The Peninsula

Beyond the Data: The Impact of the Ukraine War on Semiconductor Production

The widely publicized shortage of semiconductor chips – a remnant of the pandemic supply chain disruptions – faces new challenges from the ongoing Russia-Ukraine conflict. Eastern Europe is the largest supplier of industrial, rare gasses that are crucial to semiconductor production in South Korea. Conflict-caused supply disruptions open the door for other nations to fill the gas market vacuum, if processes can catch up in a timely manner.

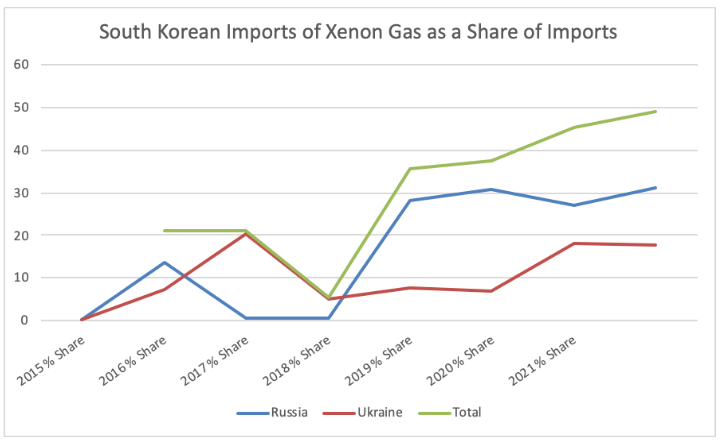

Since 2015, the percentage share of Russia and Ukraine’s contributions to South Korea’s imported xenon increased 28.07%.

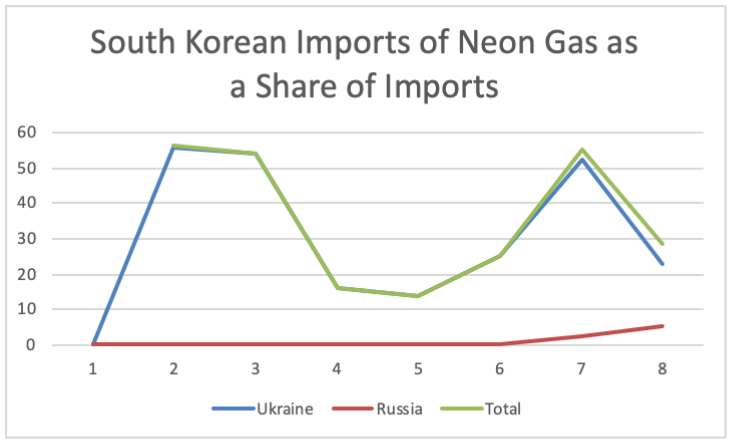

Imports of neon fluctuated, but Ukraine supplied over half of South Korea’s neon imports in 2015, 2016, and 2020.

Semiconductor producers like Samsung and SK hynix are highly dependent on the neon and xenon gasses Russia and Ukraine export, and the invasion of Ukraine will likely result in a sharp drop off of exports of both of these rare gasses to Korea. In the short-term – two months time – there are material reserves to keep prices at a manageable level. In the medium-term, however, supply disruptions are expected to lead to higher costs for the semiconductor industry. Prices for neon grew 500 percent shortly after the invasion began.

Filling any gaps will be challenging. Neon is a byproduct of steel production and the technology used in used to capture the gas tends to only be in older plants from the 1980s. Prior to the war, two Ukrainian companies accounted for 45-54 percent of the world’s semiconductor grade neon. Both of those companies have since suspended operations.

South Korean semiconductor firms have access to supplies and the buying power to acquire neon and xenon from other sources, but it is inevitable that they will face rising prices and potential shortages in the coming months.

Julia Fadanelli is a Research Assistant at the Korea Economic Institute of America and an undergraduate at the Ford School of Public Policy at the University of Michigan. The views expressed here are the author’s alone.

Image from Shutterstock.