The Peninsula

Overall U.S. Trade Deficit with Korea Drops below Pre-KORUS Levels

By Phil Eskeland

The U.S. Department of Commerce released its monthly trade data for January, which encompassed 4th Quarter 2018 statistics on trade in services with 15 individual countries, including South Korea. Once again, the U.S. maintained its bilateral trade surplus in services with Korea because of yet another record-level of U.S. service exports to South Korea, totaling $24.5 billion for all of 2018.

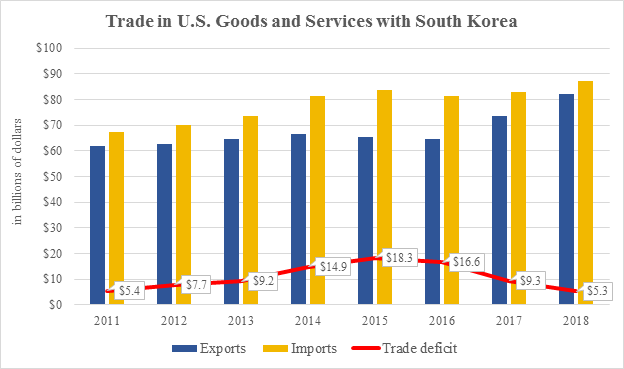

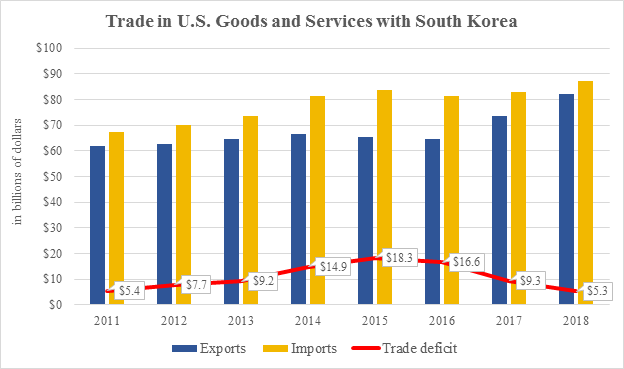

In addition, the U.S. Census report revealed that the combined goods and services bilateral trade deficit between the U.S. and South Korea has dropped below 2011 levels, the year prior to the implementation of the Korea-U.S. Free Trade Agreement (KORUS FTA). As noted in an earlier blog, record levels of U.S. merchandise exports to Korea, particularly the dramatic rise in the sale of oil and gas products to Korea, significantly contributed to the decline in the bilateral trade deficit. But Korea’s continued purchase of U.S. service products, including a steady level of high numbers of travelers from Korea to the United States, contributed to the lower bilateral trade imbalance as well. Now, there are eight more countries with a higher bilateral goods and services trade deficit with the United States than Korea, including France, Italy, and Taiwan.

As more information about trade flows in 2018 comes in throughout the year, particularly on data related to travel and tourism, the numbers may alter. However, this achievement in lowering the bilateral trade deficit between the U.S. and Korea was accomplished before any changes to the revised KORUS agreement went into effect last January. The U.S.-Korea bilateral trade deficit has declined by 71 percent from its height in 2015. This reveals that the free market and consumer choice were more important factors in the mitigating this issue than any changes to KORUS. The marketplace effectively took these actions well before President Donald Trump won his party’s nomination for office.

If present trends continue, the U.S.-Korea bilateral trade deficit for 2019 could drop even further to below $3 billion. Already, U.S. merchandise exports to Korea in January increased 5 percent over January 2018 levels. However, past behavior is not an indicator of future performance. There could be other macroeconomic factors, unrelated to any trade agreement, which could reverse these trends, such as a fluctuation in the U.S. dollar-to-Korean won exchange rate. That is why a fixation on the trade balance is an imperfect indicator of the health of any U.S. economic relationship.

Nonetheless, as Korea presently represents less than 1 percent of the overall U.S. trade deficit with the world, now is not the time to further threaten America’s stalwart ally with higher tariffs on imported motor vehicles and parts. By all metrics – rise in jobs, U.S. export growth, fostering inward investment, and reducing the trade imbalance – the KORUS FTA is working as intended. Thus, in light of all that Korea has done to mitigate the irritant in the trade imbalance with the U.S. to placate the Trump Administration, including agreeing to modifications to KORUS, Korea should be exempted from possible higher tariffs in imported autos and parts.

Phil Eskeland is Executive Director for Operations and Policy at the Korea Economic Institute of America. The views expressed here are his own.