The Peninsula

Higher Tariffs on Imported Vehicles and Parts from Korea Will Harm U.S. National Security

By Phil Eskeland

Earlier today, the U.S. Department of Commerce held a public hearing as part of the investigative process (Section 232) into the national security implications of motor vehicle and parts imports in the United States. The Commerce Department also hosted a public comment period, now closed, in which approximately 2,300 persons responded. In both the public hearing and the comments the Commerce Department received on-line, the vast majority of respondents were strongly opposed to the proposal to raise tariffs, perhaps as high as 25 percent, on imported motor vehicles and parts for numerous reasons, most notably the lack of a valid national security rationale for embarking on this course of action. The broader concern is that if the U.S. adopts the reasoning that “economic security is national security” to raise tariffs on imported vehicles and components, then this would empower other countries to emulate the American action, which would lead to a host of abuses around the world that will be detrimental not just to the U.S. economy, but to the world economy at-large.

Most of the media coverage of this issue focuses on trying to explain the rationale for the Trump Administration’s justification for launching this study: either to (1) induce Canada and Mexico to become more amenable to the U.S. position in the auto provisions in the North American Free Trade Agreement (NAFTA) renegotiation talks or (2) persuade the European Union to eliminate its 10 percent tariff on imported motor vehicles. Caught in the peripheries of this maelstrom is the effect higher U.S. tariffs on imported autos and parts would have on the Republic of Korea (ROK) and the burgeoning Korean auto manufacturing industry in the United States if Korea is not given an exemption.

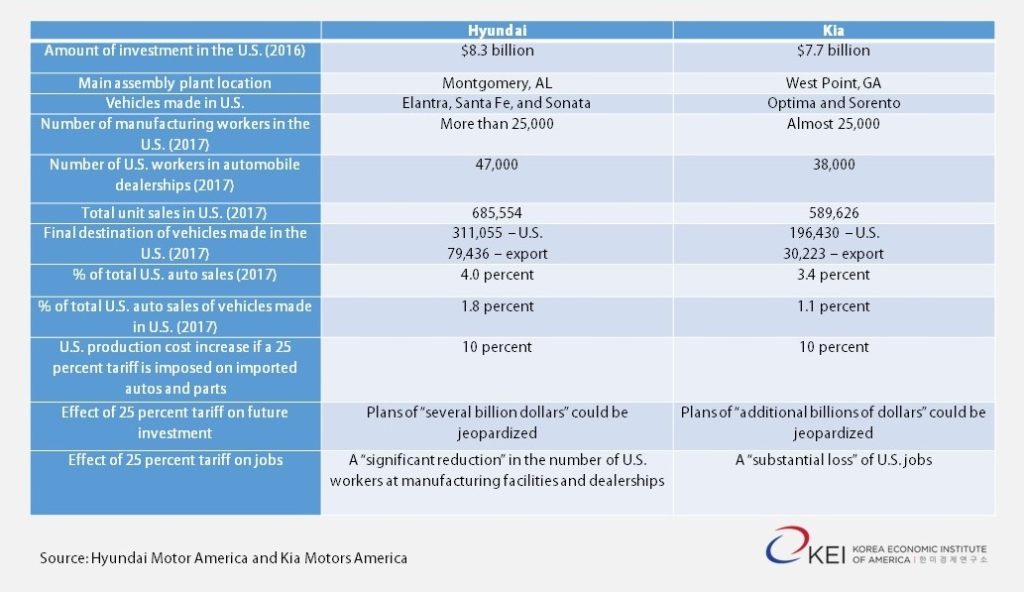

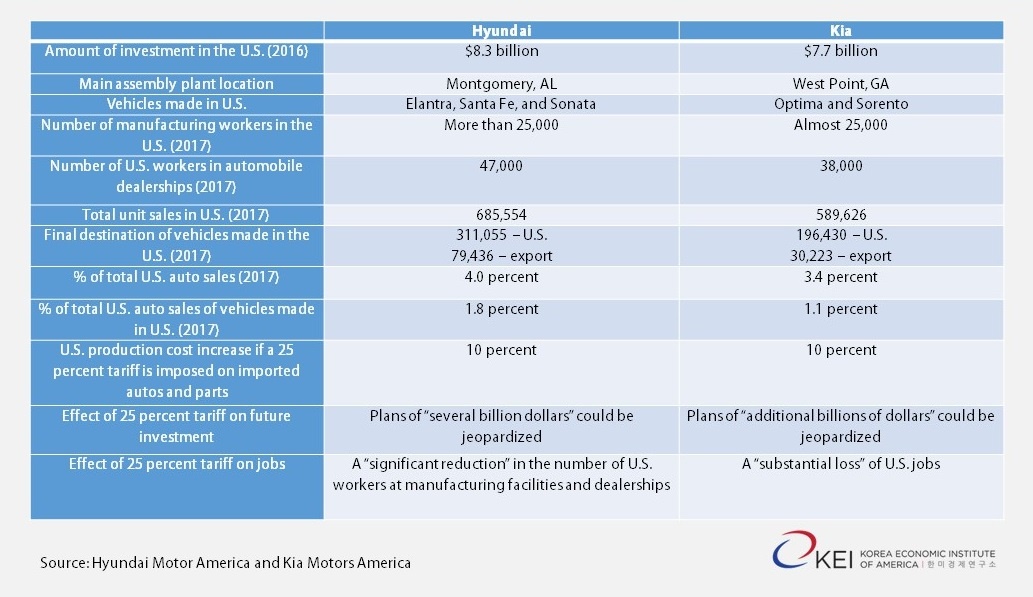

There are two Korean companies that manufacture automobiles with operations in both Korea and the United States – Hyundai Motor Company and Kia Motors Corporation. According to written comments to the Department of Commerce, Hyundai and Kia provided the following information:

There are two other automobile manufacturers that export vehicles from South Korea to the United States – General Motors (GM) Korea and Renault/Samsung Motors (Renault is now part of an alliance with Nissan). Vehicles manufactured in Korea under these nameplates include the Chevy Spark and Trax, along with some Nissan Rouge vehicles. In their written comments to the Department of Commerce, the Korea Automobile Manufacturers Association (KAMA) said that U.S. sales of all Korean automotive imports, including Hyundai and Kia vehicles, totaled 821,338 units in 2017, which was 4.8 percent of the total U.S. market share. The primary focus of these Korea-made vehicles is on small cars and cross-over utility vehicles (CUVs) that is no longer a mainstay of U.S. automakers.

In addition, the Korean automotive components manufacturers are also increasing their presence in the U.S., now producing parts in 94 facilities located in 14 states across the United States. For example, LG Electronics also spoke before the Department of Commerce panel conducting the Section 232 investigation to remind the audience of their recent investment in the Detroit, Michigan area to produce batteries for electric vehicles that resulted in the creation of 300 jobs.

Nonetheless, the unique challenge confronting Korea is that not only is the ROK a strong allied partner of the U.S., but also recently successfully concluded a renegotiation of its free trade agreement (FTA) with the United States, including making several changes to the auto provisions, that “will strengthen our national security relationship.” In fact, President Trump recently characterized the revised Korea-U.S. Free Trade Agreement during a trip to Wisconsin as a “wonderful deal for both” countries. Neither Japan nor the European Union has a FTA with the United States. Canada and Mexico, the other two major nations that exports vehicles and parts to the U.S., are still in the throes of renegotiation their FTA with the United States.

In addition, the ROK and the U.S. together face the unique challenge of North Korea. There are more than 400,000 South Koreans employed in their domestic auto sector and the U.S. is their largest export market, totaling $6.8 billion in 2016. If tariffs are imposed on South Korea’s auto and parts exports to the United States, it would represent a major blow to South Korea’s economy and thus weaken the ability of the ROK to advance our shared national security interests with respect to dealing with North Korea. Imposing tariffs would also make it extremely problematic for President Moon Jae-in to pass the revisions to the Korea-U.S. (KORUS) FTA in the divided Korean National Assembly (no single party has majority control in their parliament) because the U.S. action would be viewed by these legislators as bad faith on the part of the Trump Administration, particularly in light of other discussions in Washington, D.C. of embarking on even more Section 232 investigations into sectors important to Korea’s economy, such as semi-conductors. Already, there has been yet another Section 232 investigation launched – this time dealing with U.S. imports of uranium.

Not only are there sound economic reasons not to impose higher tariffs on Korea motor vehicle and parts imports, due to the fact that this action would significantly raise prices on the most affordable, safe, and dependable vehicles and result in job losses, but it will also damage U.S. national security by undermining a foundation of the South Korean economy. If economic security is national security, it is counterintuitive to buttress a vibrant U.S. auto industry that does not need help by undercutting Korea’s ability to continue to be a strong partner in the U.S.-Korea alliance. If this was thought of as a broad tool to force more companies to move production into the U.S., higher tariffs will be backfire because this action will only lead to fewer car sales, and thus less revenue for expansion, as the basic price for all vehicles rises and discourages Americans from buying a new car.

Phil Eskeland is Executive Director for Operations and Policy at the Korea Economic Institute of America. The views expressed here are his own.

Photo from Abdullah AlBargan’s photostream on flickr Creative Commons.