The Peninsula

Is China Helping? We Might Be Surprised

By William Brown

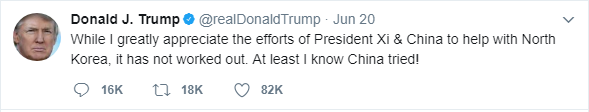

President Trump made lots of people a little nervous last week, tweeting that China had been “helpful” on North Korea but that “It just hasn’t worked out.” As if resigned to the inevitable, he typed “At least it tried”. With breaking news TV stations reporting activity at the nuclear test site it seemed something actually might happen. Maybe years of crossed red-lines was finally coming to this, a Kim Jong-un test of Trump’s resolve. I must admit, I woke up in the middle of the night just to check my USGS earthquake tickler. It, and KOPSI, was quiet.

North Korea, we all know by now, can surprise us with a nuclear test at any time but so far, in the five months of Trump’s tenure, it hasn’t, nor has it crossed a different red line and tested an ICBM, despite warning of such in January. Many short and medium range missiles have been test fired, of great danger to South Korea and Japan, but nothing close to one capable of hitting the US mainland. So, while it is still early, it is fair to ask; is China finally bringing effective pressure to bear on Pyongyang to stop the tests that so worry the United States, as we and others have demanded?

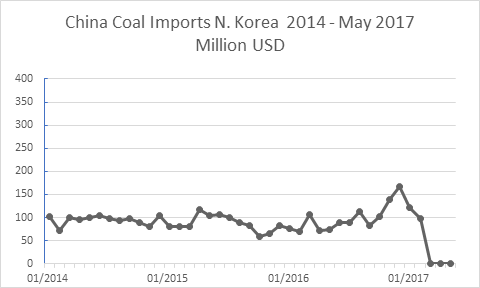

Surprisingly, after so many years, perhaps so. Over the week-end, China released trade data for May and it seems to show, despite lots of naysaying from Washington pundits, that the economic pressure is building. Monthly data is volatile, and this is not seasonally adjusted, but the trend clearly is not in North Korea’s favor. Chinese exports to North Korea were fine, in fact up 19 percent in the year through May from the same period of 2016, but imports plummeted 24 percent, largely attributable to a zeroing out of anthracite coal imports.

For Pyongyang, the rise in imports and fall in exports pushed the long-term average $50 million monthly goods trade deficit to about $200 million in each of March, April, and May. This seems unsustainable, meaning it is likely larger than the funds North Korea can garner from other activities, i.e. trade with other countries, and from services sales and remittances from overseas workers and from families who have fled, leaving their relatives. Almost no aid is flowing into the country, the Kaesong money pot is broken, and the capital account, usually a balancer for a poor country with a large trade deficit, is likely flat given no one is willing to lend anything to Pyongyang, let alone invest. If all this is correct, imports will not hold up for long and the people will begin to experience the brunt of shortages of all kinds of imported goods.

The first of these might have already happened. In May, after mere threats that China may reconsider its decades long provision of free crude oil, a legacy of the Mao-Kim era, lines for gasoline formed and prices leapt in Pyongyang, holding high at least through the end of May (see May blog).

Of course, one has to be cautious in depending too much on published Chinese trade data, especially in an area like this with such important policy dimensions and with great lack of transparency. Ever since Beijing prohibited imports of coal from North Korea back in February, the data has shown exactly zero imports, an unlikely proposition. The same can be said for other products such as precious metals although it is not true for all UN sanctioned items which have seen reductions but not to zero. Observers have seen some North Korean coal in Chinese ports and are thus skeptical the coal really has been stopped. And Beijing has a track record of fooling around with its crude oil export data, off the books since mid-2014 (this flow is not counted in the above graphics). If North Korea had to pay for the vital crude oil, this would likely add another $30 million or so to the monthly deficit. And even if Chinese customs faithfully records what it sees, there is no doubt a lot of smuggling takes place. Even so, the data, even if inaccurate, is telling North Koreans who can see it an important story; as Trump says, China is trying to limit economic interchange, a strong and worrisome message in and of itself.

Market data should begin to help confirm if the Chinese cutback on imports is real. With Kim Jong-un having bought in to at least passive acceptance of a partial market economy, domestic prices are reasonably free to rise sharply, if and when the market exchange rate deteriorates and demand for dollars rises. So far, except for gasoline and diesel, though, such changes have been only slight, as indicated by the DailyNK website. And clever North Koreans may find other things to sell in exchange for hard currency or imports. Nonetheless, price and exchange rate stability are two of Kim’s most important success stories to date and are something his father or grandfather never achieved. It will thus be important to watch these indicators to see if Chinese pressures really are building, giving the young leader worrisome things to think about, even more than Trump’s tweets.

William Brown is an Adjunct Professor at the Georgetown University School of Foreign Service and a Non-Resident Fellow at the Korea Economic Institute of America. He is retired from the federal government. The views expressed here are the author’s alone.

Photo from Global Panorama’s photostream on flickr Creative Commons.