The Peninsula

Korea’s Economic Outlook: Is More Fiscal Support Needed?

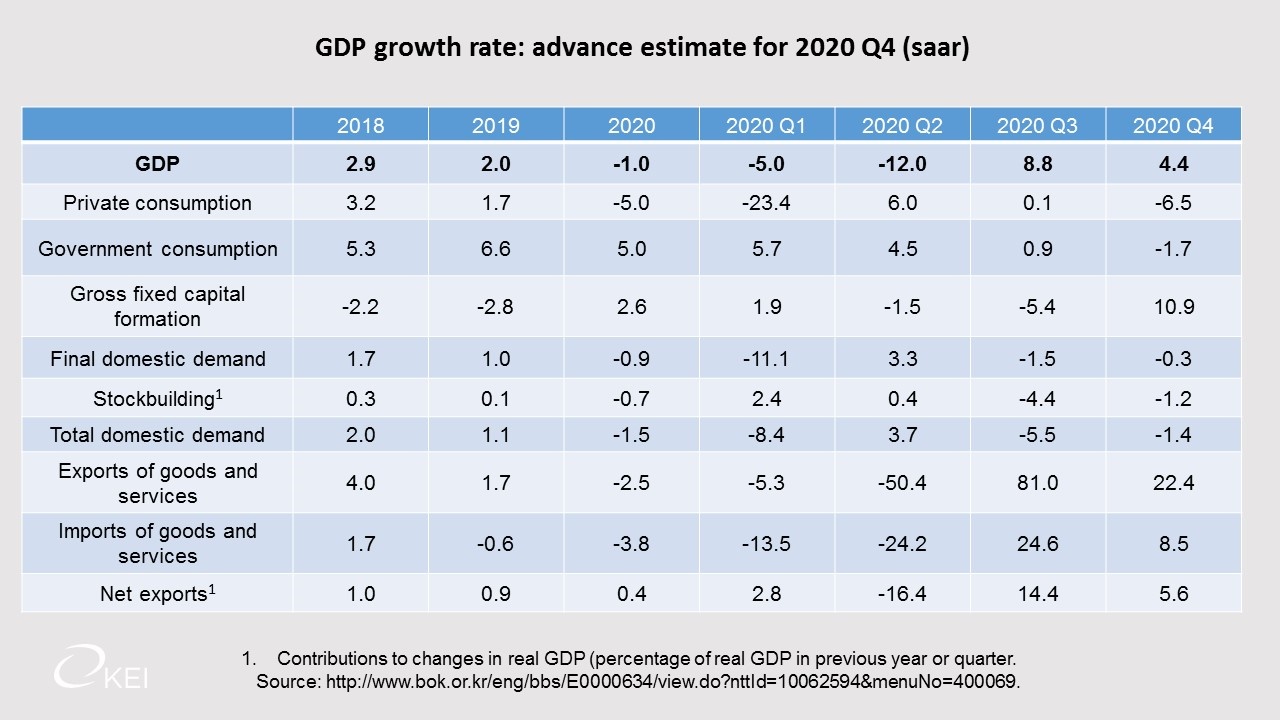

Korea’s economy shrank by 1% in 2020, the first contraction since the 1997 Asian financial crisis (Table 1). It was the smallest decline among the 38 OECD member countries, reflecting Korea’s success in limiting the spread of the coronavirus. In addition, monetary policy easing and government financial support equal to about 15% of GDP sustained economic activity. This included four supplementary budgets totaling 66 trillion won (3.5% of GDP).

Korea’s economic rebound began in 2020Q3, with real GDP growth of 8.8% (saar). The pace moderated in the fourth quarter, as the third (and largest) wave of coronavirus infections led to tighter social distancing restrictions. The tightening of the restrictions in Seoul in December to level 2.5 (the second highest in the five-tier system) and to level 2.0 in the rest of the country contributed to a 6.5% decline in private consumption in 2020Q4 (Table 1). Declining private consumption, though, was offset by two factors. First, government investment in public infrastructure surged nearly 40% in 2020Q4, sustaining the growth of gross fixed capital formation. Second, the strong rebound in exports continued, driven by semiconductors.

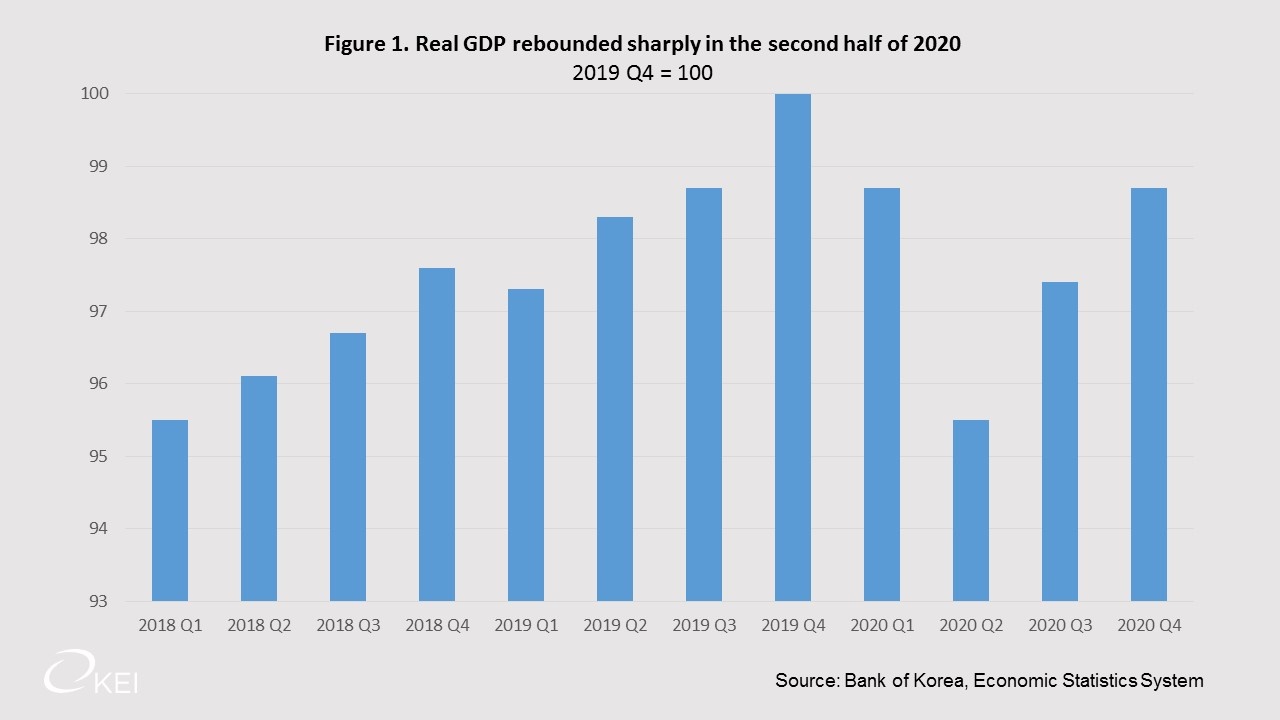

Consequently, manufacturing output increased at a double-digit rate in 2020Q4, while the service sector stalled. Korea’s relatively large manufacturing sector helped to shield its economy from the full impact of COVID-19. By 2020Q4, real GDP had recovered more than two-thirds of its decline in the first half of 2020, leaving it 1.3% below its 2019Q4 peak (Figure 1).

Outlook for 2021

Recent trends suggest that the economic recovery remains on track. Export growth was robust in the first two months of the year and consumer confidence strengthened. Consumer confidence has risen each month since April, except for declines in September and December following a resurgence in COVID-19 cases. Consequently, the index has recovered about two-thirds of its decline from January 2020 to its low in April. The easing of social distancing measures on February 15th should also support consumer confidence and private consumption.

The government continues to provide support to the economy. In January, it distributed the third round of relief checks, which totalled 9.3 trillion won. Nearly half was allocated to small businesses affected by social distancing restrictions. Around 2.8 million small businesses qualified for grants ranging from 1 million won to 3 million won ($887 to $2,661) depending on the sector. In addition, the five major banking groups “agreed” to continue financial support to businesses hurt by the pandemic by extending maturities and delaying interest payments for another six months. The program that was launched in April 2020 had been set to expire at the end of March 2021.

Most forecasters, including the OECD, IMF and Bank of Korea, project that Korean real GDP will grow around 3% in 2021, though one private institution (J.P. Morgan) projects a 4% rise. The worldwide semiconductor shortage and rising DRAM prices will boost Korean semiconductor production. Moreover, a further easing of social distancing rules would support private consumption and the service sector. However, growth could be slowed by additional waves of coronavirus infection before herd immunity is achieved. Korea began immunizations on February 26th and plans to immunize 70% of the population by September to achieve herd immunity by November. Achieving this goal, though, depends on the share of the population that chooses to be vaccinated, the vaccine delivery schedule and the threat of COVID-19 variants, which have been found in Korea.

The impact of COVID-19: higher inequality and a significant fall in employment

In a survey of firms by the Korea Chamber of Commerce and Industry, 79% had experienced a drop in sales and 72% had cut labor expenses. Services that require personal contact, such as such as accommodation, food and beverages, experienced the largest wage losses according to the Bank of Korea. Given that wages are relatively low in these sectors, low-income workers were the hardest hit by the pandemic. Already in the first half of 2020, the Gini coefficient on wage distribution (which rises with inequality) reached 0.306, compared to 0.294 in the first half of 2019, according to a study by the Korea Employment Information Service. A continuation of the “K-shaped recovery” would worsen social polarization and threaten the economic rebound.

In addition, employment fell for the 11th consecutive month in January 2021, reducing the number of employed persons by one million from its a year-earlier level, a 3.7% decline. Among the job losses, 91% were in the service sector and more than half were workers under age 40. The unemployment rate rose from 3.9% to 5.4% (seasonally-adjusted), but the increase was held down by the large number of workers who left the labor force and stopped looking for jobs. The employment rate in January 2021 was 57.4%, down from 60.0% a year-earlier.

The debate over additional government support

In early February 2021, the ruling Democratic Party’s leaders in the National Assembly called for a fourth round of government relief payments to provide cash for small businesses and households. In the first relief payments paid in May 2020, the government provided every household with between 400,000 won and one million won ($355 to $887).

The cost of the proposal for the fourth round – around 30 trillion won (1.6% of GDP) – elicited criticism from the Ministry of Economy and Finance, which is concerned about the rise in government spending and debt during the past few years. Moreover, President Moon stated, “I would like the party to give consideration to fiscal conditions”. Government expenditures rose from 30.3% of GDP in 2017 to an estimated 38.3% in 2020, while gross government debt rose from 41% of GDP to 44%. The 2021 budget is set to rise nearly 9% above the initial budget for 2020, with nearly three-quarters of the spending frontloaded in the first half of 2021. The debt ratio is projected to reach 48% of GDP this year.

The Democratic Party then decided that the fourth round of government payments would provide cash for small companies, but not households. In exchange, it wants to increase the amount given to small businesses and the number receiving payments. To raise the number receiving payments from 2.8 million, the eligibility limit on annual revenue may be increased from 400 million won to 1 billion won ($887,000). The government proposal, which is to be submitted to the National Assembly around March 4th, is expected to be around 19.5 trillion won (1.0% of GDP).

There is still discussion of new measures to support the economy. On February 18th, Prime Minister Chung Sye-kyun raised the idea of a fifth found of government cash payments even before the details of the fourth round have been completed. He has also ordered government officials to take legislative steps to legally enable compensation for small businesses that have suffered losses due to forced closures from the government’s social distancing measures. This would be a step beyond providing cash payments for companies hurt by the pandemic, as it means that the government takes legal responsibility for the impact of its health measures on companies. Such a step, which seems unique among the measures taken by governments around the world to cope with the pandemic, is estimated to cost more than 5% of GDP.

Government support should be carefully targeted

The government had long aimed to keep gross government debt below 40% of GDP, a level considered appropriate given Korea’s extremely rapid population aging and the potential costs of economic rapprochement with the North. In October 2020, the Ministry of Economy and Finance proposed rules to limit its debt to 60% of GDP and its fiscal deficit to 3% starting in 2025. The new rule is subject to parliamentary approval. Despite the increase in recent years, Korea’s debt ratio is still far below the 127% average of OECD countries. Moreover, the increase in Korea’s debt ratio is small compared to the rise in OECD countries from 110% to 127% over 2017-20.

The government could provide large amounts of additional support without breaking its new fiscal rules. However, it would make sense to consider economic developments in the coming months as government spending is frontloaded in the first half of the year, the fourth round of cash payments is distributed and vaccinations move ahead before making decisions on additional fiscal support for the economy.

It is crucial to ensure that public money is spent efficiently, particularly as Korea is the world’s fastest aging country, which implies considerable upward pressure on public spending going forward. Spending large sums to save all existing companies and jobs would be unwise. Some companies and jobs will disappear, as the COVID-19 crisis has permanently affected demand patterns and accelerated ongoing trends, such as digitalization. Avoiding wasteful expenditures would help Korea carry out its ambitious New Deal plans, which aim to invest 160 trillion won (8.5% of GDP) to create over 1.9 million jobs by 2025 and foster digital, green and inclusive growth.

Any additional cash payments to households should be targeted rather than universal, thereby focusing on the key problems of increased income inequality and poverty and the higher number of unemployed. Moreover, universal payments have less economic impact. A National Bureau of Economic Research paper examined what people did with the $1,200 per-person stimulus payments distributed in the United States in April 2020. Only about 15% of recipients said they mostly spent it, while the remainder saved it or used it to pay off debt. Moreover, a targeted approach to cash payments is favored by voters. A Gallup Korea poll found that 47% favored targeting support to people in need, compared to 32% who prefer universal grants.

Randall Jones is a Non-Resident Fellow at the Korea Economic Institute of America. The views expressed here are the author’s alone.

Photo from Rolf Venema’s photostream on flickr Creative Commons.