The Peninsula

Korea’s Potential Growth Rate has Fallen to Around 2%

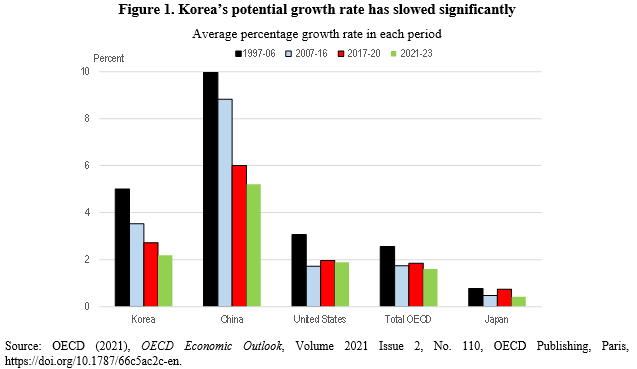

The potential growth rate – the level of output that an economy can produce at a constant inflation rate – in Korea has declined steadily from 5.0% during 1997-2006 to 2.7% during 2017-20, according to the OECD (Figure 1). The OECD projects that it will slow further to 2.2% from 2021-23. The Bank of Korea is a bit more pessimistic with its estimate in September 2021 of 2.0% in 2021-22. Both estimates are close to those for the United States (1.9% over 2020-23) and the OECD total (1.6%).

Korea’s slowdown is not unusual, as potential growth typically decelerates as a country converges towards high-income economies. Indeed, China’s potential growth has nearly halved from the 10.0% rate during 1997-2006. However, the rate of Korea’s slowdown raises some concern, given that it faces exceptional challenges, notably the most rapid population aging among advanced countries and the potential cost of economic rapprochement with North Korea. Korea’s working-age population (ages 15-64) peaked in 2017 and its decline will continue as the fertility rate fell to 0.84 in 2020, one of the lowest in the world. This will put further downward pressure on potential growth, which depends on the potential labor force (which in turn is determined by demographic factors and participation rates), the capital stock and labor efficiency.

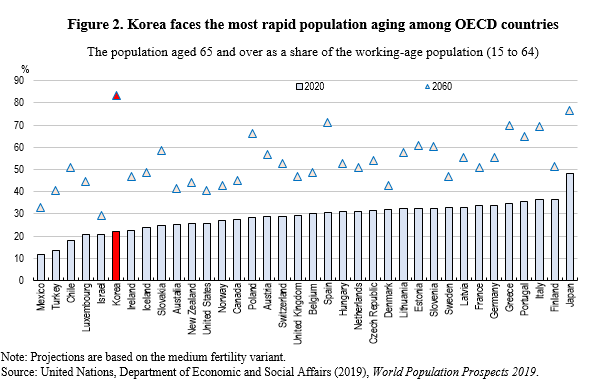

Population aging will also increase Korea’s elderly dependency ratio, defined as the population aged 65 and above relative to the working-age population. In 2020, the ratio in Korea was the sixth lowest among OECD countries, but by 2060, is projected to be the highest (Figure 2). This implies that the number of working-age persons per elderly will fall from 4.5 in 2020 to 1.2 in 2060. A government research institute has estimated that the large increase in the number of elderly will drive up government social spending from around 10% of GDP to 26% by 2060 under its current framework. The large increase in spending on health and long-term care and pensions poses a serious fiscal challenge. Fortunately, Korea has a number of options to mitigate the impact of demographic change. First, there is considerable scope to raise the relatively low employment rates of women and young people. Second, the working lives of employees, which generally end before age 60 could be extended. Third, Korea could increase the role of foreign workers.

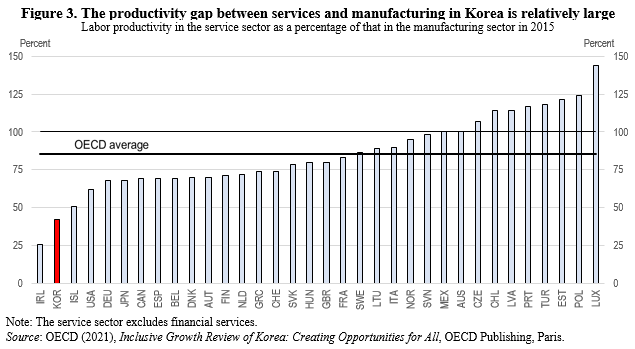

Korea also has scope to raise labor productivity. Although Korea’s per capita GDP now exceeds the OECD average (in purchasing power parity exchange rates), labor productivity is only about two-thirds of that in the top half of OECD countries. Low labor productivity is offset by labor inputs, reflecting long working hours. With the cut in the maximum weekly working time from 68 hours to 52 hours, increasing productivity is even more crucial. Korea has large scope to narrow large productivity gaps between the manufacturing sector and services. Indeed, service sector productivity in Korea was only 44% of that in manufacturing in 2015, compared to the OECD average of 84% (Figure 3).

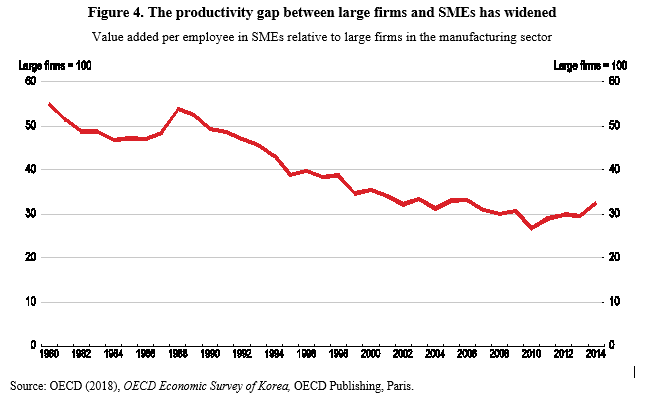

In addition the productivity gap between large firms and small and medium-sized enterprises (SMEs) is also large and has increased during the past few decades. In the manufacturing sector, productivity in SMEs has fallen from more than half of large firms in 1980 to less than one-third (Figure 4). SMEs, which tend to face shortage of capital and skilled labor, have been slow to adopt digitalization and to innovate.

In sum, the deceleration of potential growth in Korea partially reflects its success in narrowing the large gaps with advanced countries. Looking forward, it is essential to support potential growth by limiting the fall in the labor force by removing obstacles to employment, particularly for women, young people and the elderly, and to make greater use of foreign workers. This should be accompanied by reforms to narrow the large productivity gaps between manufacturing and services and between large firms and SMEs. Such policies would help Korea to meet the challenges ahead.

Randall S. Jones is a Non-Resident Fellow at the Korea Economic Institute of America. The views expressed here are the author’s alone.

Photo from wwian’s photostream on flickr Creative Commons.