were only up 2 percent, after having been up more than 40 percent every month of 2018 outside of October when the slowdown in China likely began.

By entering the automotive processing segment, Samsung can diversify away from its dependence on the memory segment, which has largely driven operating profits in recent years but is also a lower value segment than processing.

Samsung’s partnerships in the automotive market aren’t expected to be confined to Audi. Recent reporting indicates that Samsung is scouring for talent in the autonomous vehicles segment. The producer could move into making other automotive processing chips for autonomous systems and is reportedly producing the new Tesla designed chip for the Model 3.

With the market for memory chips slowing, the automotive segment could be a new area of growth for Samsung. The market for automotive chips was estimated to be worth $22.7 billion in 2016 and is expected to grow to $56.2 billion by 2025. These numbers are still small compared to Samsung’s earnings in the memory segment where it had sales of 60.3 trillion Korean won ($53.7 billion), but the move towards both autonomous vehicles and the increasing integration of technology such as infotainment systems into vehicles will lead to increasing demand for high-value chips to manage the complex processes.

However, Samsung isn’t the only chip maker moving into the automotive sector. Intel, AMD, Qualcomm, and Nvidia, which supplied Tesla until recently, are all looking towards the automotive sector to drive demand for high-end chips, as are other chipmakers. If Samsung is going to successfully lessen its dependence on memory chips, it will need to succeed in a much more competitive segment of the semiconductor market.

Troy Stangarone is the Senior Director for Congressional Affairs and Trade at the Korea Economic Institute of America (KEI). The views expressed here are the author’s alone.

Photo from user Honou on flickr Creative Commons.