The Peninsula

Korean Economic Growth is Projected to Decelerate

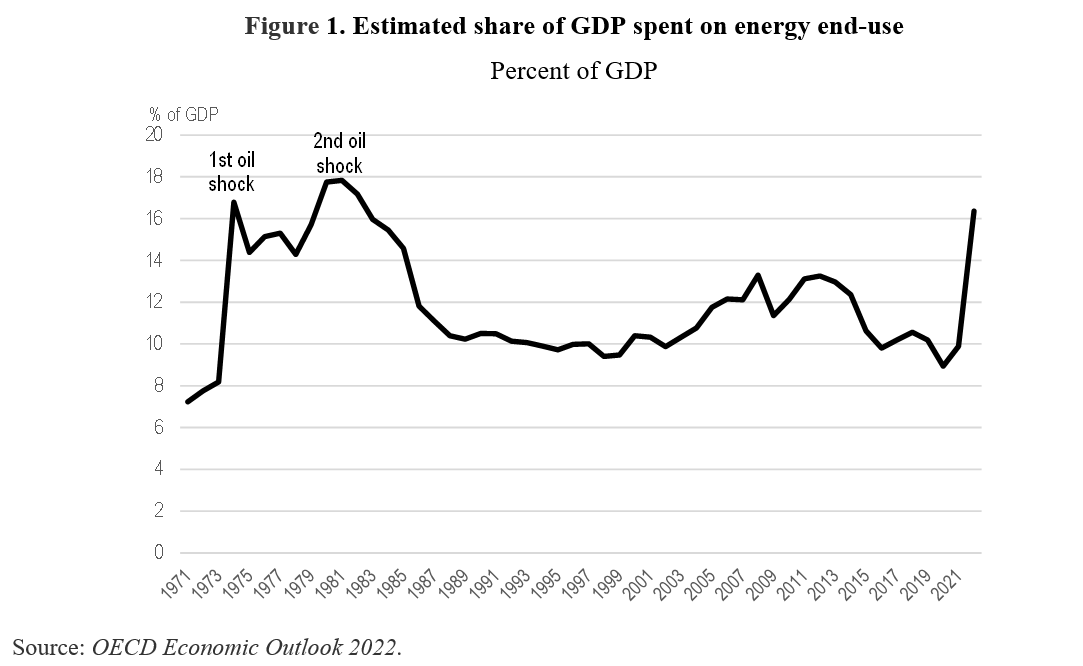

The latest OECD Economic Outlook, released on November 22nd, paints a grim picture of the world economy. Russia’s war against Ukraine has resulted in a significant energy price shock similar in magnitude to those seen in the 1970s (Figure 1). High inflation has spread across countries and products, prompting central breaks to raise interest rates, which has intensified financial vulnerabilities. The war in Ukraine has heightened the risks of debt distress in low-income countries and food insecurity. The OECD projects that world GDP growth will slow from 5.9% in 2021 to an estimated 3.3% this year and 2.2% in 2023, with risks skewed to the downside, before rebounding in 2024.

The Korean economy has lost some momentum and faces headwinds

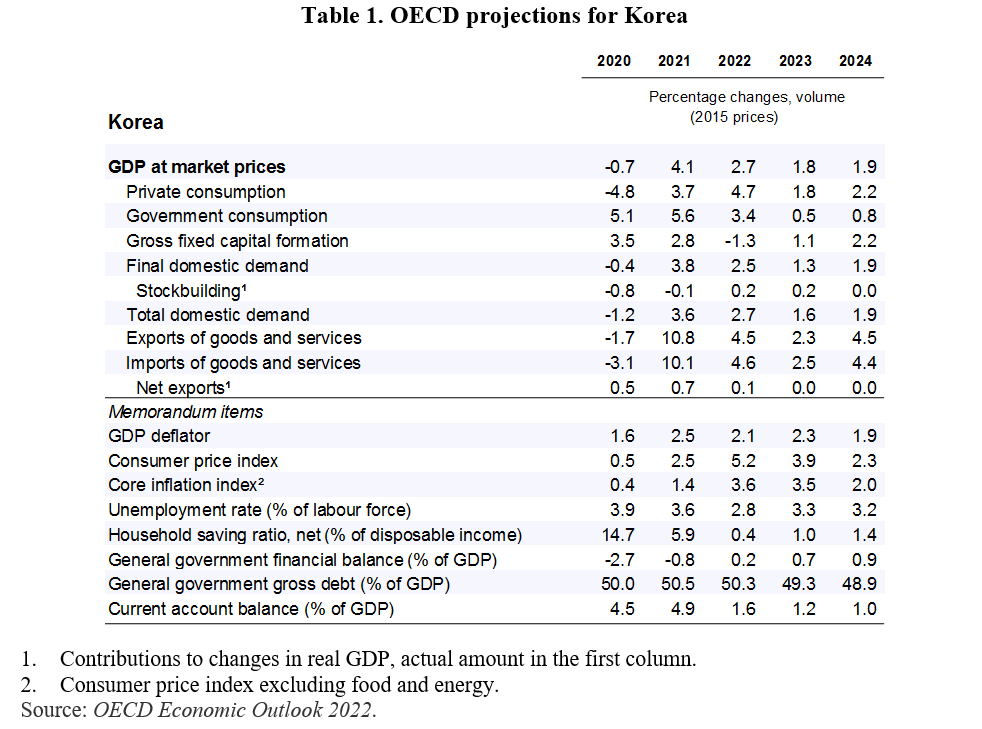

The OECD projects that Korea’s GDP growth will slow from 2.7% in 2022 to just under 2% in 2023 and 2024 (Table 1). The 2023 outlook of 2.2% growth published in the OECD Economic Survey of Korea last September has been revised down to 1.8%, which matches the Korea Development Institute forecast. The OECD outlook for Korea is below the 2.3% projection by the Asian Development Bank, 2.1% by the Bank of Korea and 2.0% by the International Monetary Fund. The OECD predicted growth rate in 2023 would mark only the third time in this century that growth has failed to reach 2% (the 0.8% in 2008 in the wake of the global financial crisis and the -0.7% in 2020 during the COVID-19 pandemic).

The direct impact of Russia’s war in Ukraine on Korea has been small, reflecting limited trade and financial links with those countries. However, the surge in global energy prices led to hikes in electricity and gas prices by 5% and 16%, respectively, in October and further increases are expected. Moreover, the depreciation of the won, which has fallen by 12% relative to the U.S. dollar during the past year, has pushed up import prices. Headline consumer price inflation was 5.7% in October (year-on-year), down slightly from its July peak of 6.3% in July, but still far above the 2% inflation target. Core inflation (excluding food and energy) came in at 4.2% in October. High inflation is reducing households’ purchasing power, negatively affecting private consumption growth. In addition, export growth is slowing as global demand is softening, including for semiconductors, Korea’s major export. With weak domestic and external demand, GDP growth fell to 1.1% (at an annualized rate) in the third quarter of 2022.

Tighter monetary and fiscal policies are also putting downward pressure on growth. The Bank of Korea has raised its key policy rate in eight steps from 0.5% to 3.0% since August 2021 to keep inflation expectations in check. The government has proposed a fiscal rule that would limit the budget deficit (excluding social security) to 3% of GDP. In line with this target, its 2023 budget would reduce the deficit from 5.1% of GDP in 2022 to 2.6% in 2023, primarily by scaling back support introduced during the pandemic. The OECD projects that such policies will help cut headline consumer price inflation to 2.3% in 2024 and reduce gross government debt to below 50% (Table 1).

The OECD supports Korea’s macroeconomic policy stance, arguing that “monetary policy tightening should continue to re-anchor inflation expectations.” On the fiscal side, the OECD calls for gradual consolidation by shifting government spending from the broad-based financial support implemented during the pandemic towards targeting vulnerable people and houses.

Risks facing the Korean economic outlook

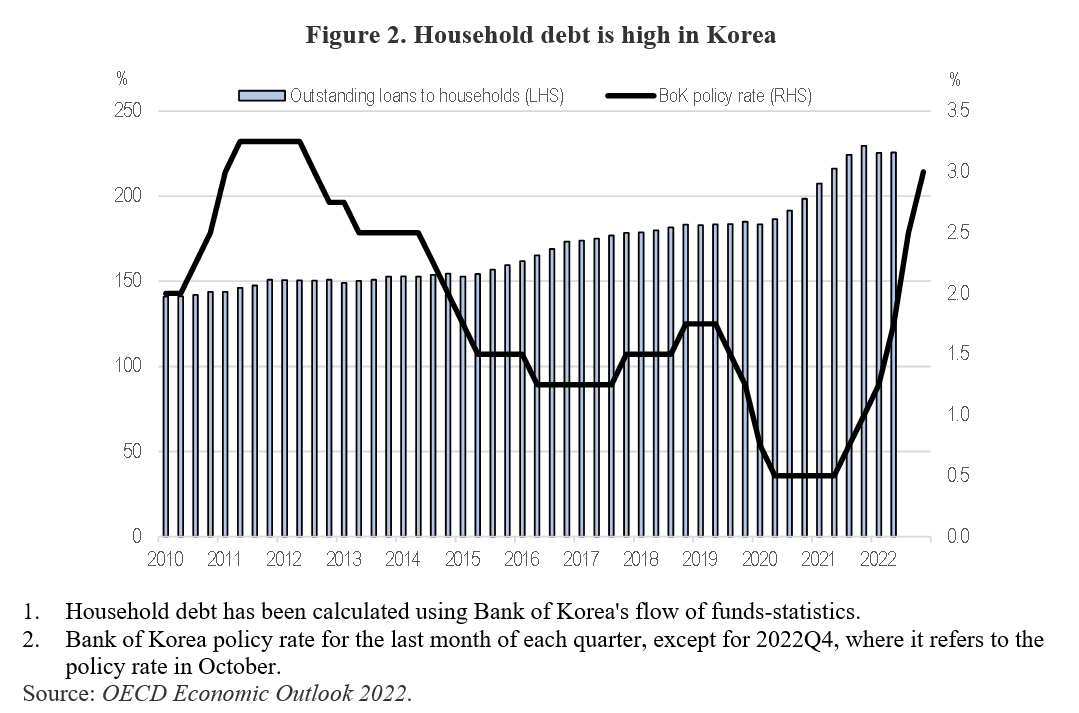

The high level of debt held by households and small businesses poses a significant risk to private consumption and investment. Household debt has risen to 225% of GDP, one of the highest levels in the OECD. With rising interest rates, the increasing debt servicing burden raises the risk of a more pronounced housing price correction. This could result in corporate failures, posing further downside risks to consumption and investment. The OECD also warns that “Increasing protectionism, such as rising tensions between the United States and China, Russia’s war against Ukraine and potential further geopolitical tensions may trigger realignments of Korean supply chains.” On the positive side, an easing of geopolitical tensions and a relaxation of China’s zero-COVID-19 policy could result in faster-than-expected GDP growth.

Randall S. Jones is a Non-Resident Distinguished Fellow at the Korea Economic Institute of America. The views expressed here are the author’s alone.

Photo from Shutterstock.