The Peninsula

Korea’s Economic Growth Projected to Accelerate in 2024

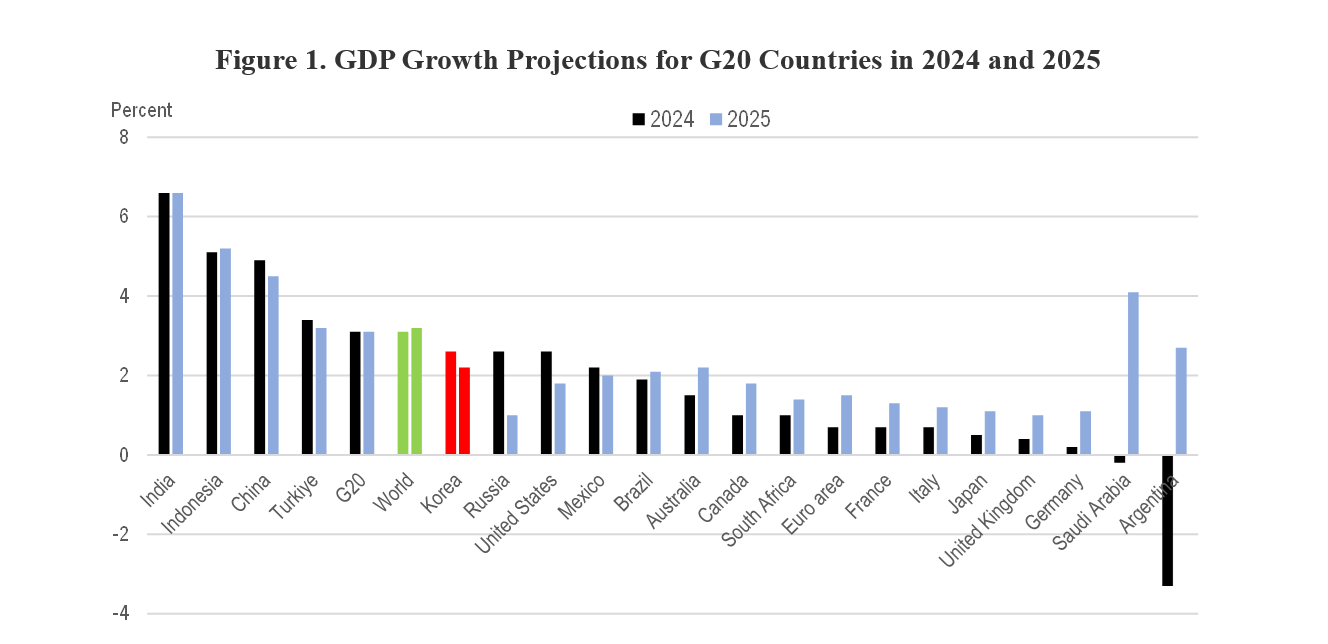

The semi-annual OECD Economic Outlook released in May projects that global GDP growth will remain around 3 percent in 2024 and 2025, shown below in Figure 1. The report’s outlook reflects the continued impact of tight monetary conditions. Nevertheless, the report cites several positive trends, such as falling inflation and improving private-sector confidence. With unemployment remaining close to record-lows, households’ real (inflation-adjusted) incomes have begun to increase, and international trade growth has turned positive. US GDP growth is projected to be 2.6 percent in 2024 before falling below 2 percent in 2025, while China’s growth edges down from 5.2 percent in 2023 to 4.5 percent in 2025.

Source: OECD Economic Outlook, Volume 2024 Issue 1: Preliminary version | OECD iLibrary (oecd-ilibrary.org).

Korea’s Economy is Projected to Rebound in 2024

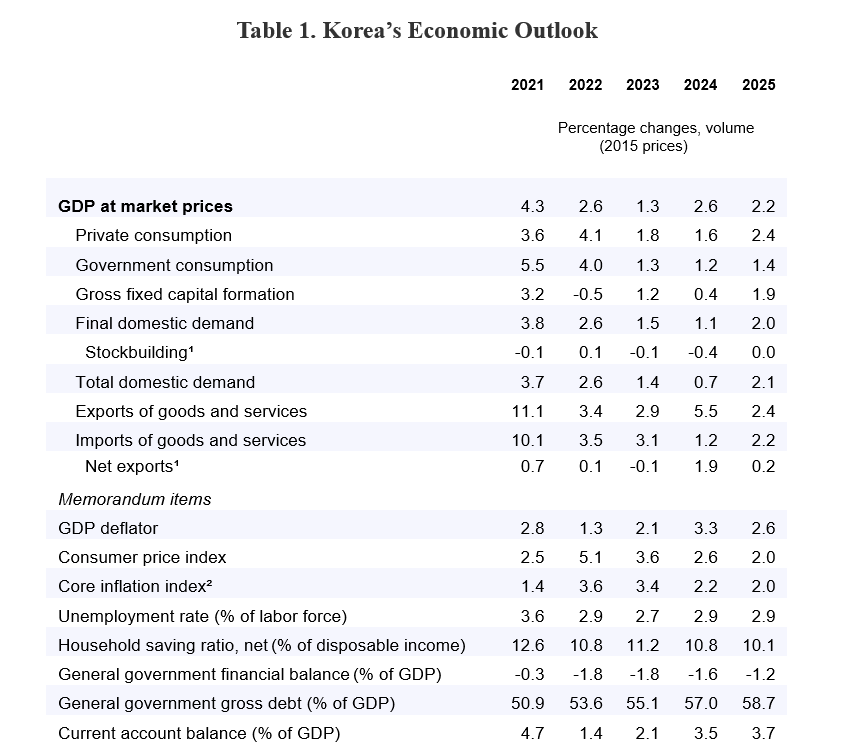

Korea’s GDP growth slowed to 1.3 percent in 2023 (see Table 1) as high debt-servicing burdens, which reflect elevated interest rates, and above-target inflation posed headwinds to private consumption. Investment, notably in construction, was also hampered by high interest rates, modest real wage growth, and the sluggish housing market. Weak domestic demand was accompanied by a slowdown in export growth to below 3 percent in the context of the falling trade volume in global merchandise during the first half of 2023.

As highlighted in Table 1, the OECD projects a GDP growth rate of 2.6 percent for Korea in 2024. The new projection is substantially higher than the February 2024 outlook of 2.2 percent, reflecting a robust growth of 1.3 percent (quarter-on-quarter) in the first three months of 2024. With domestic demand expected to slow this year, the Korean economy will be led by strong global demand for computer chips, which continues to serve as a key driver of the country’s economic growth. Indeed, the total amount of exports rose 16.5 percent (year-on-year) during the first ten days of May, led by a 52 percent rise in semiconductor exports. On May 23, President Yoon announced a KRW 26 trillion (USD 19 billion) support program for the semiconductor industry that encompasses financing, infrastructure and research and development.

Source: OECD Economic Outlook, Volume 2024 Issue 1: Preliminary version | OECD iLibrary (oecd-ilibrary.org).

Interest Rate Cuts May Lead to a Rebound in Domestic Demand

The Bank of Korea has maintained its policy interest rate at 3.5 percent since January 2023, helping to slow inflation from 5 percent to under 3 percent over the past year, as seen in Figure 2. The OECD projects that inflation in Korea will reach the 2 percent target by the end of 2024, prompting the central bank to begin reducing its policy rate before the end of 2024. It expects that the policy rates will drop to 2.5 percent by mid-2025, helping to triple domestic demand growth from 0.7 percent in 2024 to 2.1 percent in 2025, led by private consumption. Real wage gains will likely increase as the unemployment rate is projected to remain below 3 percent. Moreover, the household debt-to-GDP ratio has fallen below 100 percent for the first time in more than three years, creating space for household spending and reducing the risk of financial instability. Still, the household debt ratio remains high at 98.9 percent of GDP in the first quarter of 2024, the highest among the listed 34 countries in a study by the Institute for International Finance.

Risks to the Projection

The Korean economy will be heavily influenced by the semiconductor industry, which accounts for about one-fifth of its exports. Thus, volatility in the semiconductor industry creates uncertainty about Korea’s economic prospects. Chairman Chey Tae-won of SK Group, the world’s third-largest semiconductor producer, recently stated the semiconductor sector’s “roller-coaster ride is likely to continue.” Continued US-China trade frictions may also significantly impact Korea. The United States recently announced significant tariff hikes against a range of Chinese imports, including semiconductors, electric vehicles, advanced batteries, solar cells, and steel, based on what the administration describes as unfair trade practices by China. Such restrictions could give Korea a significant advantage over China in exporting to the United States. At the same time, the significant US tariff hikes, combined with retaliatory moves by China, could disrupt global supply chains.

Source: OECD Economic Outlook, Volume 2024 Issue 1: Preliminary version | OECD iLibrary (oecd-ilibrary.org).

Inflation trends and monetary policy changes provide additional uncertainty for the economic outlook. Bank of Korea Governor Rhee Chang-yong recently dampened hopes for an interest rate cut in 2024, stating in early May that “all the premises for [BOK’s] monetary policy that were considered valid until last month have changed.” In addition to Korea’s unexpectedly strong economic growth in the first quarter of 2024, Governor Rhee cited the delay in interest rate cuts by the US Federal Reserve, given its buoyant economy and inflation above 3 percent. The recent weakness of the KRW relative to the USD and the wide interest rate gap between the two countries may lead the Bank of Korea to delay monetary easing. At the same time, geopolitical tensions in the Middle East are pushing up oil prices, increasing inflationary pressures.

Conclusion

Despite the risks facing Korea and the world economy, strong economic growth at the beginning of 2024 confirms projections of an upturn this year in Korea. This creates an opportunity for Korea to bring the government budget back into balance and prepare for a rapidly aging population. The mildly contractionary fiscal stance in 2024 should continue in 2025. For, reforming the pension system is another priority. At a press conference on May 9, President Yoon Suk Yeol criticized previous governments for ignoring the pension issue and promised to achieve reform during his term. Nearly 40 percent of Koreans above the age of 65 have incomes below the poverty level, which is defined as an income below one-half of the national median. With the rise in the number of retirees and fewer workers contributing to the National Pension Service, the National Pension Fund will be exhausted by 2055. Fundamental reforms to increase the coverage of the National Pension Service, boost the contribution rate, and raise the pension eligibility age are essential. President Yoon also pledged to create a ministry to address Korea’s low fertility rate, which fell to 0.72 in 2023, the lowest in the world.

Randall S. Jones is a Non-Resident Distinguished Fellow at the Korea Economic Institute of America. The views expressed here are the author’s alone.

Photo from Shutterstock.

KEI is registered under the FARA as an agent of the Korea Institute for International Economic Policy, a public corporation established by the government of the Republic of Korea. Additional information is available at the Department of Justice, Washington, D.C.