The Peninsula

Confusing Electric Power Currents in North Korea Suggest Radical Reforms May Be Ahead

By William B. Brown

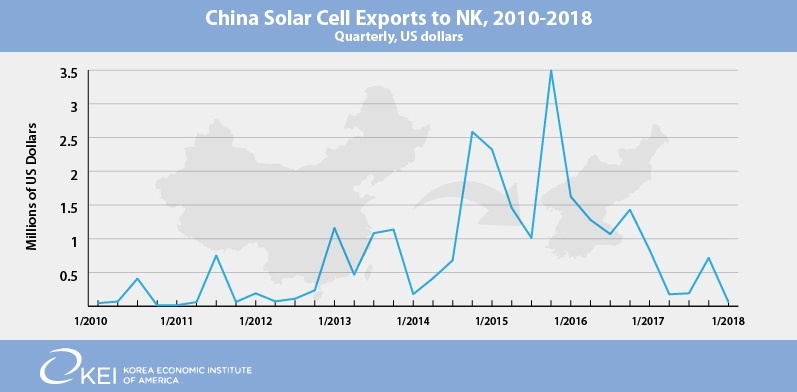

Consider this. In a well developing suburb of Pyongyang, households are no longer able to tap into the electric power grid for their meager, centrally planned, and virtually free allotments of electricity, in theory enough for lights or TV two or three hours a day. Instead, most have purchased small solar power panels, imported from China, to charge their cell phones and produce a little heat for cooking and other household uses.

Such imports soared in 2016 but have fallen victim to Chinese sanctions in the past year. No battery or storage capability is apparent. In an emergency, say they have a wedding and guests, they can pass 50,000 won to the local power ministry officer and he will flip the switch for a few hours of un-metered power. Then it flips off. The 50,000 won is about a year’s official pay for the officer, or any North Korean bureaucrat or state worker, who also are entitled to receive free, but not available electricity, along with other essential rationed goods and services, most importantly food and housing. (Think of the pay as pocket money for a teenager who expects to be provided everything from his/her parents.) In contrast, for anyone working in the expanding market economy, where money is important and is earned from work done, it might be a few week’s income. For those lucky enough to earn U.S. dollars by selling or otherwise dealing with people abroad, or with the increasing numbers of North Koreans using foreign money, it is only about $6 at the unofficial but widely prevalent exchange rate. For more sustained needs of electricity, say pumping water to high rise apartments, or elevators, a private group might form to buy generators and pay top dollar for imported, and now sanctioned, petroleum fuels. This all according to on-the-spot reporting from a North Korean defectors group in Seoul, through their website, Daily NK, with further analysis by North Korea Econ Watch.

Let’s take another case, also from Daily NK. One of many new private bath houses in Pyongyang caters to the new class of people with money and who wish to escape poor conditions in public bath houses, but how can it obtain electricity for heating the water and creating the plush environment? The entrepreneurial owner makes a deal with a nearby widget factory that is on the state five-year plan for essentially free electricity distribution. The factory is likely under-achieving its production goals because of shortages of other inputs, so it has electricity to spare. But neither are the rice rations being delivered. It sells the power at a negotiated price to the bath house and buys rice in the market place for the workers. The official who brokers the deal gets a $50 a month bribe for his, perhaps dangerous, illegal work. The bath house charges a healthy 5,000 won per bath for its services—affordable to people in the private market, and everyone seems happy. The only losers are other state enterprises who don’t get the widgets they had been promised in the plan, but they probably would not have anyway. The bath house uses the properly priced negotiated power much more efficiently than the factory ever did, and GDP rises.

Other than Presidents Moon and Trump, irrational pricing must be among Marshal Kim’s biggest headaches these days as the market economy collides head first with the fixed prices of the planned economy, corrupting officials at every turn and giving people unprecedented freedom. As a Chinese Global Times reporter said in a piece over the weekend, her recent travels in North Korea show a bizarre system of (at least) two prices for everything, this after being charged W5,000 won for a drink with a W140 price sticker (presumably the price for state workers) on it. People are getting rich arbitraging the differences. But, less visible perhaps, many others, and likely the most loyal of the Workers Party cadre, are getting screwed.

The electric power industry is emblematic of these pricing contradictions and may give us some hints at where the overall economy is going—towards full market reform or sinking further into the socialist morass. State planned and owned with millions of direct consumers, the industry must now compete with street use of solar panels, generators, and old car batteries charging whatever the market will bear, and it must rely on essentially free coal provided by state mines that face the same set of market constraints—probably even more since a mine can secretively export coal at a high price. It is hardly a sustainable situation, breeding corruption and the slow disintegration of the otherwise orderly society. But North Korean policy remains very confusing. A new electric power “law” was promulgated by the power ministry this summer which might, one would think, give guidance on these pricing issues.[i] But there is no mention of pricing and no mention of finance. Only grand visions for better output and more efficient usage, which in the ministry’s view means as carefully scheduling factory usage so as to prevent black outs and to protect essential industry and public lighting in Pyongyang. Capacity expansion is to be in renewables, generally hydro and solar cells, but with no details. Interestingly, a lot of attention is paid to off grid or decentralized production and distribution, in other words private production and use. And in the 96-page document, no mention is made of nuclear power. Just a few years ago Kim was heralding the construction of a pilot scale light water nuclear power reactor at the Yongbyon nuclear research facility that was going to serve as the model for a big nuclear power drive. That pilot plant has been externally complete for several years—it is supposed to be fueled by the now famous uranium enrichment plant nearby—but nothing seems to be happening. And President Moon says Kim is willing to shut down the entire complex given the right signals from Trump.

Electricity is given top billing in all North Korean economic development pronouncements and rightfully so. It is the engine of the economy without which modernization will fail. It’s an old story; as far back as the Japanese colonial era the country built up extensive electric power capacity in hydropower, of which it has large latent resources, and in locally available anthracite fired plants. Japan built the largest hydropower plant in Asia at Supung, on the Yalu river in 1940 and, with 700 megawatts capacity, it is still the country’s second largest provider. Stalin stole the generators in 1945 then relented and returned them a few years later. Heavily bombed in the Korean War, East Europeans helped rebuild it. And when Korea was cut in two in 1948, Pyongyang cut the South off from 98 percent of its power sources, leaving Seoul dark. For years the Supung facility split its output between China and North Korea—three turbines producing at 50 cycles for China, three at 60 cycles for Korea, and a seventh turbine switching between the two. More recently, unconfirmed reports indicate that China is allowing all the power to go to North Korea and power availability thus appears to have improved in northern North Korea, although seasonal hydro trends may be responsible. The largest power plant in North Korea now is a 1,600 MW coal-fired behemoth built by the Soviets in the 1960s at Pukchang, said to be a near duplicate of Manhattan’s power facility of the early 1900s, inefficiently devouring huge quantities of coal mined nearby by political prison labor. Many smaller hydro and thermal plants, all built prior to the 1980s, fill in to give about 6,000 MW national capacity, essentially unchanged in thirty years.

As an outgrowth of the oil embargo on Japan during the WWII era as northern Korean was industrializing, North Korean industry ran on electricity, not oil. With no petroleum resources, and its own proclivity toward self-reliance, North Korea has remained largely an electric economy. Rural electrification came early as did electrified railroads. Even agricultural machinery, irrigation pumps and threshing machines, run on electricity as much as possible. Heavy industry, chemical and especially metals industry are large consumers. Problems began in the early 1980s, when, as South Korea’s nuclear power industry ramped up, Kim Iisung decided North Korea also needed nuclear power, coincidental with its drive for nuclear weapons. Rather than expand or even maintain thermal and hydro power, and improve transmission systems, Pyongyang has pumped tens of billions of dollars into nuclear power technology. Three decades later, the investments have yielded no electricity production, and, apparently, none is in the pipeline. Ever obsolete hydro and coal fired plants now strain to provide the country’s minimal needs.

Interestingly, some reports suggest that the UN coal embargo may be helping Pyongyang’s electricity supply, since coal not shipped to China is available for use in the city’s two power plants. This may be the case, but its hard to figure how the coal mines are being paid; likely they are not and are thus closing down production. China may be helping; as with Supung, there are rumors circulating that China supplied new equipment to one of the plants this summer, likely in violation of its own UN sanctions.

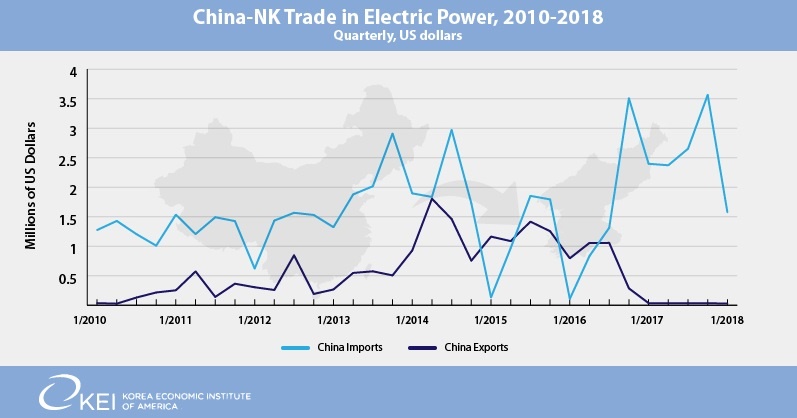

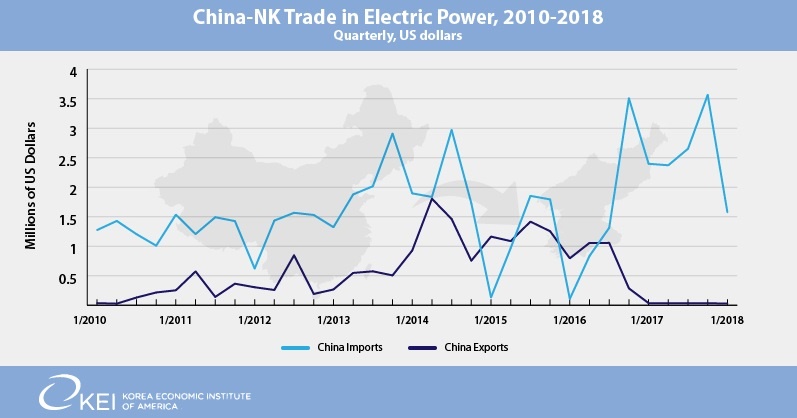

So, what can we expect? A rational move would be to sharply raise prices for everyone, forcing state enterprises to use power more efficiently and enabling the industry to build new capacity. North Korea has long charged Chinese buyers—a small amount of power is exported from Yalu river plants, and an even smaller amount is imported—about 4 cents a kilowatt hour, only a little lower than worldwide wholesale prices and a hundred times or more than it charges its own consumers. And it pays a high 11 cents per kilowatt hour for imports. Street prices for battery and solar power are likely far higher. A good indication of possible change is an order that residences purchase electric power meters so that electricity can be charged by volume used, like everywhere else in the world, but citizens are complaining about the cost and claim there will still be no supply. A Japanese journalist has reported that a survey is being undertaken in northern provinces that would raise the price to residences to 10,000 won a month, a price they say they would willingly pay (assuming they are in the private not state economy) if supply is reliable.[ii] Rumors and wild information fly in the current confused atmosphere, with everyone trying to figure out how they might profit or avoid losses. For example, on September 8, a big Chinese supplier of solar panels, Hunan Gongchuan Photovolcaic, reportedly signed a strategic cooperation agreement with a North Korean state company, Kuwo’lbong Group, to provide an astonishing $3 billion in solar cells to North Korea over the next five years, enough to provide 2,500 MW of power, representing a 50 percent increase in North Korea’s installed total power capacity. There was no word on financing or how the firm would deal with UN sanctions—the firm has a major U.S. partner. A pipe-dream, no doubt, similar to many such projects down the years. But Kim needs to do something soon or those 40-story high rises in Pyongyang won’t have pumped water for their bath rooms or electricity for their elevators. That might send the elite into the streets.

Are their opportunities here for U.S. or South Korean investors to aid North Korea, make money, and advance the denuclearization process? The Hunan Gongchuan project, as odd as it is, might serve as a template, assuming the Chinese investors are demanding to be repaid in real money. But the key is not big amounts of foreign investment in new plants, and certainly not capital-intensive nuclear power plants; that has occurred too many times in the past with terrible results for all. Instead, a project aimed simply at improving the efficiency of older facilities, combined with new pricing rules that allow a foreign venture to sell the power at say 8 cents a kilowatt hour, and use North Korean coal at $60 a ton, could make money for everyone, eliminating headaches all around.

The Global Times reporter last week was cautiously optimistic, despite the confusion, thinking this was like China in 1978, as Deng’s reforms were just starting. One concern was that no one she met would utter the key phrase “reform and opening”. But after so many false hopes, let’s hope she might be right.

William Brown is an Adjunct Professor at the Georgetown University School of Foreign Service and a Non-Resident Fellow at the Korea Economic Institute of America. He is retired from the federal government. The views expressed here are the author’s alone.

Photo from Wikipdedia.com.

[i] Minju Joson (Electronic Edition) in Korean 10 Jun 18 – 15 Jul 18

[ii] Osaka Asia Press International in English 21 Sep 18