The Peninsula

“Maximum Pressure” Beijing Style

By William B. Brown

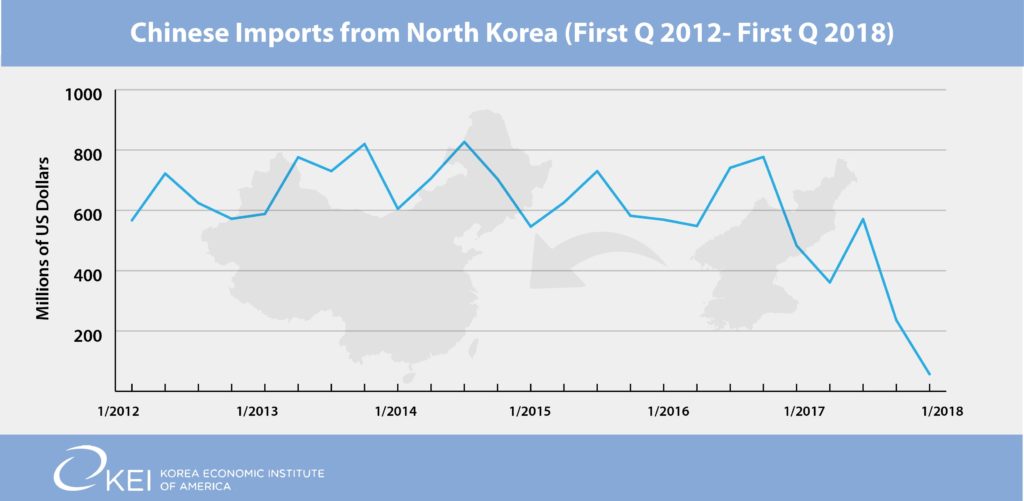

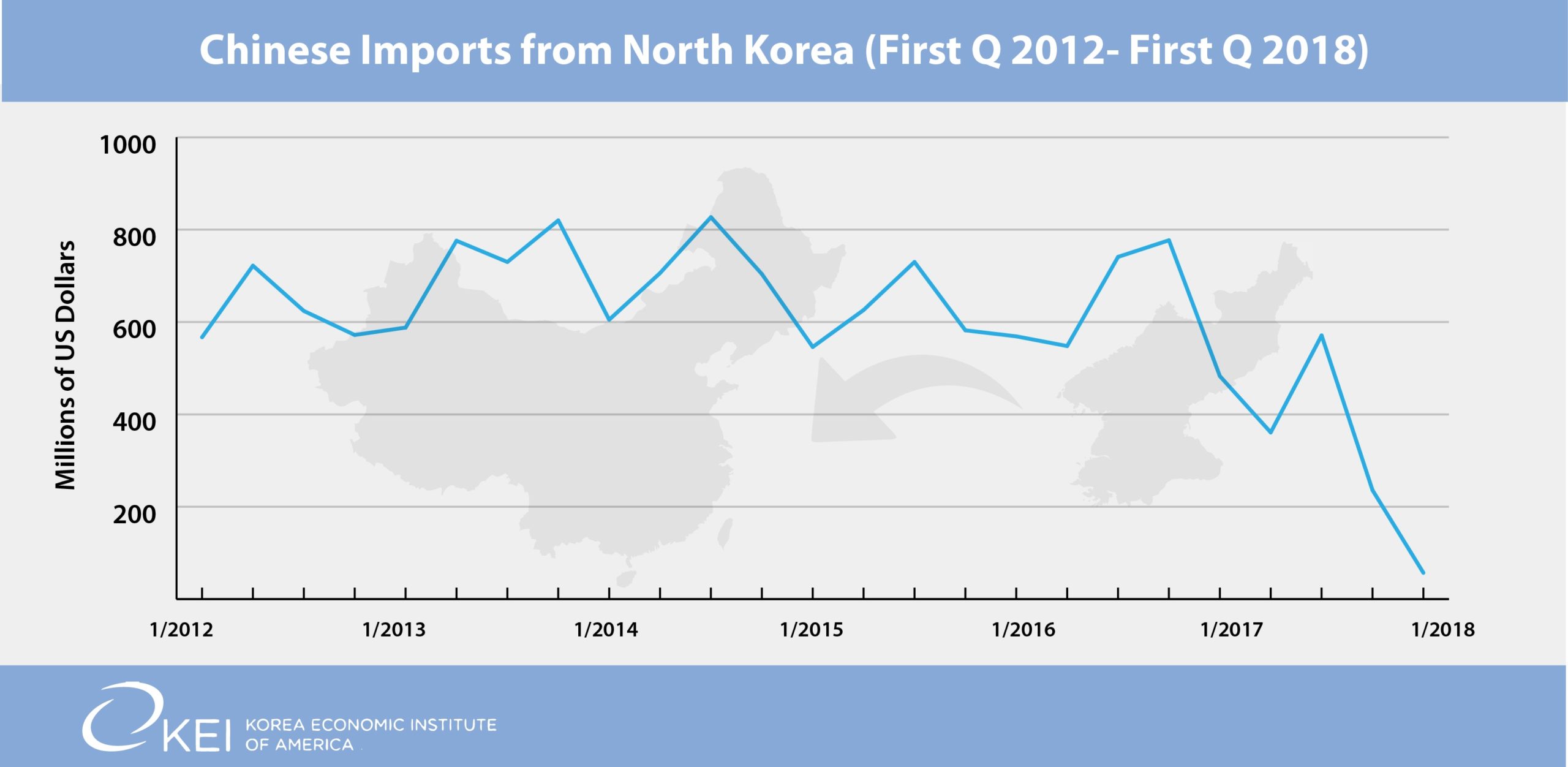

China, and Xi Jinping, might not have been mentioned in the North-South summit talks on Friday, and may have been glossed over in much of the expert analysis of why the meeting was taking place, but one can bet their influence on Kim’s decision to make the trip south was paramount. Data released by China’s customs just a day or two before the historic occasion shows that official trade with North Korea remained in a near collapsed state in March, with only $12 million in imports from North Korea and $143 million in exports.[i] (Kim travelled to Beijing, probably to ask for relief, in late March so any softening by Xi would not yet be reflected in this data.) Year-earlier figures, before the Trump-Xi talks in Florida at which tough measures against North Korea were hammered out, were $109 million and $328 respectively, indicating drops of 89 and 56 percent. Quarterly data indicates the same remarkable trend (graphics below). First quarter imports were down 89 percent to only $57 million, from $483 million in the same quarter of 2017.

North Korean sales of usually important and now sanctioned textiles, coal, fish, iron ore and non-ferrous metals all registered near zero in the official data for the quarter. Food items and tungsten, not sanctioned, showed increases.

Perhaps more interestingly, first quarter Chinese exports to North Korea, which generally are not sanctioned, were down a stunning 42 percent from first quarter 2017, including 92 and 86 percent drops in the important electrical and non-electrical machinery sectors, which include many consumer electronics products and computers, but also essential parts needed to keep North Korean industry in operation.[i]

Refined petroleum products, which are capped by the UN sanctions, fell to near zero. Food products, interestingly including tobacco, tended to rise as did fertilizer. Some of these may be purchased in China by foreign aid organizations and the UN, and shipped to North Korea.

Most damaging to North Korean industry is likely the drop in industrial parts and materials, presumably reflecting a growing inability to pay in hard currency. And vehicle imports, mostly trucks, totalled $28 million in first quarter 2017, fell to near nothing this year.

The absence of refined petrolem product imports is cushioned by the continued, but not officialy counted, flow of Chinese crude oil. The latest UNSC rules allow the crude to flow by pipeline at its historical rate, about 50,000 tons (350,000 bbl) a month, to a small refinery in northwest North Korea. This has accounted for about two-thirds of all North Korean petroleum supply in recent years so the halt in petroluem products imports erases about one third of supply. Gasoline prices have responded and are about double the level of a year-ago, much higher than world prices. They jumped in early April but have since fallen back.

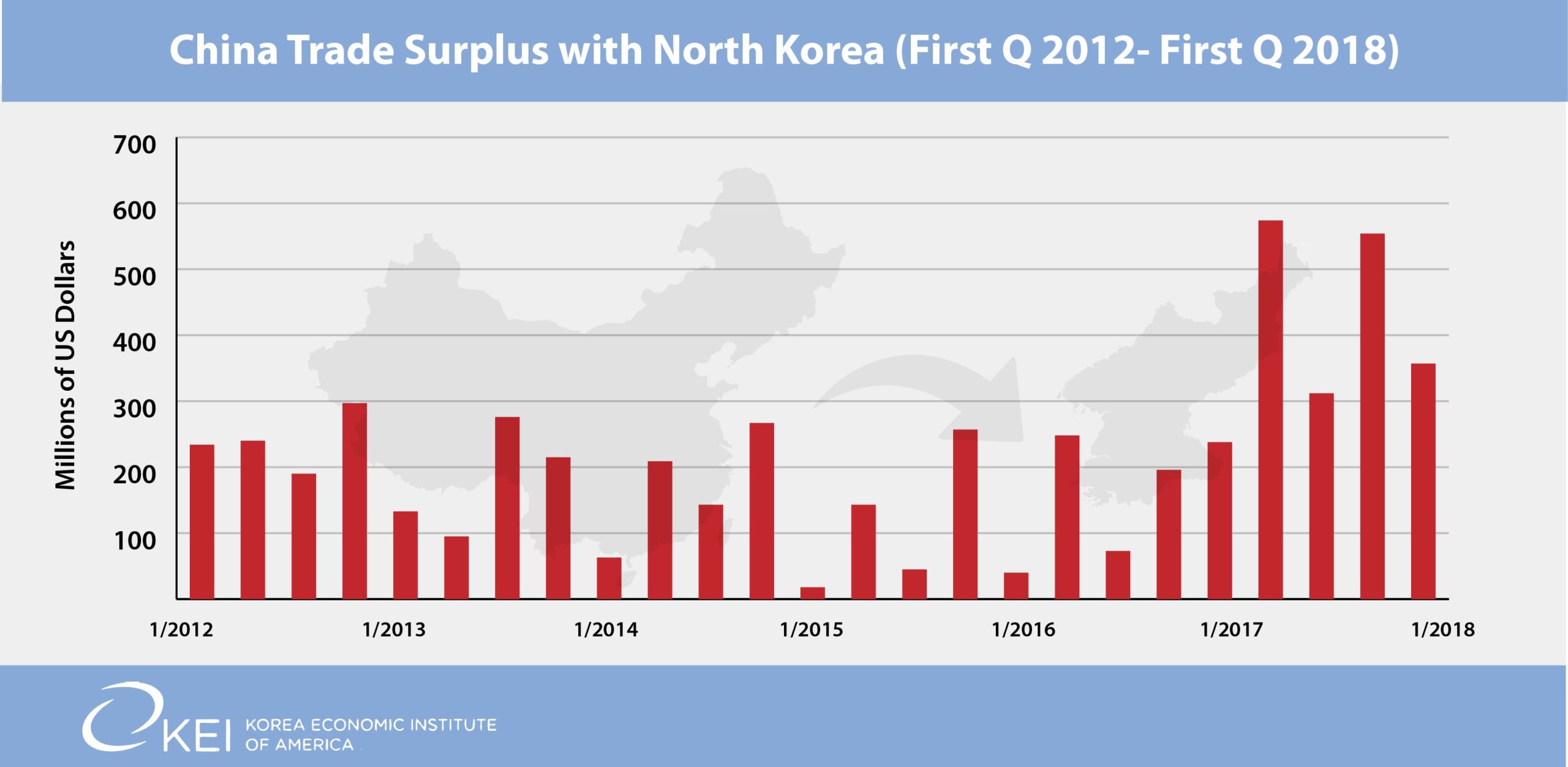

The drop in North Korean imports lowered its bilateral trade imbalance in the first quarter from fourth quarter 2017, to a little over $100 million a month ($131 million in March). With essentially no credit, and with little trade with other countries, Pyongyang’s persistent goods trade deficit with China is probably financed with about a $50 million a month surplus in services, remittances, and aid, all of which also are negatively affected by UN sanctions, and these would not likely cover the much larger recent deficits, suggesting a drawdown of whatever foreign exchange reserves the regime might have had. The impact of tough Chinese sanctions on North Korean exports a few quarters ago is thus now resulting in a drop of often essential imported products, a difficult task for the management of the command economy. Surprisingly, Pyongyang continues to keep its won currency, traded in unofficial markets all over the country, virtually pegged against the U.S. dollar, suggesting very tight won monetary conditions and no lending to state owned enterprises and agencies and a very tight budget—maximum pressure by almost any definition.

Two weeks ago, in a speech to his Worker’s Party Central Committee, widely heralded in Western media for his promise to end nuclear and long-range missile testing, Kim also said he will now focus entirely on the economy, suggesting an end to the parallel nuclear and prosperity, or “byongjin” line. “The whole party and the whole nation will now focus on socialist economic development. That is our new Party line”. Tight money, busted budgets, desperate foreign trade and a temperamental American adversary, may be giving him little choice.

William Brown is an Adjunct Professor at the Georgetown University School of Foreign Service and a Non-Resident Fellow at the Korea Economic Institute of America. He is retired from the federal government. The views expressed here are the author’s alone.

Photo from Roman Boed’s photostream on flickr Creative Commons.

[i] China stopped including crude oil shipments to North Korea in its data beginning January 2014. By all accounts these continue at historical rates and should add $50 to $150 million a quarter in Chinese exports but do not add to the overall deficit since they are provided free of charge.

[i] All data is from Global Trade Atlas, April 28, 2018.