The Peninsula

Growing competition in the streaming market

As a result of more South Koreans choosing to stay at home since the start of the pandemic, Netflix saw its subscribers soar in the country. This rise in demand has prompted the streaming giant to invest USD 500 million in creating new Korean content and cement its position as a leader in the Korean streaming market.

From creating Korean original content to promoting Korean content experts to the company’s senior creative leadership team, Netflix’s efforts may be showing dividends as South Koreans’ spending on the service more than tripled from 2020. Despite Korea’s reputation as a highly selective market for multinational technology companies to enter, these actions have contributed to Netflix becoming the uncontested leader in the content streaming provider for now.

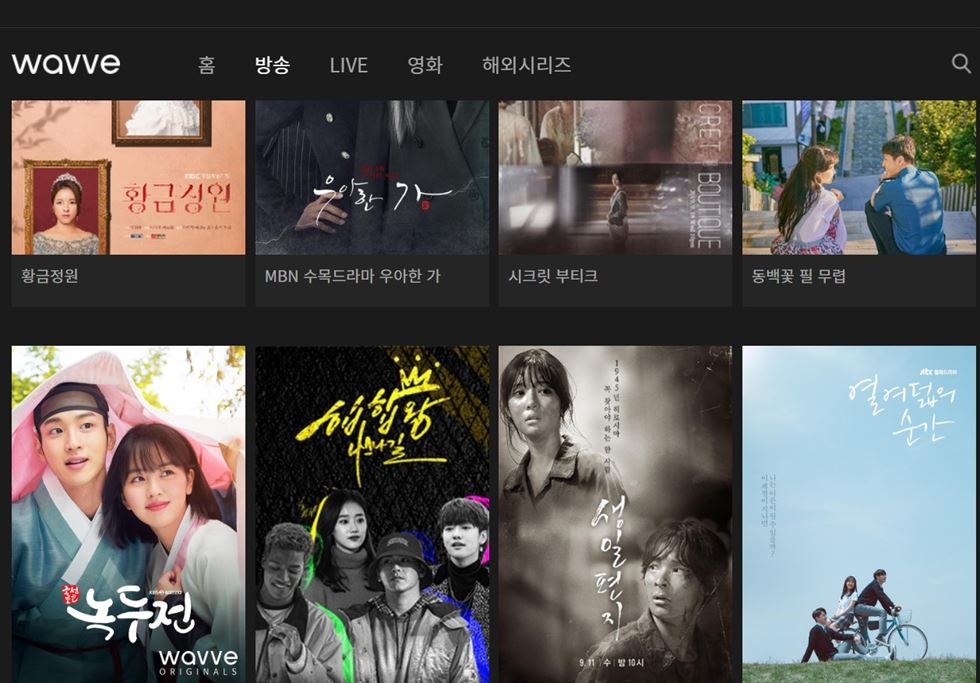

Although Netflix is currently the most popular provider in the Korean market, that status might change as soon as the company faces competition from both outside and within Korea. Globally, Disney+, Apple TV+, and Amazon Prime have announced plans to produce original Korean content in conjunction with their planned launch in Korea later this year. Domestically, SK Telecom’s Wavve, CJ ENM’s Tving, and KT Corp.’s Seezn are following the lead, although there is a significant margin of monthly active users (MAU). Waave, the second-most popular streaming platform in Korea, announced its plan to invest close to USD 900 million in content by 2025 following Netflix’s earlier announcement. Moreover, in an effort to bolster its content portfolio against global rivals, Waave has joined hands with the country’s three major broadcasting companies – SBS, KBS, and MBC – in a joint venture.

These investments and partnerships seem to be bolstering Korea’s domestic content providers. While Netflix still maintains a wide lead, its MAU has started to decline in the past few months while Wavve and Tving’s MAU have been on a steady incline. As local broadcasting companies partner with domestic streaming services and local services funnel investment into content creation and acquisition, Netflix’s standing as #1 may soon be threatened.

This briefing comes from Korea View, a weekly newsletter published by the Korea Economic Institute. Korea View aims to cover developments that reveal trends on the Korean Peninsula but receive little attention in the United States. If you would like to sign up, please find the online form here.

Korea View was edited by Yong Kwon with the help of Sean Blanco, Marina Dickson, and Jina Park.