The Peninsula

Korea’s Monetary Policy During the COVID-19 Pandemic

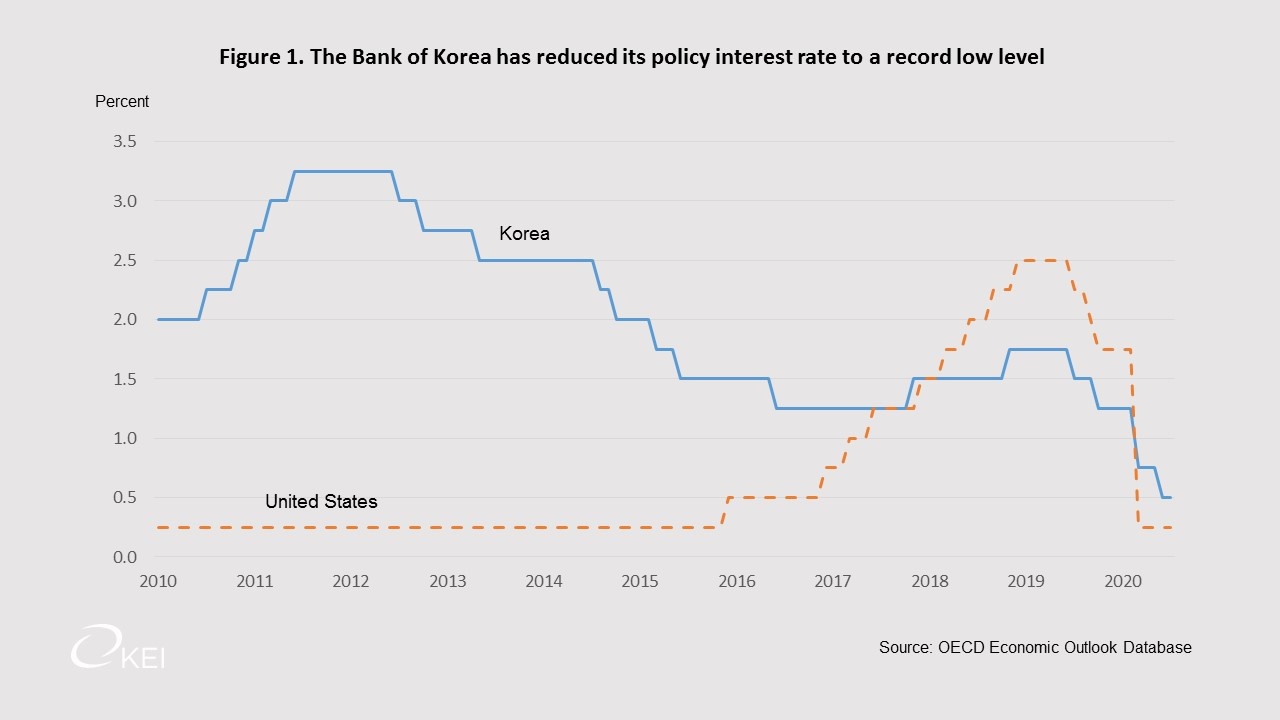

With inflation undershooting its 2% medium-term target, the Bank of Korea (BoK) cut its policy rate by 50 basis points twice in 2019 (Figure 1). Faced with further disinflationary pressures during the COVID-19 pandemic, the central bank cut the rate by another 50 basis points in March 2020 and 25 basis points in May, to a record low 0.5%. This was accompanied by a range of measures, such as purchasing government bonds to ease stress in the bond market. In April 2020, the BoK launched a new lending scheme, the Corporate Bond-Backed Lending Facility (CBBLF) to provide a safety net for businesses, banks and non-bank financial institutions that facing a deterioration in credit flow due to the pandemic. In addition, the central bank increased the ceiling of the Bank Intermediated Lending Support Facility from 25 trillion won to 35 trillion won and lowered the interest rate to support small and medium-sized enterprises and small merchants.

Inflation and economic developments

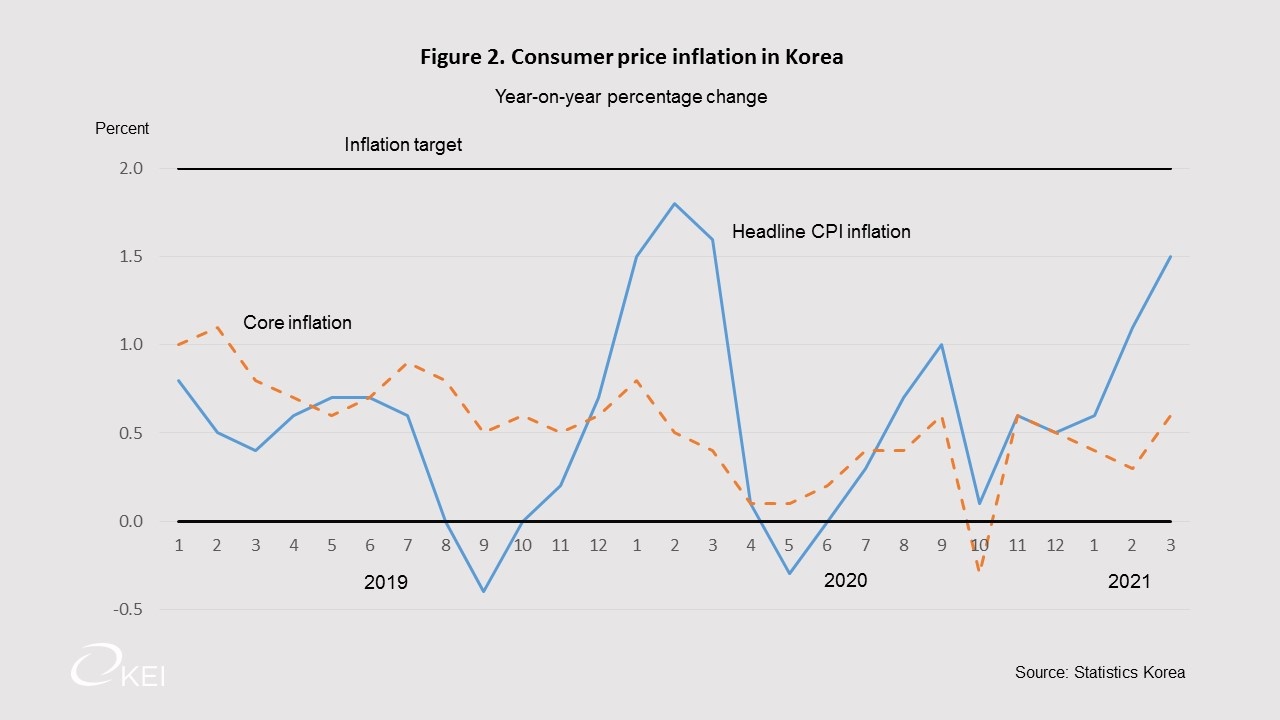

Consumer price inflation in 2020 was 0.5%. It remained around that level in January 2021 before rising to 1.1% in February, and further to 1.5% in March, its highest level since March 2020 (Figure 2). Higher inflation was accompanied by a number of positive economic developments:

- Industrial production surged 4.3% (month-on-month, seasonally adjusted) in February, led by computers and parts (21.7%) and semiconductors (7.2%).

- The manufacturing PMI rose again in February, reaching its highest level in more than a decade.

- Merchandise exports jumped 9.5% (year-on-year) in February, on top of an 11.4% rise in January. The increase was driven primarily by semiconductors, reflecting worldwide shortages in this sector. Moreover, merchandise imports surged 13.9%, the largest increase since 2018.

- The BoK’s consumer sentiment index rose for the third consecutive month in March, reaching its pre-pandemic level. Improved sentiment is likely to sustain stronger consumer spending. The survey also reported that inflation expectations for one-year ahead, which had hovered around 1.8% in the latter half of 2020, increased to 2.1%, the highest since 2018.

On March 25, the National Assembly passed the fifth supplementary budget since the start of the pandemic. It calls for 14.9 trillion won (0.7% of GDP) of additional expenditure: i) 8.4 trillion won to support small businesses and vulnerable persons; ii) 2.5 trillion won to subsidize employment; and iii) 4.2 trillion won for medical expenses, such as vaccine purchases.

Concerns about rising inflation

A strong rebound in China and higher U.S. bond yields have led to concerns about rising inflationary pressures in the world economy and in Korea. Strong industrial production has led to signs of supply constraints, including for semiconductors, leading to bottlenecks in certain sectors. There is also uncertainty about the impact of pent-up consumer demand on the service sector. A number of forecasters expect at least a temporary rise in inflation in the global economy from its relatively low level. In a statement on March 24, Bank of Korea Governor Lee Ju-yeol said, “As oil prices pick up quickly and food prices soar, there are growing worries about inflation.” Such concerns have led to discussions about the timing of monetary policy normalization from its current accommodative stance in Korea.

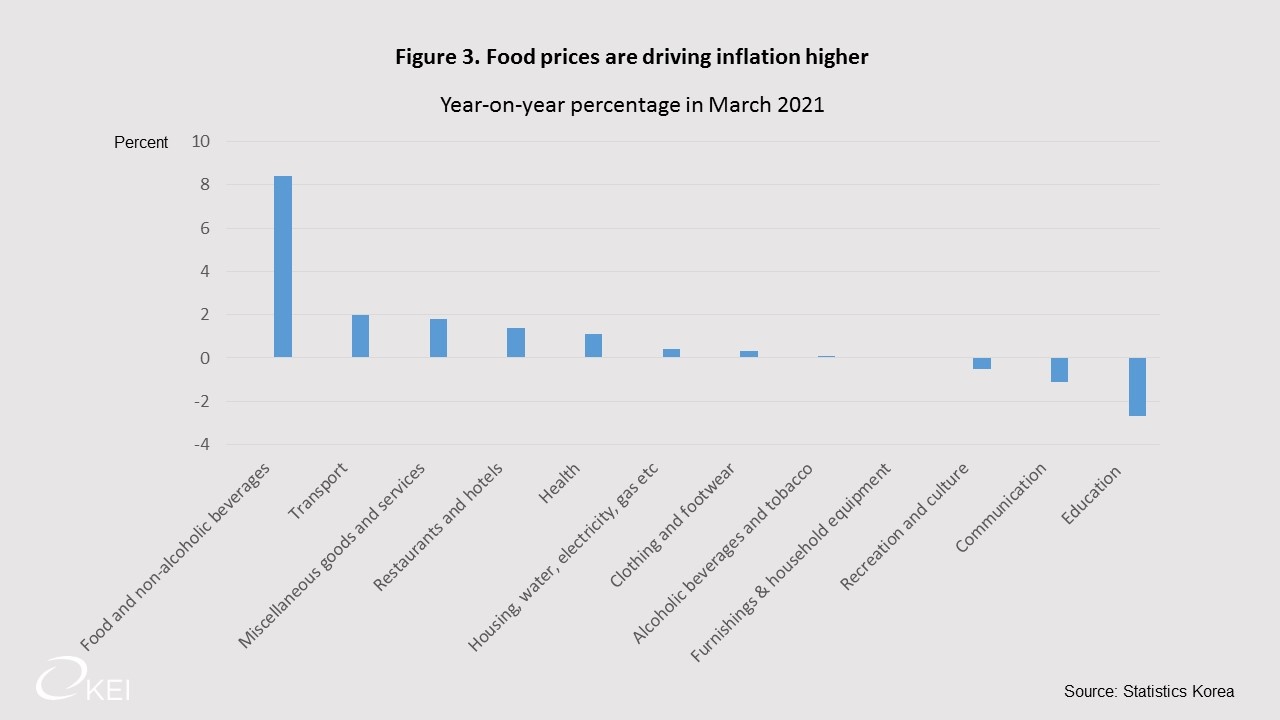

However, a closer look at Korea’s inflation numbers suggests less cause for concern. The pick-up in inflation in March was driven by a 8.4% (year-on-year) rise in food prices (Figure 3). In four of the other 11 categories, prices were unchanged or lower in March. Only four categories (transportation, health, hotels and restaurants and miscellaneous goods and services) reported price increases above 1%. Consequently, core inflation, which excludes food and energy, remains stable at around ½ percent (Figure 2). Governor Lee stated that he expects consumer prices to rise faster than the central bank’s earlier forecast of 1.3% but to stay below the 2% inflation target. To ease financial burdens on businesses that have suffered from hikes in raw material prices the government may release its stockpile of raw materials, expand financial and tax support, and ease import procedures.

It is too early for a shift away from an accommodative monetary policy. The BoK conducts “monetary policy with the aim of keeping CPI inflation at 2% over the medium term, while considering symmetrically the risks of inflation remaining persistently above or below the target”. The persistent undershooting of inflation in 2019-20 suggests allowing inflation to move closer to the target before tightening the monetary policy stance, particularly given the uncertainty about progress in overcoming the pandemic. Moreover, maintaining the current stance would promote a stronger recovery in employment, which in February was nearly 0.5 million below its year-earlier level. Consequently, the employment rate has fallen by 1.5 percentage point to 64.8%.

Concerns about financial stability

The Bank of Korea Act requires the Bank to ensure price stability “while giving due consideration to financial stability in carrying out its monetary policy.” The main two concerns in this regard continue to be the growth of household debt and housing prices. Household debt in Korea was among the highest in the OECD area at more than 190% of net disposable income in 2019, and has continued rising during the pandemic. Much of the debt is related to real estate. The central bank and the government should address financial stability risks through carefully targeted macro-prudential policies while maintaining its accommodative monetary policy stance to support the economy.

Randall Jones is a Non-Resident Fellow at the Korea Economic Institute of America. The views expressed here are the author’s alone.

Image from 한국은행’s photostream on flickr Creative Commons.