The Peninsula

Is Renegotiation of the Korea-U.S. Free Trade Agreement on the Horizon?

By Phil Eskeland

Last week, the Office of the U.S. Trade Representative (USTR) released the President’s National Trade Policy Agenda for 2017. It should not be unexpected that the Trump Administration seeks a new approach on U.S. trade policy because it was a top tier issue on the presidential campaign trail, particularly for businessman Donald Trump. This reflects his long-held beliefs on this subject and the policy positions of his key trade aides.

However, while there are a few disparaging comments in the USTR document about the Korea-U.S. Free Trade Agreement that cherry-picks certain statistics to portray the deal in the most negative light, there is no mandate for a renegotiation or even a review of the agreement. All that is required in this new agenda is a request for “a major review of how we [the U.S. government] approach trade agreements.” This is more of a forward-looking document as to how “future trade agreements can work for all Americans more effectively than they have in the past.” This not to say that KORUS or any other FTA is exempt from a review or renegotiation in the future. The document reveals a future intention to submit a more detailed report on the President’s trade policy agenda once the U.S. Senate confirms a new USTR, so no one should rest at ease.

Nonetheless, the Trump’s Administration trade policy agenda document rests its entire criticism of the KORUS FTA on the decline of U.S. exports of goods to Korea from 2011 to 2016 and the increase of U.S. imports of goods from Korea over this same time period that resulted in more than doubling the trade deficit in goods. This approach does not include several nuances in U.S.-Korea trade relations.

First, the agreement is not fully implemented yet; it is at its half-way point. While it is debatable to think of trade as a competition with winners and losers, using the trade balance as the sole metric of success, all agree that no one decides who wins a game at half-time. If that was the case, then the Atlanta Falcons would have won the Super Bowl.

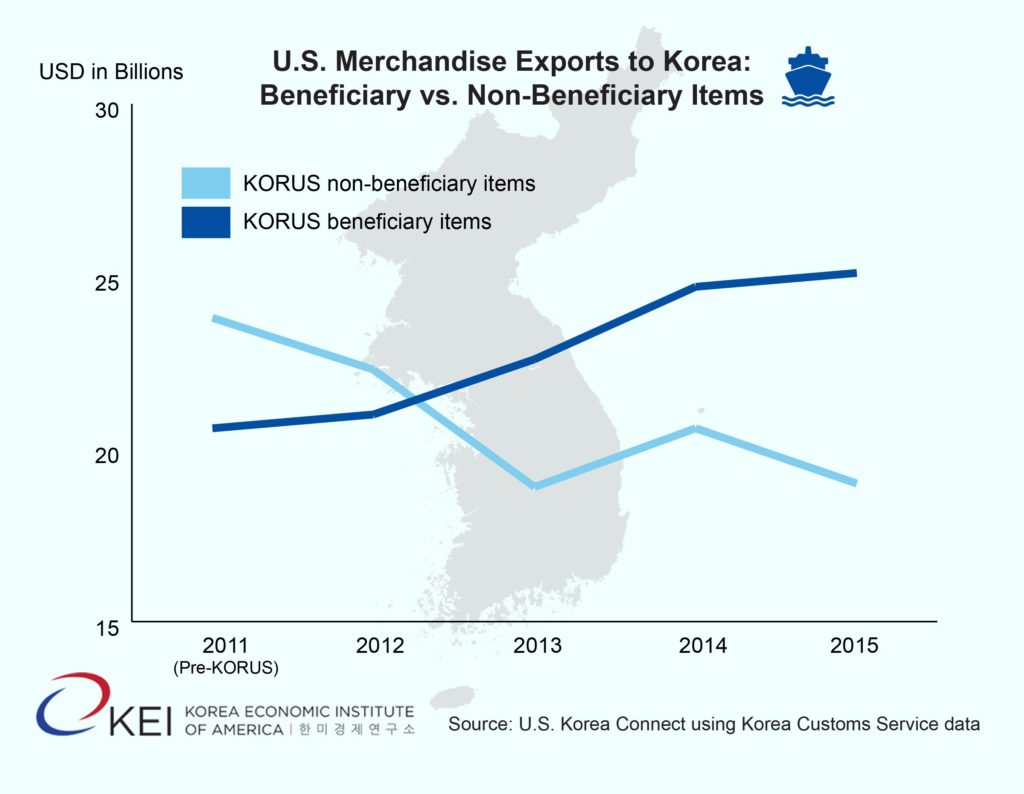

Second, by including the total value of all goods traded between the U.S. and Korea in the trade policy agenda document, there is a misleading supposition that every product grown or made in America is covered by the KORUS FTA. In reality, there are still some items that comprise a significant value of total U.S. exports to Korea which did not benefit from the agreement upon implementation. Some trade benefits for U.S. producers and providers are phased-in over time. There are some items not covered by the agreement at all and some goods that already traded duty free. Nonetheless, according to the Korea Customs Service, U.S. exports of FTA beneficiary goods increased by 18 percent between 2011 and 2015. In contrast, U.S. exports of items not covered by the KORUS FTA decreased by 20 percent over that same time period (see chart). Thus, any decline in total U.S. exports of goods to Korea cannot be attributed to KORUS. As the independent U.S. International Trade Commission concluded, the KORUS FTA is estimated to have improved the bilateral merchandise trade balance by nearly $16 billion in favor of the United States. In other words, if the KORUS agreement was not in place, the U.S. merchandise trade deficit would be $44 billion in 2015 instead of $28.3 billion.

When looking more closely at the U.S. trade deficit, the statistic overlooks the 2.3 percent decline in the annual bilateral merchandise trade imbalance between the U.S. and Korea in 2016 plus the decline of Korean imports into the United States. It also disregards the $4.27 billion in U.S. merchandise exports to Korea in December 2016 (second highest monthly level in the history of U.S.-Korea trade) despite the challenge of the stronger U.S. dollar. While it is premature to conclude that this trend will continue, Korea recognizes the need to purchase more American products, as evidenced by their desire to access more energy supplies from the United States.

Finally, the Trump Administration should also take into consideration the growing role of foreign direct investment from Korea. According to SelectUSA, Korea’s investment in the U.S. has nearly doubled since 2011 to reach $38.2 billion in 2015, employing 45,100 workers in almost every state of the union. These workers earn an average compensation package of salary and benefits of over $92,000. More Korean investment may be on the way with recent announcements by Hyundai, Samsung, and LG. Any re-examination of KORUS should also factor in the possible effect on investment flows from the Republic of Korea into the United States.

While it is the prerogative of every new administration to review past policies, the KORUS FTA has demonstrated its effectiveness in addressing the main concern expressed by the proposed trade policy agenda – mitigating the bilateral merchandise trade deficit between the U.S. and Korea.

Phil Eskeland is Executive Director for Operations and Policy at the Korea Economic Institute of America. The views expressed here are his own.

Photo from the Port of Tacoma’s photostream on flickr Creative Commons.