The Peninsula

Record Levels of U.S. Agricultural Exports to South Korea

By Phil Eskeland

As we continue to examine the effect of the Korea-U.S. Free Trade Agreement (KORUS FTA) on its 7th anniversary, one of the major sticking points in the negotiations was the treatment of various agricultural products. Because South Korean tariffs on agricultural imports were very high (averaging 55.4 percent vs. 3.8 percent for the United States), there were predictions that the U.S. agricultural community would disproportionately gain from KORUS as various tariffs and import quotas were eliminated or dramatically reduced. Much of the strongest support for KORUS came from the U.S. farming and ranching community during the process to pass the KORUS implementation legislation into law back in 2011.

The economic analysis conducted by the independent U.S. International Trade Commission prior to Congressional passage of KORUS confirmed these suppositions. The USITC concluded that “agricultural exports to Korea that would be likely to increase…include grains, oilseeds, animal feeds, fruits, vegetables, seafood, and various processed foods and nonalcoholic beverages.” The USITC also concluded that the largest agricultural sub-community to benefit from KORUS in terms of an increase in output and employment would be the meat sector.

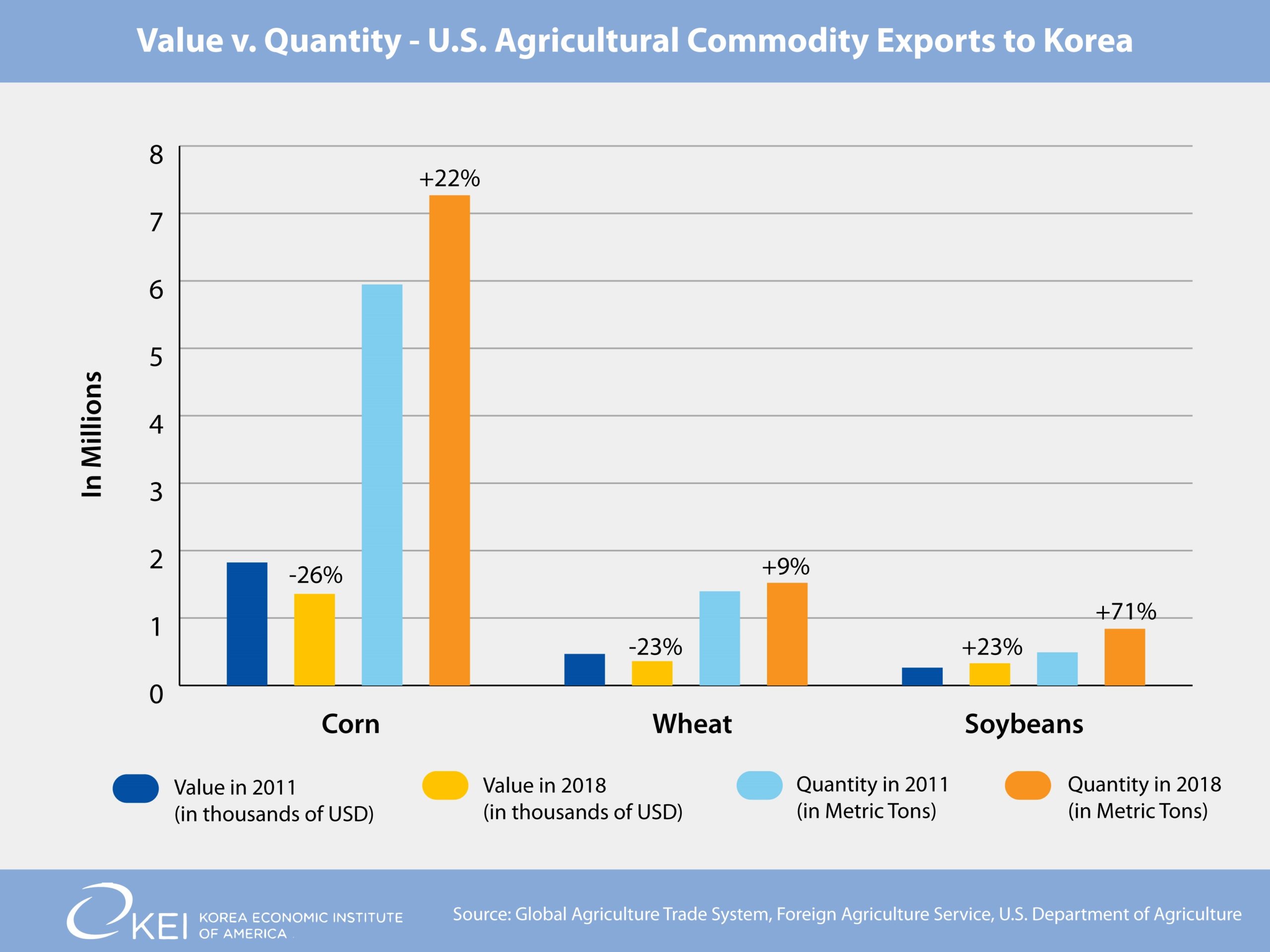

However, in the few years after KORUS went into effect in 2012, the overall export level of U.S. agricultural products to Korea did not live up to expectations. While exports to Korea of U.S. consumer-oriented agricultural products (i.e., beef, nuts, wine, cherries, etc.) and intermediate goods (i.e., soybean and vegetable oil) grew since KORUS implementation, the value of most bulk agricultural commodity products (i.e., corn, wheat, soybeans), shrunk. Some groups critical of the KORUS FTA used these results to justify their reasons to scuttle the agreement, but they overlooked the dramatic decrease in prices for commodities in contributing to the decline in the value of U.S. agricultural products to Korea.

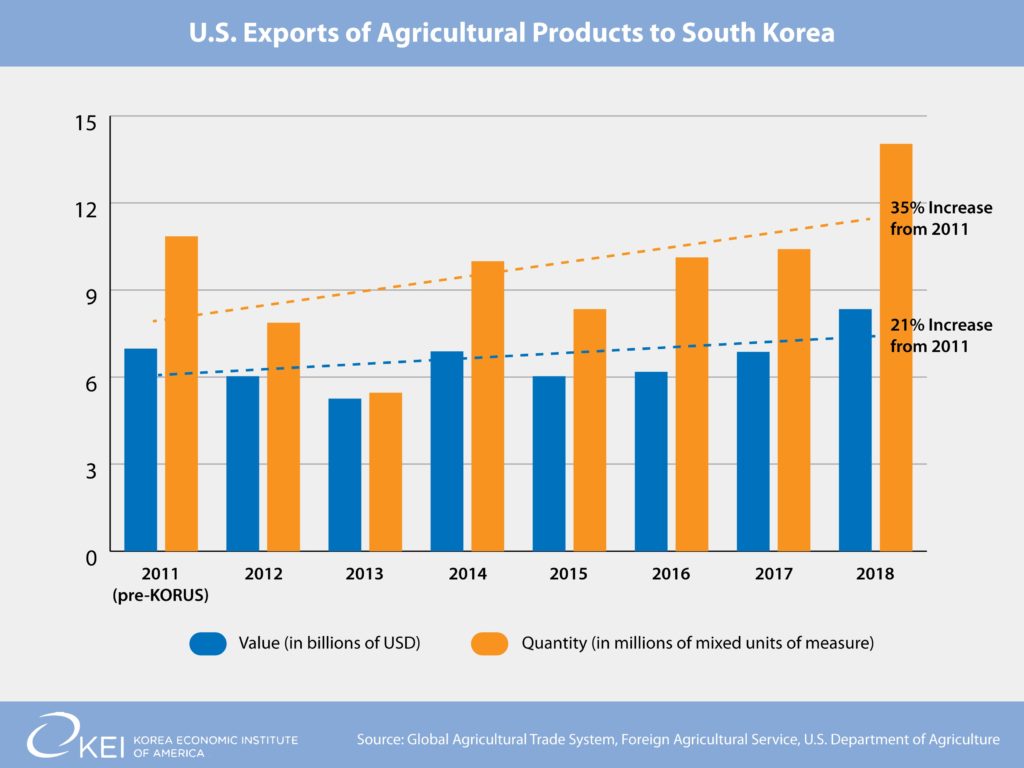

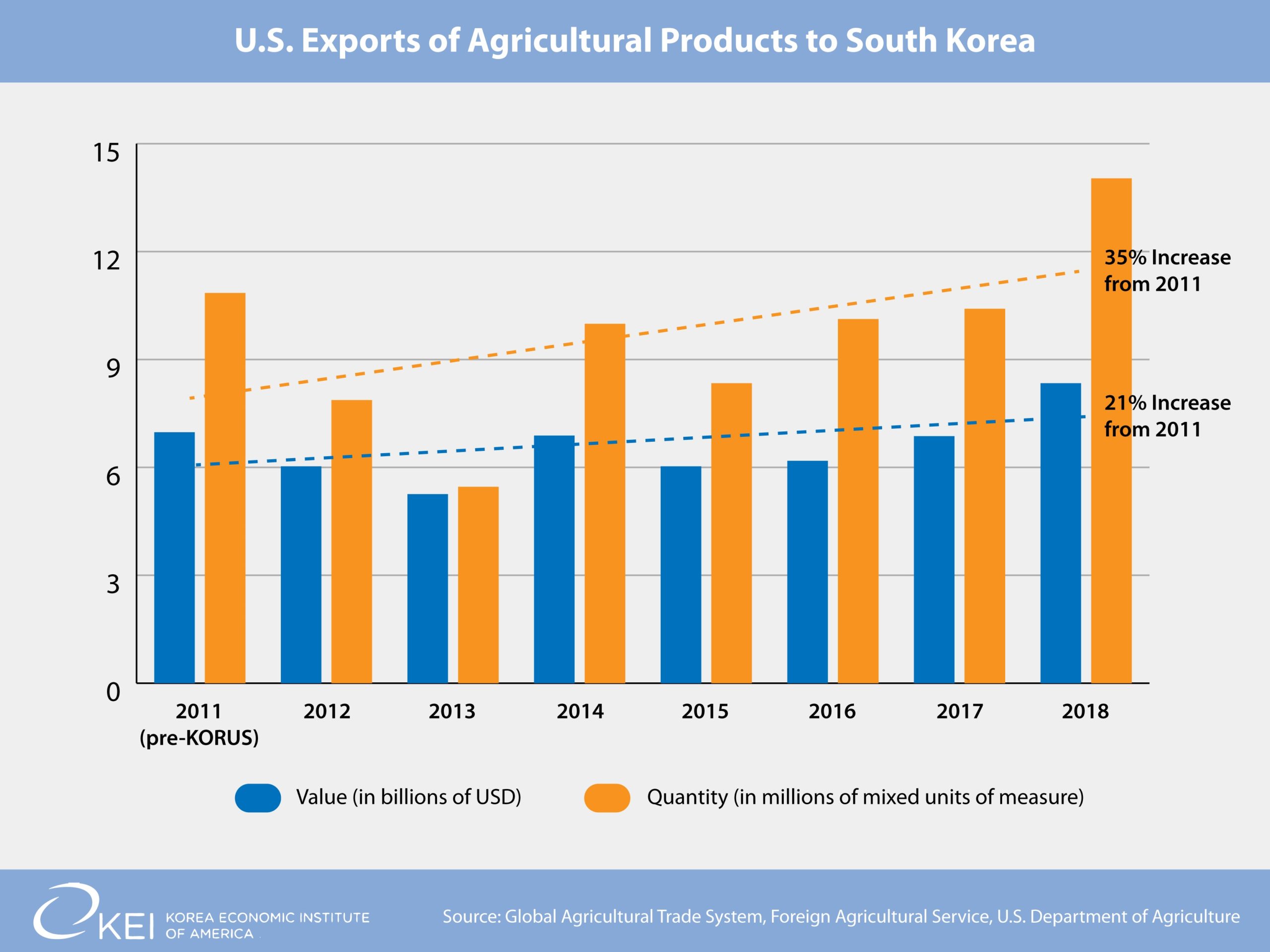

However, despite the continuation of low prices for various bulk agricultural commodities, the U.S. exported record levels of agricultural products to Korea, going from nearly $7 billion in 2011 to a record $8.3 billion in 2018. South Korea is America’s sixth largest export market for U.S. agricultural products, which is remarkable for a country that is ranked 27th in the world in terms of population and 11th in the world in terms of Gross Domestic Product (GDP).

How did the export performance of various agricultural sectors compare against initial predictions?

For grains (corn, wheat, rye, etc.), the USITC initially predicted KORUS would have a “negligible impact of U.S. grain exports to Korea” – a modest $7 million increase for corn and $2 million for wheat. However, the USITC could not have foreseen the dramatic decline in agricultural commodity prices and the 2013 drought in the Midwest that affected the availability of these crops for export. Nonetheless, in terms of metric tonnage, Korea increased its purchase in 2018 of wheat and corn by 9 and 22 percent respectively from 2011 (pre-KORUS) levels. Just in the last year alone, Korea purchased an additional 3.3 million metric tons of corn from American farmers, providing them an alternative export market as trade tensions with China mounted.

With respect to oilseeds, the USITC projected that KORUS would have a “significant positive impact on U.S. oilseeds exports to Korea,” estimated at a 5–11 percent increase. What has happened in the intervening years? In 2018, Korea’s purchases of U.S. soybeans increased 23 percent in value and 71 percent in quantity as compared to 2011 levels, exceeding initial estimates.

Finally, one of the most politically sensitive issue the KORUS negotiations was the treatment of U.S. beef products. The USITC predicted that KORUS would “likely result in increased U.S. exports of meat to Korea.” Once Korean tariffs were phased-out on U.S. beef products in 15 years (or by 2027), the USITC predicted U.S. beef exports would increase by $0.6-1.8 billion or between 58 and 165 percent. What are the results halfway into the tariff phase-out? Already, sales of U.S. beef in Korea are up over $1 billion from 2011 levels, representing a 155 percent increase.

These results once again show that the initial criticism of the KORUS FTA was premature and unjustified. KORUS has worked particularly well for U.S. agriculture, even during declining commodity prices. Withdrawing from KORUS back in 2017 would have produced even more heartbreak in the American heartland and depressed farm prices even further. Fortunately, the Trump Administration listened to the U.S. farming and ranching community by leaving the agricultural provisions untouched in the KORUS renegotiation talks, allowing the agreement to work as intended.

Phil Eskeland is Executive Director for Operations and Policy at the Korea Economic Institute of America. The views expressed here are his own.