The Peninsula

2017 U.S. Agricultural Exports to South Korea Nearly Tied Record

By Phil Eskeland

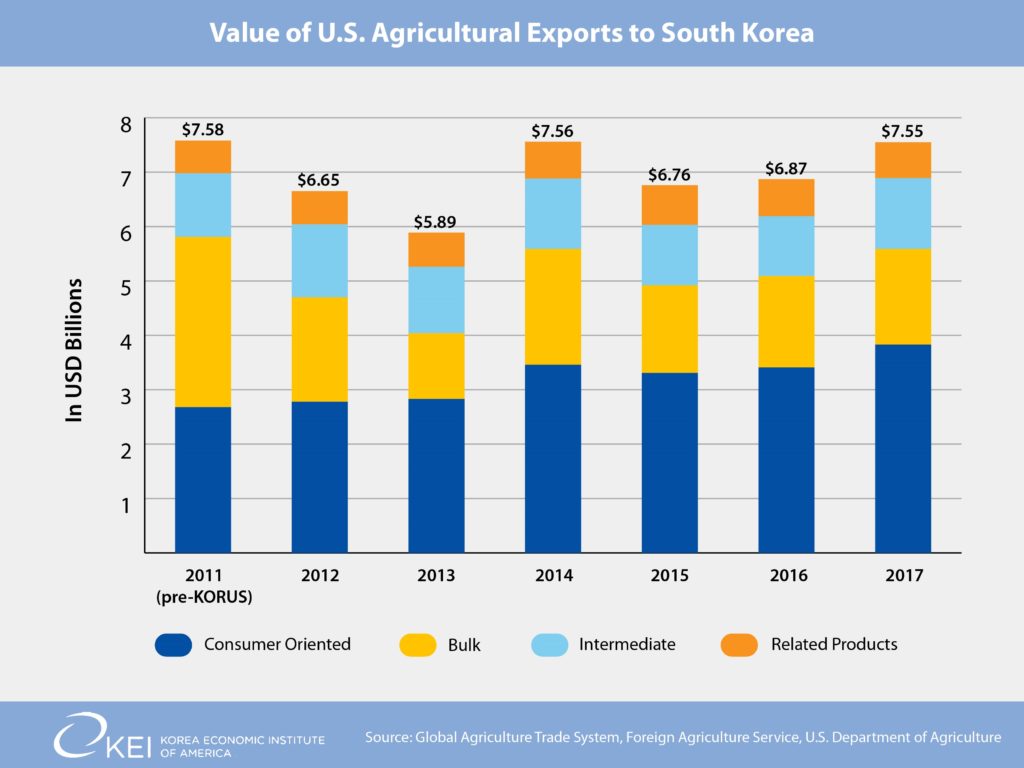

Recently, the Foreign Agricultural Service (FAS) of the U.S. Department of Agriculture (USDA) released 2017 trade statistics showing that the value of U.S. agricultural related exports to South Korea reached $7.55 billion, very close to the same level as in 2011 ($7.58 billion), the year before the implementation of the Korea-U.S. Free Trade Agreement (KORUS FTA). Korea is now America’s sixth largest market for agricultural exports. Using the USDA estimates, U.S. agricultural exports to Korea kept over 60,000 Americans employed in 2017, mostly located in the rural heartland, and have generated nearly $9.6 billion in additional economic activity in the United States. The U.S. also still runs a massive trade surplus in agricultural trade with South Korea, totaling $6.3 billion for 2017.

Because South Korean tariffs on agricultural imports were previously very high (averaging 55.4 percent vs. 3.8 percent for the U.S.), there was heightened expectation that U.S. agricultural exports to Korea would soar as tariffs on U.S. agricultural products were either eliminated immediately (i.e., on almonds, cherries, and wine) or were gradually phased out over time (i.e., on beef, cheese, and pork). For many specific product areas, U.S. exports did dramatically climb. Most notably in one of the more contentious items negotiated in the KORUS FTA, U.S. beef exports to South Korea grew 78 percent, from $686 million in 2011 to $1.22 billion in 2017, as the tariff rate has been gradually ratchetting down from 40 percent. However, why has the aggregate number with respect to U.S. agricultural exports to Korea remained essentially frozen during these past six years?

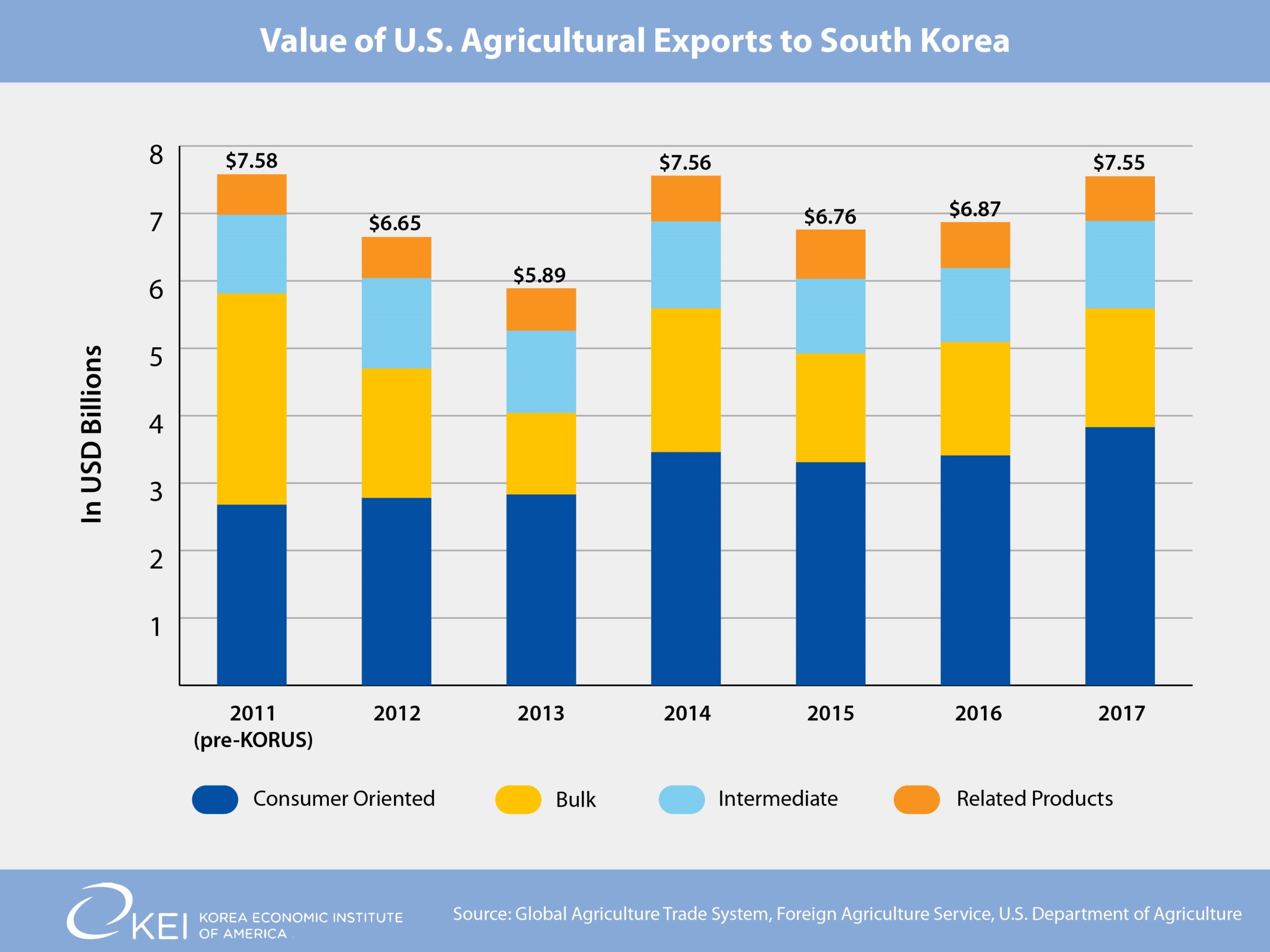

The answer can be primarily found in falling prices for basic farm commodities. In all but one sub-category of agriculture-related products, U.S. exports of these items to Korea have increased since KORUS came into effect. Since 2011, exports of U.S. consumer-oriented food products, such as beef, fruit juice, nuts, and wine to Korea have increased overall by 47 percent. Exports of U.S. intermediate agricultural goods to Korea, such as soybean and vegetable oil, have increased 11 percent since 2011. Exports of agricultural-related products, such as distilled spirits, forest and fish products, to Korea have also increased by 10 percent during that same time period. What has not increased is the dollar value of bulk commodity exports such as wheat, corn, and soybeans. U.S. exports of these products to Korea have declined in value by 44 percent between 2011 and 2017.

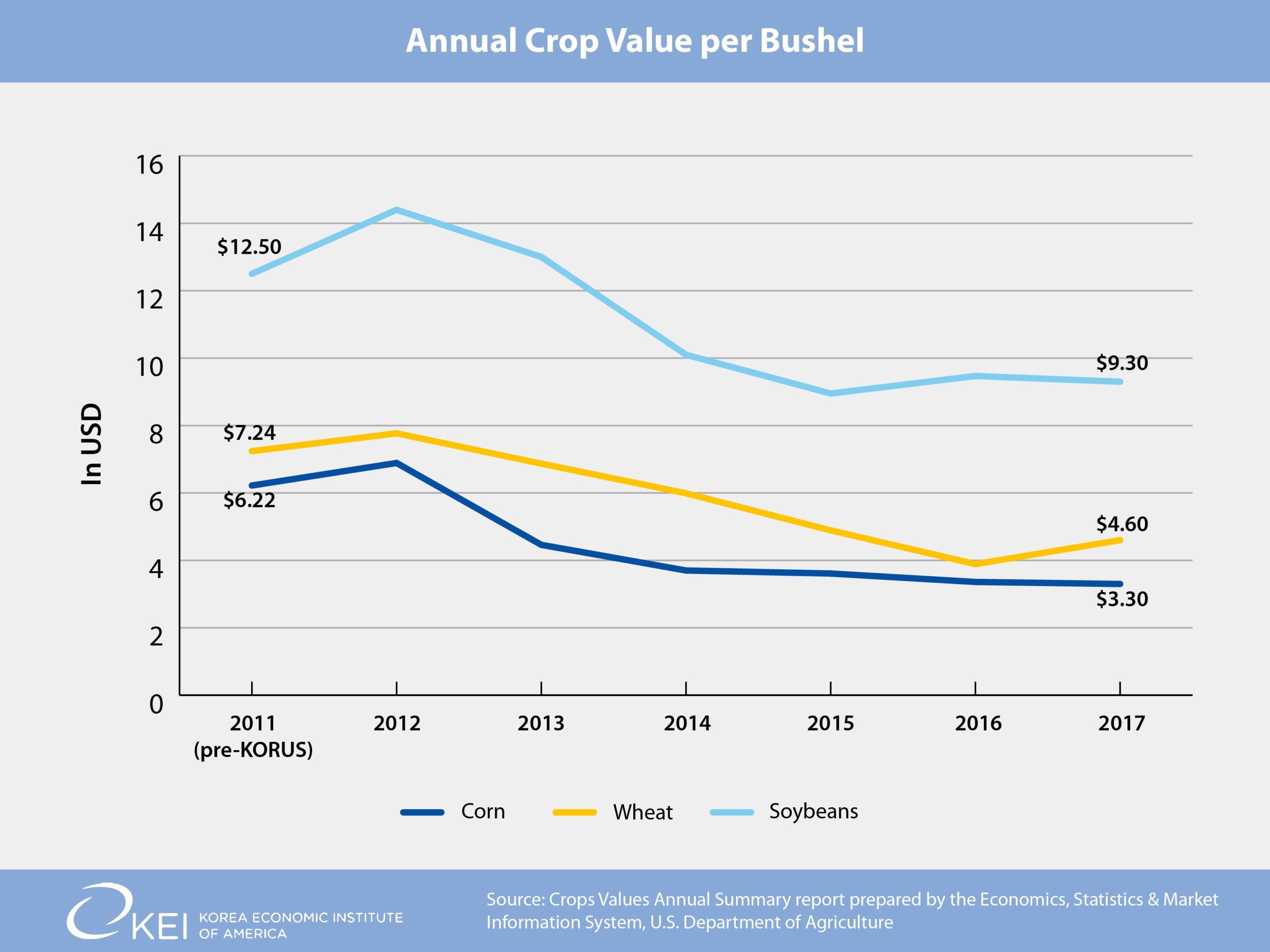

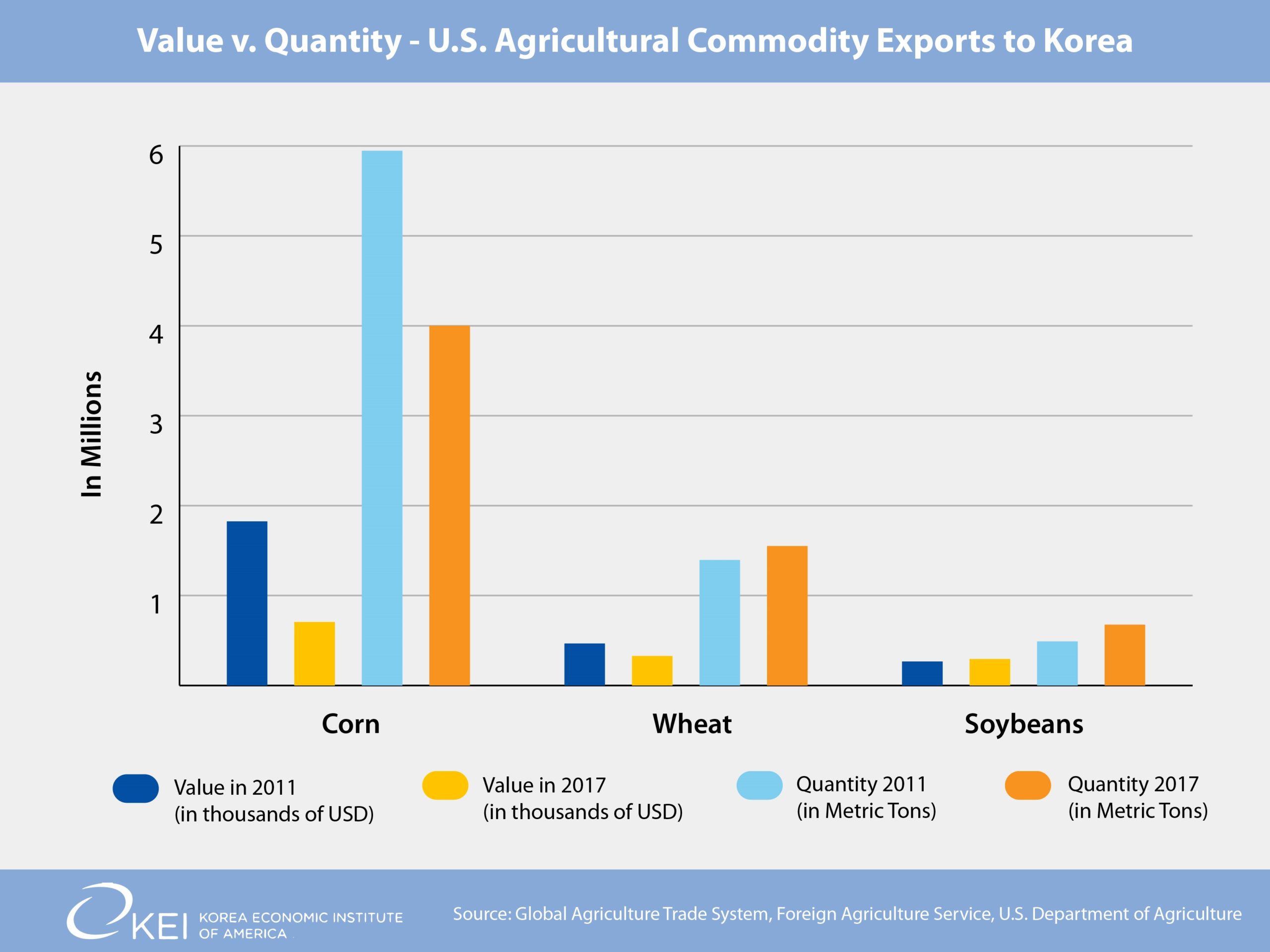

Some groups critical of the KORUS FTA have seized upon the drop in the value of U.S. agricultural exports to Korea, but conveniently omit that prices for commodities have fallen and overlook the fact that for many commodities, the quantity of these exports has increased even as U.S. exporters receive a lower remuneration for their product. Thus, just examining the value of certain agricultural exports misses the broader picture. The drop in bulk commodity prices unfortunately began to occur during the implementation year of the KORUS FTA in 2012, for reasons unrelated to the agreement, and have still yet to recover. This slump in commodity prices over the past five years has cut total U.S. farm income in half.

In 2017, three commodities formed 75 percent of all bulk U.S. agricultural exports to Korea: corn, wheat, and soybeans. The price for all these commodities dramatically declined since 2011, some as much as 50 percent. For example, even though the U.S. exported more wheat to Korea (in terms of volume) in 2017 than in 2011, the monetary value of that export declined by $138.6 million because the price of wheat fell by 37 percent during that same time period.

U.S. corn exports have a similar, but more complicated story. The U.S. exported 5.9 million metric tons of corn to Korea in 2011, valued at $1.8 billion. For the next two years, American exports of corn dramatically declined, not just to Korea, but all around the world due to a drought in the United States. As a result, corn growers in other parts of the world took advantage of America’s misfortune to meet the demand for corn in other countries that the U.S. previously supplied. The Economic Research Services at the USDA reported that “…farmers (in the Southern Hemisphere) plant their corn after discovering the size of the U.S. crop, thereby providing a quick, market-oriented supply response to short U.S. crops. Several countries–including Brazil, Ukraine, Russia, India, and South Africa–have had significant corn exports when crops were large or international prices, attractive. South Korea is a price-conscious buyer…willing to buy corn from the cheapest source.” After the drought, the price for corn dropped by over 50 percent, going down from its height of $6.89 per bushel in 2012 during the drought to the present level of $3.30 a bushel. The U.S. is still trying to regain market share in Korea with the export of 4 million metric tons of corn in 2017 (33 percent decline in quantity from 2011 levels), but only received $705.3 million for this same product (representing a greater decline of 61 percent in value).

To put this another way, if prices for corn, wheat, and soybeans in 2017 remained the same as they were in 2011, the value of U.S. bulk agricultural exports to the ROK would have increased 28 percent or by nearly $400 million. As a result, the total value of U.S. agricultural exports to South Korea would have surpassed the previous record set in 2011 to reach $7.93 billion if agriculture commodity prices had remained stable during the past six years.

In sum, the latest release of agricultural trade statistics continues to demonstrate the value and benefits of the KORUS FTA. Even with a drop in world farm commodity prices, the U.S. is able to capitalize on lower tariffs to offer high quality and lower cost American farm products to Korean consumers. The U.S. should not undermine its current massive bilateral trade surplus in agriculture with Korea and further depress American farm income by terminating KORUS. That will only result in Korean tariffs on U.S. agricultural products snapping back to an average of 55 percent and U.S. farmers losing opportunities to sell their goods to a growing customer base in Korea.

Phil Eskeland is Executive Director for Operations and Policy at the Korea Economic Institute of America. The views expressed here are his own.

Photo from hopeless128’s photostream on flickr Creative Commons.