The Peninsula

UN Sanctions Continue to Devastate North Korean Trade

By William Brown

Some in Washington and elsewhere continue to think sanctions pressures are easing on North Korea, and that Marshal Kim heads into his second summit with President Trump in a strong position. We face a lot of uncertainties when it comes to North Korea, but Kim is probably not going to Vietnam with the upper hand given what we do know about the situation in the country.

After a six-month hiatus of Chinese customs authorities not reporting country-by-commodity trade statistics (at least in a way that can be read by computers), extensive trade reports through December 2018 were released to the public a few weeks ago. [1]

The data is not surprising. It showed tough adherence to sanctions that the PRC itself agreed upon in 2017. Nonetheless, the details are stunning. In 2018, China’s imports from North Korea amounted to only $195 million, down 88 percent from 2017. During the same period, its exports to North Korea fell 34 percent to $2.01 billion. As a result, North Korea’s deficit soared to a record $1.8 billion. [2]

More interesting though is the composition of China’s exports. Products that tend to be sold in North Korean markets–sugar, tobacco, grain, soybean oil, and other foodstuffs–continue to trade pretty much as normal and in some cases, tobacco and beverages, for example, have jumped in value.

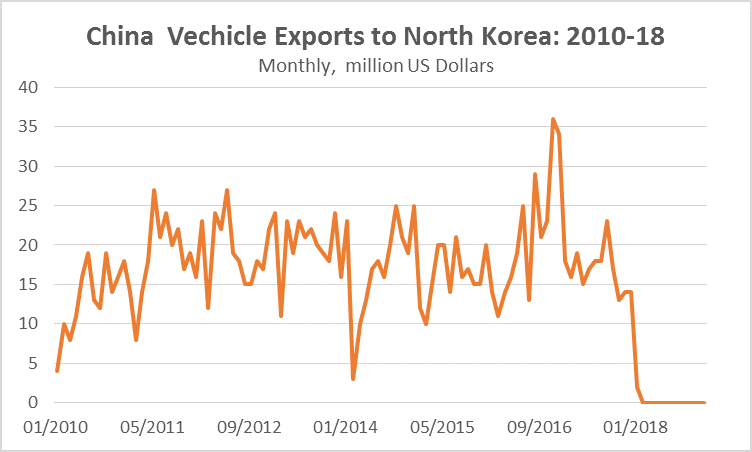

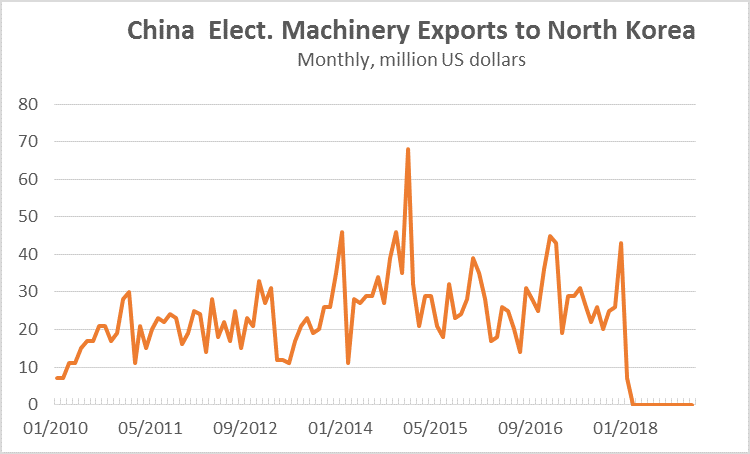

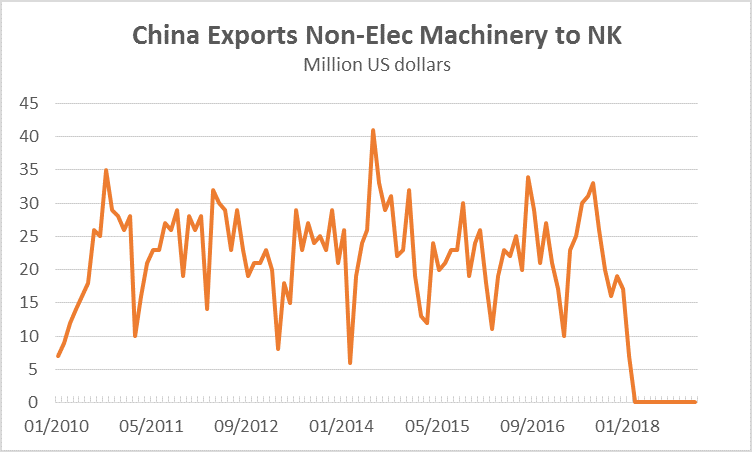

But the story is much different for manufactured and industrial goods, many of which are sanctioned. Huge drops have occurred in North Korean imports of all kinds of vital machinery, vehicle, and industrial materials products. These are products that the country needs to prevent further deterioration of its industrial sector, let alone allow the economy to grow in the manner promised by Kim.

This appears to suggest that to-date the industrial state is being squeezed much more than the people’s livelihood. But a decline in industrial output will no doubt eventually impact people’s incomes and the government’s ability to supply critical goods and services. It is no wonder Pyongyang has been demanding sanctions relief every chance it can get, and will no doubt raise it in the strongest terms during the Kim-Trump summit.

Several line-items in the China exports (North Korea imports) data illustrate this difficulty and suggest that the issue is widespread, affecting virtually all industrial items. A rare exception to the import decline is in plastic goods—since North Korea has no petroleum, it has no alternative but to import the considerable amount of plastics that it consumes. In 2018, this included about $30 million each in plastic flooring, plastic sheeting for agriculture, and plastic containers. Imports of these items have remained fairly steady over the years. Some textile items and shoes have also held up, as well as many food products and milled grain. The latter might be foreign aid products purchased in China and exported across the border.

By contrast, North Korea’s purchase of electrical machinery, non-electrical machinery, and vehicles have taken the brunt of the UN sanctions. In some cases, these products appeared to have been stockpiled prior to the tough sanctions implementation. But these stockpiles are likely depleted, or close to depleted, by now.

Amazingly, in 2018, Chinese customs authorities report that only 20 trucks and 46 cars were shipped to North Korea, down from a customary 6,000 and 2,500. A spike in 2016 may suggest an inventory buildup, but, again, that is likely well depleted by now.

North Korea’s electrical machinery imports fell to mere $7.7 million in 2018, from $338 million the year before. This category covers everything from cell phones and computers to electric motors and all kinds of electrical machinery. The collapse of these imports must be devastating. North Korean industry can replace some of these items but at a severe cost in efficiency and quality.

More broadly, the North Korean industry is likely experiencing the severe consequences of the collapse in the regular import of non-electric machinery. These fell from $268 million in 2017 to $7 million in 2018. The table below demonstrates what this meant for industrial operations:

| 2017 | 2018 | |

| Gearboxes | 14,762 | 358 |

| Transmission shafts | 6,121 | 21 |

| Ball bearing sets | 10,000 | 0 |

| Refrigerator/freezers | 69,216 | 117 |

| ADP equipment (in $ value) | $38 million | $472,000 |

One interesting shipment that did occur was delivery of a moderately sized turbine generator set, possibly a Chinese contribution to one of the country’s delipidated power stations.

China, of course, is not North Korea’s only trade partner. However, even with the near collapse in China-North Korea trade in 2018, trade between North Korea and all others pale in comparison. India, Russia, and the EU’s trade with Pyongyang are respectively less than 1 percent of China’s engagement. And the entire UN family of countries appears to be adhering well to the North Korea sanctions, at least according to each country’s official data. Plenty of smuggling takes place, much of it via China, but this is unlikely to offset but a small portion of North Korea’s normal trade and no doubt is much costlier.

In these circumstances, it is no wonder that Kim has focused attention on creating a self-reliant industry. Meanwhile, the Korean media make it clear they want and need sanctions relief as quickly as possible.

Endnotes

[1] Global Trade Atlas, Feb 5,2019

[2] North Korea’s financing of this deficit is addressed in other recent articles on this blog and in NAEIA.com. Chinese data excludes China’s crude oil exports of about 600,000 tons per year, worth about $200 million last year. For unexplained reasons, Beijing has excluded these from its export data since 2014.

Bill Brown is a non-resident scholar at KEIA and teaches at Georgetown University and UMUC. This and other related postings can be found on his website, NAEIA.com

Photo from NVictor’s photostream on flickr Creative Commons.