The Peninsula

Policies to Stabilize Housing Prices in Korea

By Randall S. Jones

The steep upward trend in housing prices has become a key social and economic issue in Korea. The failure of government policies to stabilize housing prices is blamed for a sharp fall in President Moon’s approval rating from 71% in early May, when he received credit for effective policies to stop the coronavirus pandemic, to 39% in Gallup Korea’s recent weekly poll.

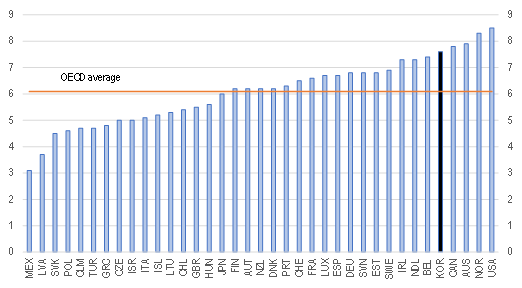

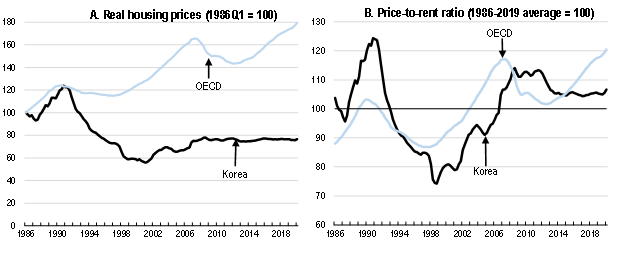

The concern about housing may seem surprising given that Korea ranks among the top countries in the housing indicator in the OECD’s Better Life Index (Figure 1). Korea’s ranking is primarily due to the fact that housing costs accounted for only 15% of households’ gross adjusted disposable income, the lowest in the OECD area. In addition, nationwide housing prices, adjusted for inflation, have been remarkably stable since 2007, in contrast to the rising trend in the OECD area (Figure 2, Panel A), reflecting policies in the late 1980s and early 1990s to expand the supply of housing. Moreover, the price-to-rent ratio is close to its historically average (Panel B).

Figure 1. Korea ranks high in the housing indicator in the OECD’s Better Life Index

Note: the housing indicator has three components: i) housing costs as a percentage of households’ gross adjusted disposable income; ii) percentage of people with indoor flushable toilets in their home; and iii) average number of rooms shared per person in a dwelling.

Source: OECD (2017), OECD Better Life Index, www.oecdbetterlifeindex.org.

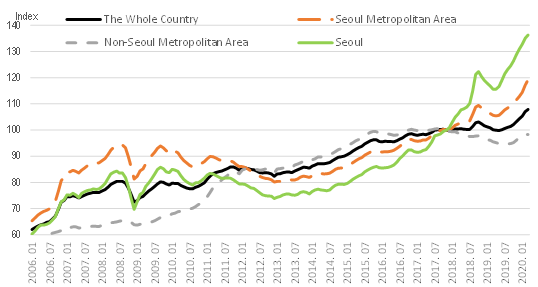

Rising housing prices in Seoul

The key problem is rapid price increases in the nation’s capital, which make home ownership impossible for many. Only two-fifths of people living in Seoul own their homes. According to the Korea Appraisal Board, a government company that reports transactions-based sale prices, housing prices in Seoul jumped by 40% (in nominal terms) between May 2017 (when President Moon was inaugurated) and March 2020 (Figure 3). The increase was fueled in large part by demand for scarce high-quality apartments in popular districts such as Gangnam. Moreover, prices in the Seoul Metropolitan Area, which accounts for about half of the country’s population and 12% of its area, rose by 23%. The Seoul Metropolitan Area includes Incheon and Gyeonggi province in addition to Seoul. In contrast, prices in metropolitan areas excluding Seoul fell by 2% over that period. The Citizens’ Coalition for Economic Justice, a non-governmental organization, reported that apartment prices in Seoul, which typically increase faster than single-family homes, jumped 52% in the three years since President Moon took office, citing data from the Kookmin Bank. Mortgage lending increased at 9.9% and 7.2% (seasonally-adjusted annual rate) in the first two quarters of 2020, respectively, boosting the already high level of household debt.

Figure 2. Korea’s housing prices have been remarkably stable since 2007

Note: Real housing prices in Panel A are deflated using the private consumption deflator.

Source: OECD, House Price database.

Housing price increases is thus primarily an issue in the Seoul Metropolitan Area, which has continued to grow to despite government policies to promote development in other parts of the country. For example, the government established Sejong City as the administrative capital in 2007 and has created ten “innovation cities” throughout the country. In addition, environmental rules and measures that restrict construction limit the growth of population and economic activity in the capital region. Nevertheless, economies of agglomeration attract firms to the capital region, which offers a wide range of specialized business services, highly educated workers and high-quality infrastructure. At the same time, though, the concentration of population has worsened air quality and raised the cost of congestion.

Recent policies to cool the housing market

The Moon administration has introduced 24 sets of measures, focusing primarily on regulations and tax increases, to stabilize real estate prices.

Price caps on new apartments

In 2019, the government announced that it would impose price caps on privately-built apartments, stating that it would drive down the presale price of new homes to “70% to 80% of the current level.” After a delay due to the coronavirus pandemic, the price cap was introduced in July in 18 districts in Seoul and three cities in Gyeonggi Province. Price caps, which were originally introduced in 2007 and largely removed in practice in 2015, were based on the value of the housing price site and public disclosure of the developers’ construction costs.

While the cap on the price of new apartments may slow the upward trend in housing prices in the short run, it is likely to be counterproductive in the longer run. Setting the cap at a low level in line with the objective of reducing the price of new homes by 20% to 30% would reduce incentives for residential construction. The impact may be most severe in the high-end market, which has higher profit margins and faster-growing demand. Moreover, requiring private firms to publicly disclose construction costs as part of the price-setting process removes incentives to increase profits by reducing costs. Instead, ensuring adequate competition between developers would be the best way to prevent excessive increases in prices of new apartments. If developers still enjoy windfall gains, taxing such gains in a transparent manner would be more efficient than price controls.

Figure 3. Housing prices in Seoul rise rapidly while nationwide prices have edged down since 2017

November 2017 = 100

Note: Data provided by a government company that reports transactions-based sale prices. The prices are not adjusted for inflation.

Source: Korea Appraisal Board.

Automatic rollover of jeonse contracts and a price cap

Under Korea’s jeonse system, a tenant pays a lump-sum leasehold deposit, which is typically around 60% to 70% of the property value, to the landlord in return for the right to live there for two years. The tenant does not pay any monthly rent during that time and the deposit is returned in full at the end of the contract. Many tenants find jeonse contracts to be less burdensome than paying monthly rent, given that the deposit is returned at the end of the contract. During the first half of 2020, there were 670,000 jeonse contracts signed nationwide compared to 460,000 monthly rent contracts. The jeonse system is particularly popular in Seoul: in June, monthly rent accounted for only 29% of tenant contracts. From the landlords’ perspective, the deposit from a jeonse contract helps them to purchase additional residential properties. The fact that around four-fifths of tenants rent from individuals rather than corporations or the government may reflect the widespread use of the jeonse system.

In July 2020, the National Assembly passed several laws to revise the jeonse system; i) tenants have the right in most cases to extend their two-year jeonse contract for another two years; and ii) the increase in jeonse deposits are capped at 5% when the contract is renewed. The changes are intended to help jeonse tenants by reducing the number that are forced to move every two years. However, it could undermine the jeonse system by prompting landlords to sell the lodgings rather than accept the price cap, thus reducing housing options for young people and those with low income. Landlords might instead shift to monthly rent systems, which would increase the tenants’ housing expenses. Already in July, the number of jeonse contracts in Seoul fell to its lowest level since the city government started tracking the number, reflecting the new policy as well as low interest rates. On the positive side, a shift to monthly rent would free up cash placed in housing, allowing it to be used more productively elsewhere.

Raising taxes on property holding and capital gains

Annual local property taxes are set between 0.15% and 0.5%, depending on the location and type of building. In addition, Korea introduced a national tax, the Comprehensive Property Tax (CPT), in 2005. The tax is applied to households and companies owning housing with a combined assessed value of more than 600 million won ($506,000). In 2018, the tax rate for owners of three or more homes ranged from 0.6% to 3.2%, as part of an effort to curb “speculative demand”. To achieve that goal, the government announced in July 2020 that it would raise the property tax on owners of three or more homes to a range of 1.2% to 6%. The top rate would apply to only 0.4% of the population. However, the higher rate may discourage landlords from investing in real estate, thus restricting supply. Moreover, they may be able to pass the tax burden on to tenants. To limit speculation, the high rates should be applied only to landlords who own properties for short time periods. The government also promised to sharply raise capital gains taxes, which are steeply progressive, ranging from 6% to 42%. The current deductions based on length of ownership – ranging from 10% for a period of three to four years to 30% for more than ten years – would already appear to discourage speculation.

Regulations on mortgage lending

Regulations on household mortgage lending have been tightened. The loan-to-value (LTV) ratio, which restricts the size of a housing loan to a certain percentage of the value of the property securing the loan, was cut from 70% in 2017 to between 0% and 40% in “overheated areas”, depending on the location and the value of the home. For example, the maximum LTV allowed on a dwelling worth more than 900 million won ($760,000) was cut to 20%. Mortgages were banned on properties worth more than 1.5 billion won, which is around the price of an average apartment in the Gangnam area of Seoul. In addition, the debt-to-income (DTI) ratio, which shows borrowers’ monthly debt burden relative to gross monthly pay, was lowered from 60% to a range of 0% to 40%. While reducing the availability of mortgages may hinder speculators, it is also hurting young people and those who cannot afford to pay large down payments, forcing them to continue renting.

The key is to increase the supply of housing

Changes in property taxes and regulations alone cannot stabilize soaring apartment prices. It is necessary to shift the focus of housing policy from reducing demand and discouraging speculation to increasing the housing supply. This would address the fundamental problem: the supply of high-quality housing in areas where people want to live has not kept up with demand. Policies to address the supply-demand imbalance is not an overnight solution, but will take some time. In the short run, there will continue to be strong demand for housing in the context of the exceptionally accommodative monetary conditions introduced to offset the impact of the coronavirus pandemic.

The government moved in this direction in August when it announced that land planning regulations in Seoul would be relaxed and that the government would begin developing publicly-owned land. The two measures are expected to increase the number of apartments in the greater Seoul area by 132,000 by 2028. In Seoul, the maximum floor ratio area for redevelopment of existing apartments is 250% of the area of land on which it is built, while the maximum height for apartment towers is 35 stories. These limits have been expanded to allow a maximum floor ratio area of 500% and buildings as tall as 50 floors.

However, high-density reconstruction projects have to fulfil a public service role. Moreover, it requires the participation of state-owned housing developers (Korea Land & Housing and Seoul Housing & Communities), which will play a role in key issues, including the selection of construction companies. Between 50% and 70% of the additional apartments that will be built thanks to the easing of the floor area ratio restriction and the additional floors must be donated to the government, which will lease them to low-income households, newlyweds and young people. Nam-ki Hong, the Minister of Economy and Finance, said that the government will collect 90% of the profits generated from the reconstruction of apartment complexes. This raises the question of whether cooperatives of primarily elderly apartment owners will agree to government terms for reconstruction.

Finally, the introduction of 24 real estate policy initiatives in a little more than three years has created excessive uncertainty for long-term investors. Housing price trends are affected by structural factors, including regulatory and tax changes, as well as by business cycles and interest rates. Many studies thus show that volatility in housing prices is exacerbated by frequent policy changes. As Minister Hong stated, “In the market, there is still uncertainty on the real estate measures.”

Randall Jones is a Visiting Fellow at Columbia University and a Non-Resident Fellow at the Korea Economic Institute of America. The views expressed here are the author’s alone.

Image from Stanley Young’s photosream on flickr Creative Commons.