The Peninsula

Korea’s Economic Growth is Projected to Accelerate Following the Slowdown in 2023

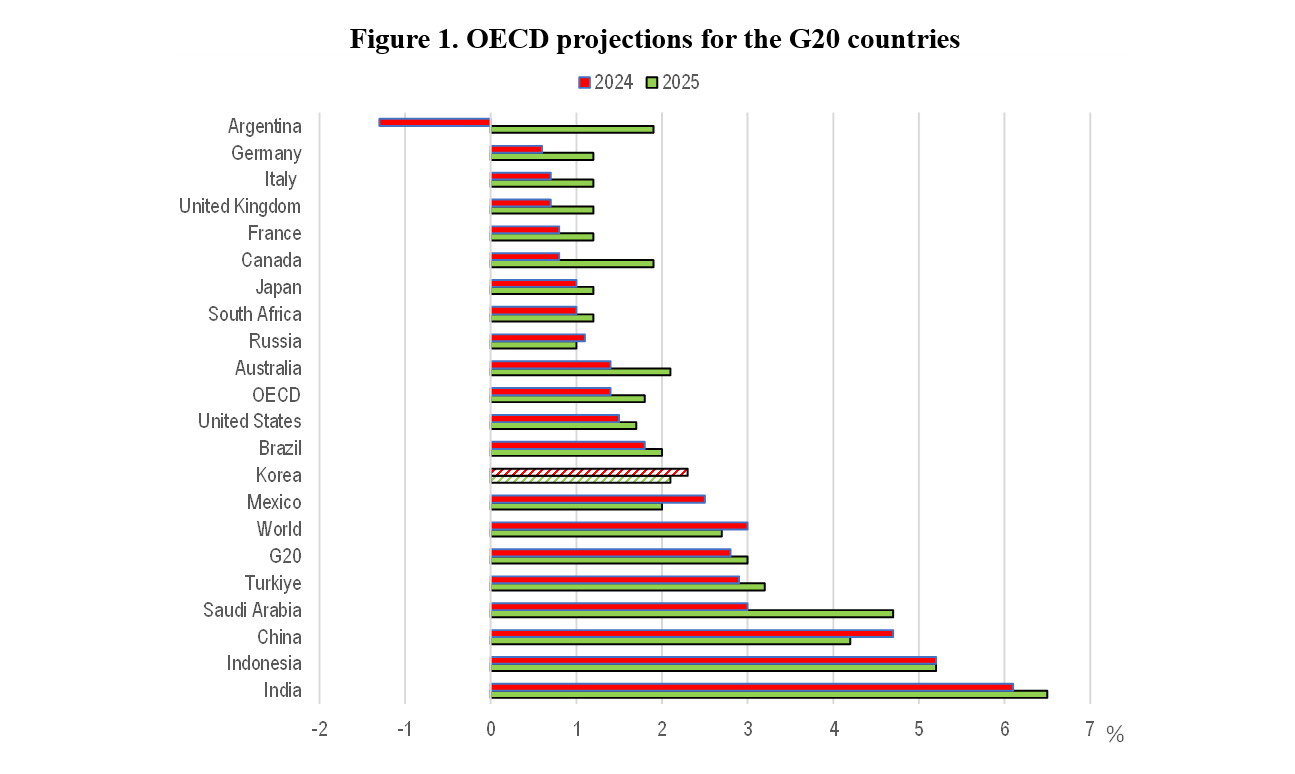

Korea’s real GDP growth will rebound to more than 2 percent in 2024 and 2025, according to the Organization for Economic Co-operation and Development (OECD)’s bi-annual economic projections published at the end of November (Figure 1). The OECD’s outlook of 2.3 percent next year is in line with the 2.1 percent and 2.2 percent forecasts by the Bank of Korea and the International Monetary Fund, respectively. For the OECD area, economic growth is projected to remain sluggish at less than 2 percent in 2024 and 2025.

Source: OECD Economic Outlook.

Signs of a rebound from slow growth in 2023

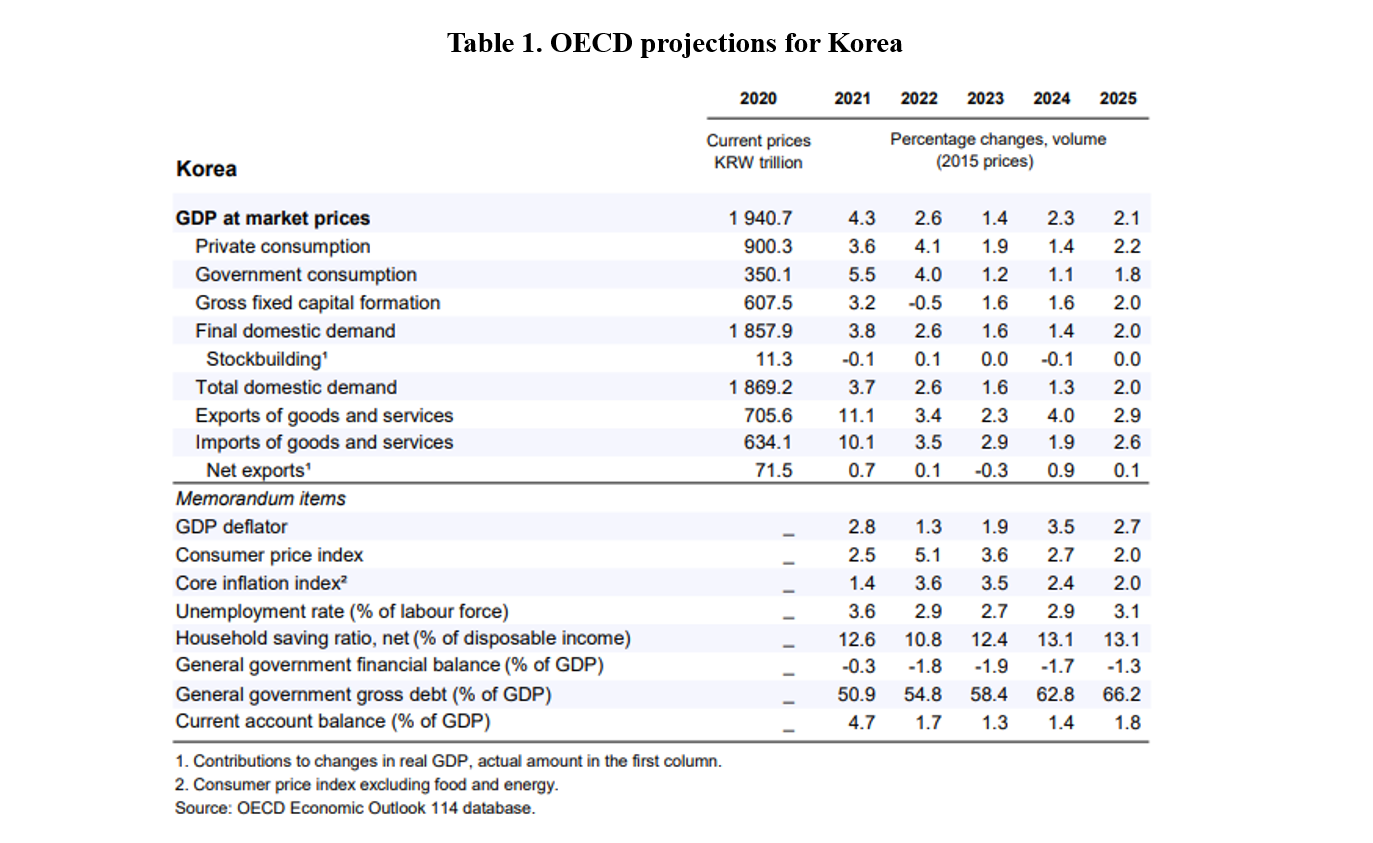

The deceleration of growth from 2.6 percent in 2022 to an estimated 1.4 percent in 2023 was driven in part by weak private consumption, which has faced headwinds from high interest rates, elevated energy prices, weak real wage increases and a sluggish housing market. The high level of household debt is another concern; Korean households owed an average of KRW 91.9 million (USD 68,260) to banks and other financial companies in March 2023, according to Statistics Korea. The problem is most severe in the lowest income quintile, which saw its debt increase 22.7 percent in the year to March 2023. The high debt level has raised concerns about the financial soundness of domestic savings banks. The Financial Supervisory Service reported that their loan delinquency rate reached 6.15 percent in September, double the level at the end of 2022. Retail sales declined 2.0 percent in September compared with a year earlier and by 4.4 percent in October, suggesting continued weakness in private consumption. The OECD projects that it will slow further to 1.4 percent in 2024 (Table 1). In addition, facility investment decreased 9.7 percent (year-on-year) in October, reflecting declines in the machinery and automobile sectors.

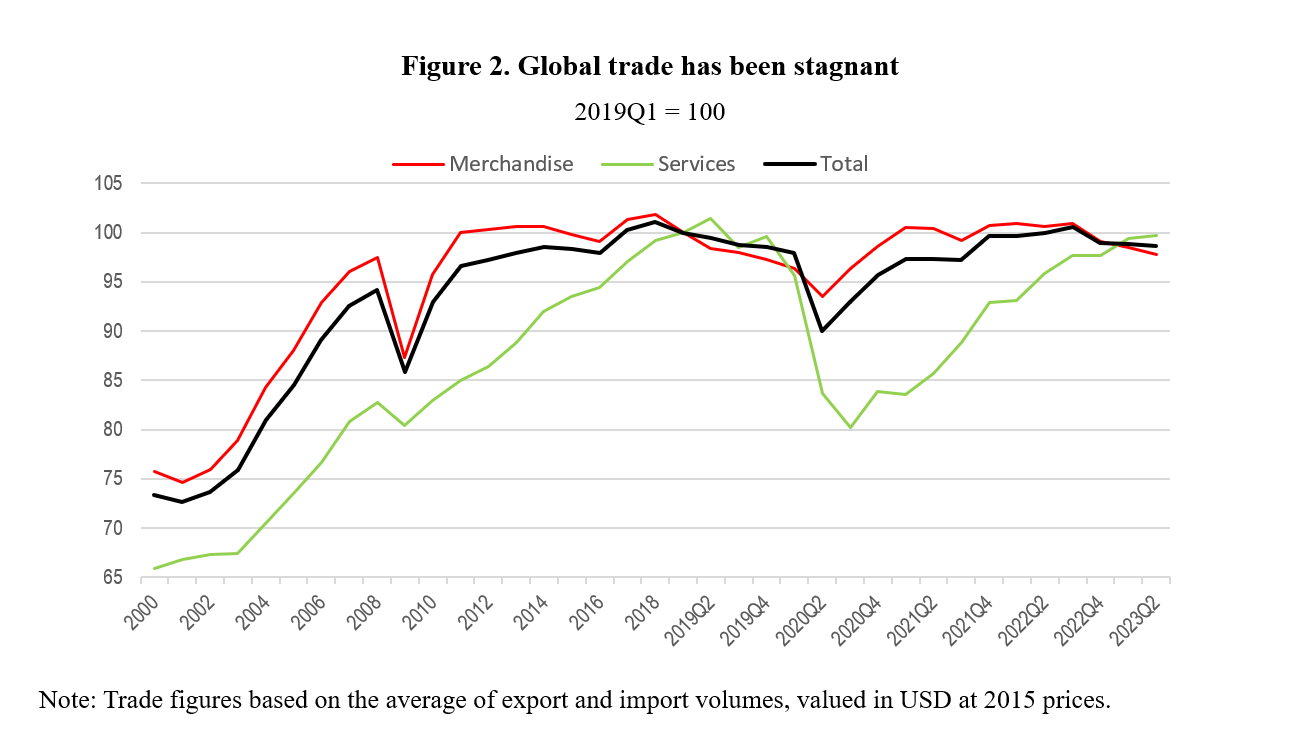

Korea’s economic rebound will be led by exports, which grew only about 2 percent in volume terms in 2023, according to the OECD, in the context of weak global trade. Although world trade volume returned to its pre-pandemic level in the third quarter of 2022, it declined again in the first half of 2023 (Figure 2). However, Korea’s exports appear to have bottomed out in recent months. They rose 5.1 percent in October (year-on-year, in U.S. dollar value), the first increase since August 2022. Semiconductors, which account for about one-fifth of Korean exports, led the rebound. According to a Bank of Korea report, growing demand for personal computers and smartphones will continue to drive demand for AI-related chips. In addition, investment by the United States and the European Union in new sectors, such as renewable energy, will also boost Korea’s semiconductor sales. Bang Moon-kyu, the Minister of Trade, Industry and Energy, predicts that Korea’s semiconductors will jump 18 percent in 2024 after dropping 25 percent in 2023.

Government policies: fighting inflation and reducing budget deficits

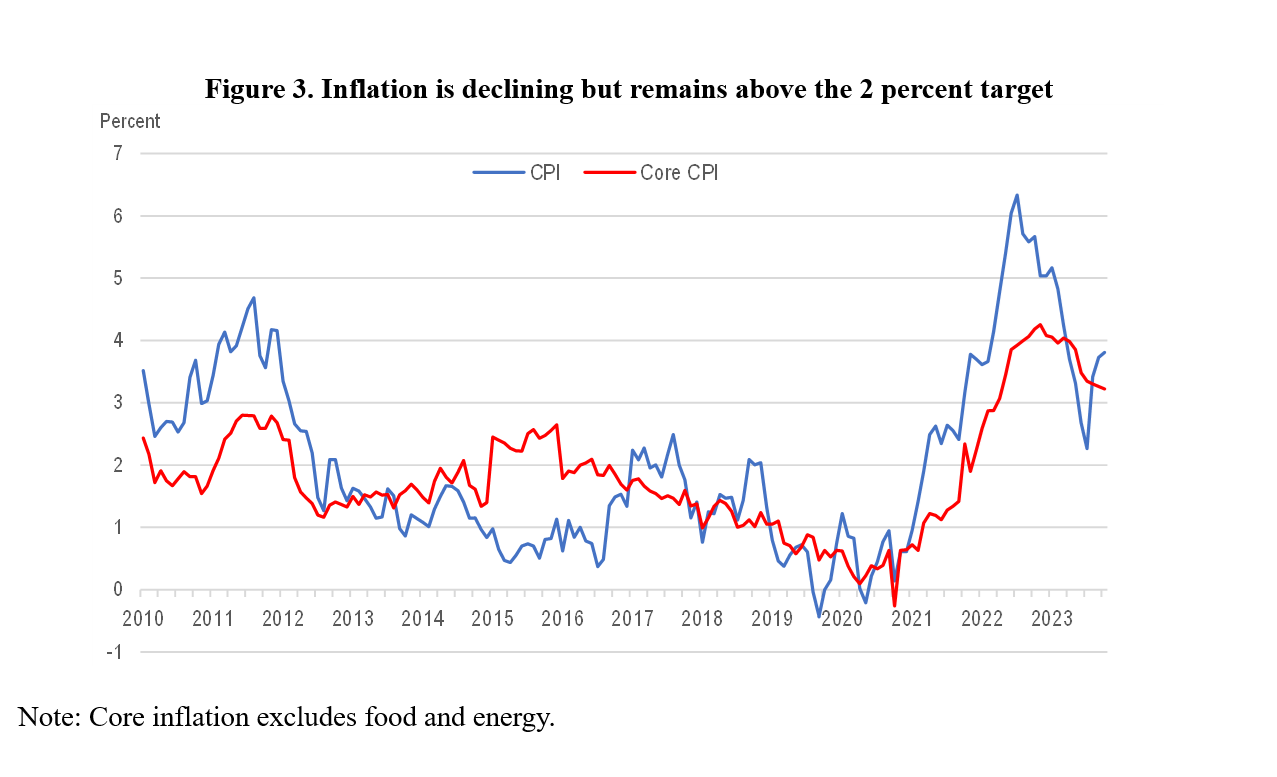

Headline inflation in Korea peaked at 6.3 percent in July 2022, the highest rate since 1998 in the wake of the Asian financial crisis (Figure 3). The Bank of Korea boosted its policy rate ten times since early 2022 to 3.5 percent in January 2023, its highest level since 2008. Both headline and core (excluding energy and food) inflation exceed 3 percent, well above the central bank’s 2 percent inflation target. On November 30, the Monetary Policy Board kept the policy rate unchanged and raised their 2024 forecasts for headline inflation to 2.6 percent and core inflation to 2.3 percent. The OECD projects that inflation (headline and core) will fall gradually to 2 percent in 2025, even as the policy rate is reduced to 2.5 percent.

Source: Korea projection note OECD Economic Outlook November 2023 by OECD – Issuu.

Fiscal policy is set to be mildly restrictive in 2024 and 2025. The 2024 budget calls for a 2.8 percent increase in total expenditures, the smallest since 2005. Nevertheless, the government’s budget deficit is forecast to be 3.9 percent of GDP, surpassing the proposed fiscal rule ceiling of 3 percent. Fiscal consolidation is essential to prepare for rapid population aging, driven by Korea’s low fertility rate. The OECD estimates that increased outlays for pensions and healthcare could boost government spending by around 5 percent of GDP by 2040. The proposed fiscal rule should be implemented to limit the rise in government debt.

Source: Korea projection note OECD Economic Outlook November 2023 by OECD – Issuu.

Conclusion

While growth close to 2 percent in 2024 and 2025 may seem sluggish by historical standards, it is above Korea’s potential growth rate, defined as the level of output an economy could sustain at full capacity utilization and full employment. According to a Bank of Korea estimate, the potential growth fell below 2.0 percent this year and will drop to 1.7 percent in 2024. The OECD estimate is slightly higher at 2.0 percent, matching the rate for the United States. These estimates suggest that continued convergence in Korea’s per capita income towards the level in the United States, which is about one-third higher than Korea, will be challenging to achieve.

Sustaining Korea’s convergence to the highest income countries requires policies to boost productivity to offset the demographic challenge. Indeed, Korea’s fertility rate fell further to 0.7 in the third quarter of 2023. Choi Sang-mok, recently nominated as Minister of Economy and Finance, has stressed the importance of creating a more dynamic economy. On December 5, he stated: “Continuous innovation is a must for an economy to create values. For the goal, easing regulations, nurturing science and technology for advanced industries, and structural reform are needed.”

Randall S. Jones is a Non-Resident Distinguished Fellow at the Korea Economic Institute of America. The views expressed here are the author’s alone.

Photo from Shutterstock