The Peninsula

Improvements to the U.S.-Korea Trade Balance

By Phil Eskeland

During the presidential election campaign, trade became a top tier issue, with the Korea-U.S. Free Trade Agreement (KORUS FTA) coming under attack because of the increase in the merchandise trade imbalance between the U.S. and South Korea that some critics mistakenly extrapolate to job losses in the United States. This theme made it into the President’s 2017 Trade Policy Agenda, which was released on March 1st, stating that “this [i.e., more than doubling the size of the U.S. trade deficit in goods with Korea] is not the outcome the American people expected from that agreement.” While others can debate the root causes or the relative effect of trade deficits with specific countries on the U.S. economy, the Trump Administration is focused on policies to produce a trade surplus for the United States as a tool to boost domestic job creation.

Regardless, recent statistics released by the Foreign Trade Division of the U.S. Census Bureau show an improvement in the trade balance with South Korea in favor of the United States. This reflects that more and more products and services are benefiting from lower barriers to trade as the KORUS FTA is phased in. According to the Korea Customs Service, U.S. exports of items that directly benefited from various provisions in KORUS increased by 18 percent between 2011 and 2015 (latest data available). After the 5th anniversary of the implementation of KORUS, nearly 95 percent of U.S. consumer and industrial products are now being exported to Korea duty-free. As a result, the 2017 National Trade Estimate report on Foreign Trade Barriers released on March 31st acknowledges that the 2016 U.S. goods trade deficit declined 2.3 percent over 2015 levels. In fact, the U.S. Trade Representative’s (USTR) report states that since the KORUS FTA entered into force on March 15, 2012, the U.S. and Korea have carried out six rounds of tariff cuts and eliminations, “creating substantial new market access opportunities for U.S. exporters.”

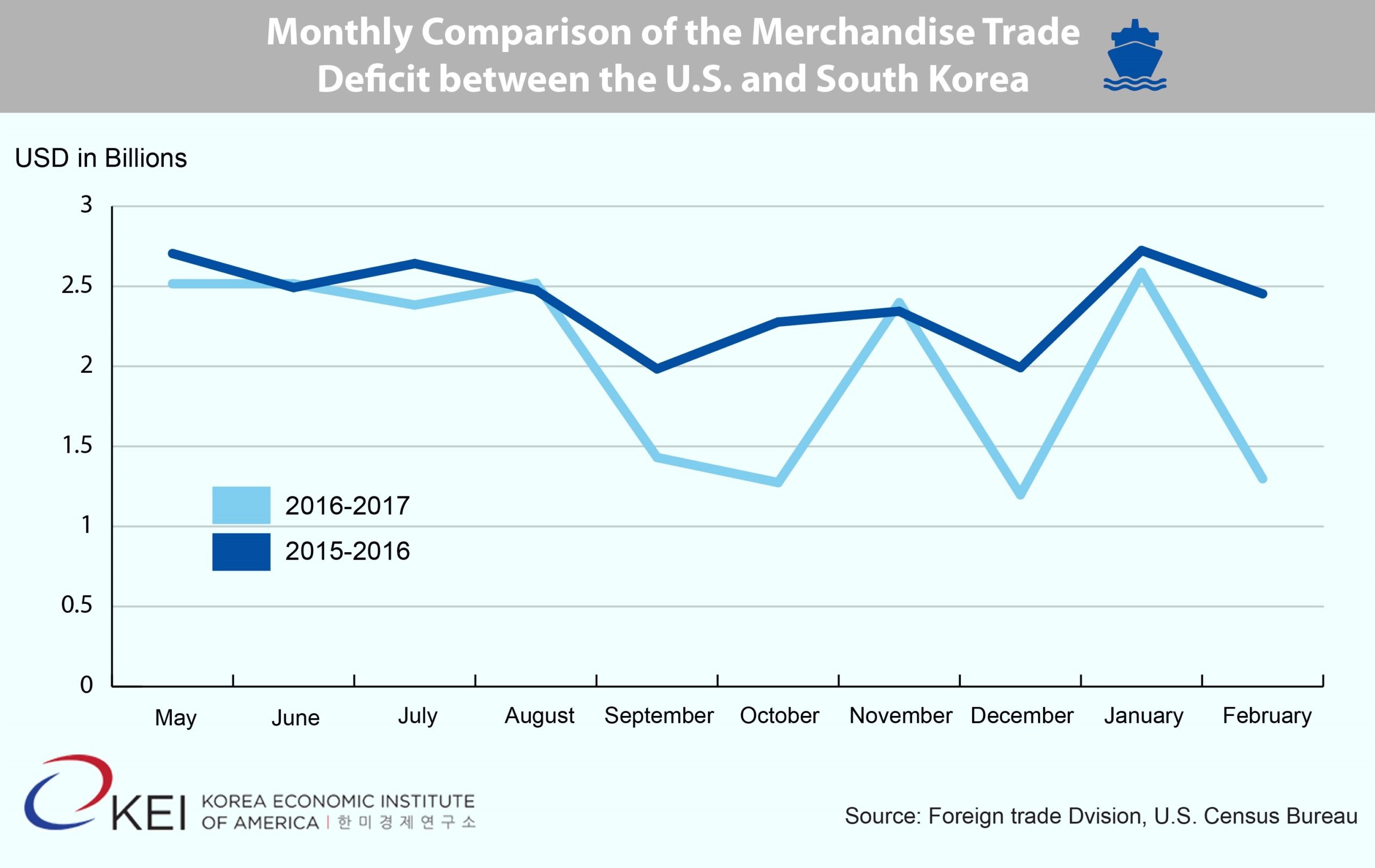

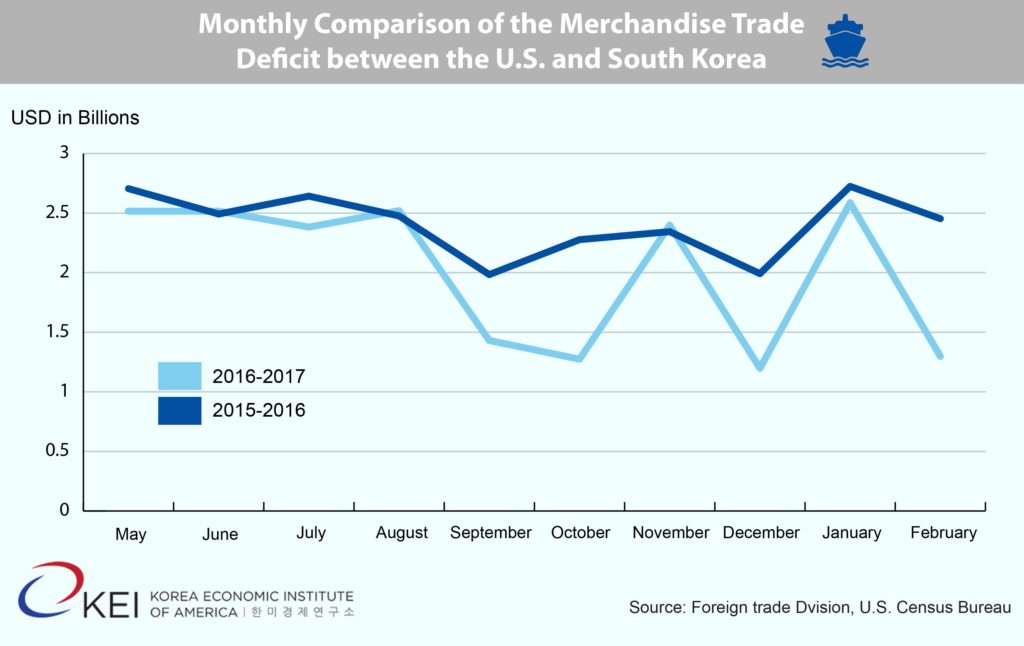

The lower trade deficit trend started mid-year in 2016. As reflected in Chart 1, the monthly merchandise trade imbalance began to drop or remain relatively steady starting in May 2016 as compared to the same month the previous year. The difference for the month of February (latest data available) is most dramatic – the trade imbalance was reduced almost in half, dropping from $2.4 billion in 2016 to $1.3 billion in 2017.

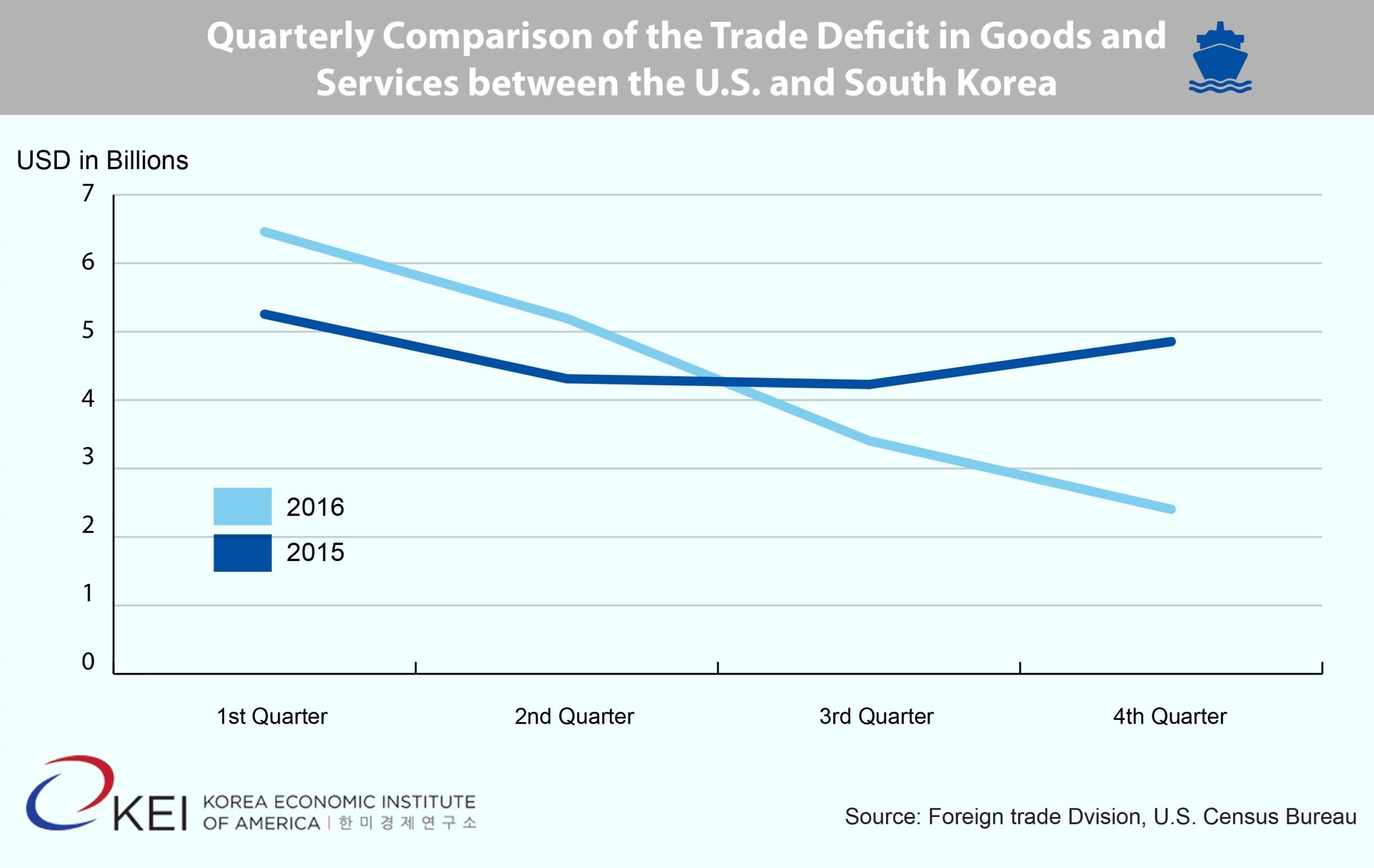

When services trade is included, the trend is even more pronounced. The U.S. exported yet another record level in services, totaling $21.55 billion, to Korea in 2016 to produce the best ever trade surplus for the U.S. in services. While 1st Quarter 2017 services trade statistics are not available yet, examining previous year’s data (see Chart 2) shows that the trend switched during the 3rd Quarter of 2016. While the U.S. trade imbalance with Korea was higher during the first two quarters of 2016 than the previous year’s level, the trend flipped mid-year for the 3rd and 4th quarters. The decline in the trade deficit between the U.S. and Korea is goods and services was most pronounced during the 4th Quarter, falling by more than half from $4.86 billion in 2015 to $2.4 billion in 2016.

There may be other macro-economic reasons for the decline in the U.S. trade deficit with Korea that have nothing to do with KORUS. Nevertheless, while is still is premature to determine if this decline in the U.S. trade deficit with Korea is a long range trend, if KORUS was blamed by some for the increase in the bilateral trade deficit, then these same critics should give KORUS credit for its recent decline. It should also demonstrate that it would be a mistake to tinker with an agreement, half-way into the full implementation process that is producing results in terms of more export and job-creation opportunities for U.S. businesses and workers and a lower trade deficit.

Phil Eskeland is Executive Director for Operations and Policy at the Korea Economic Institute of America. The views expressed here are his own.