The Peninsula

Can the U.S. Fill South Korea’s Oil Gap?

By Kyle Ferrier

Following President Trump’s decision to re-impose sanctions on Iran last May, the White House announced last week it will not be extending waivers on sanctions to countries importing Iranian oil. South Korea is one of only eight countries to be have been granted a waiver, which took effect as U.S. secondary sanctions went into force in early November and are now set to expire on May 2. Faced with this inevitability – though it may have come sooner than anticipated – Seoul’s efforts to diversify oil imports so far already suggest U.S. oil producers will play a key role in making up for the blockage of Iranian imports.

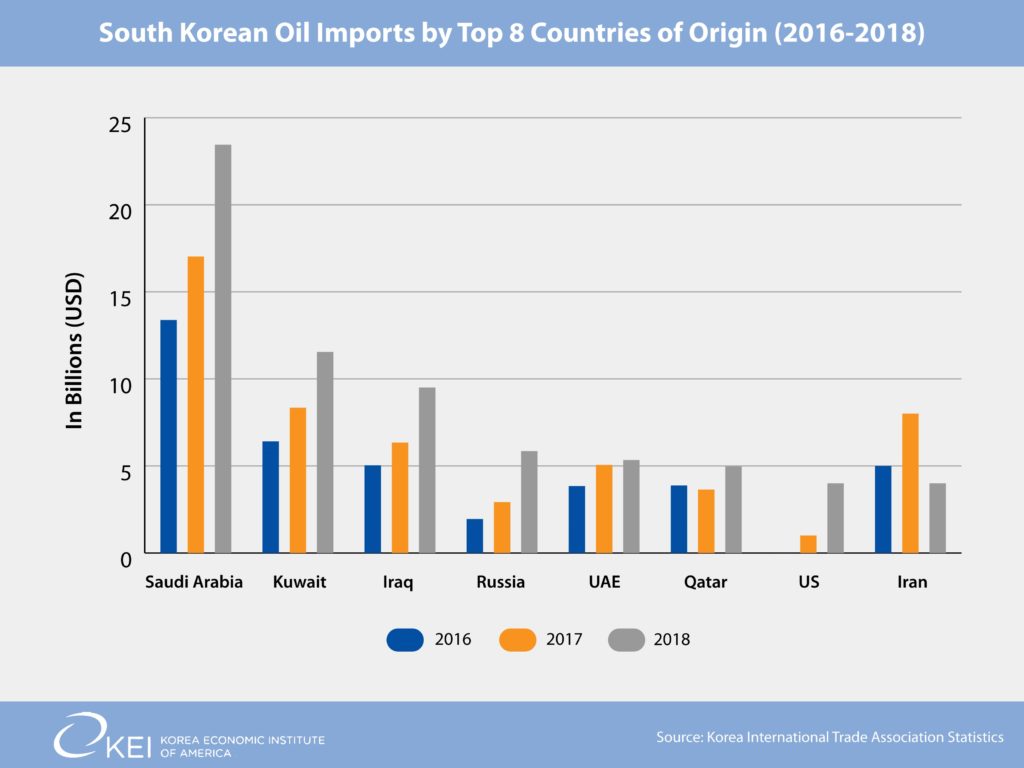

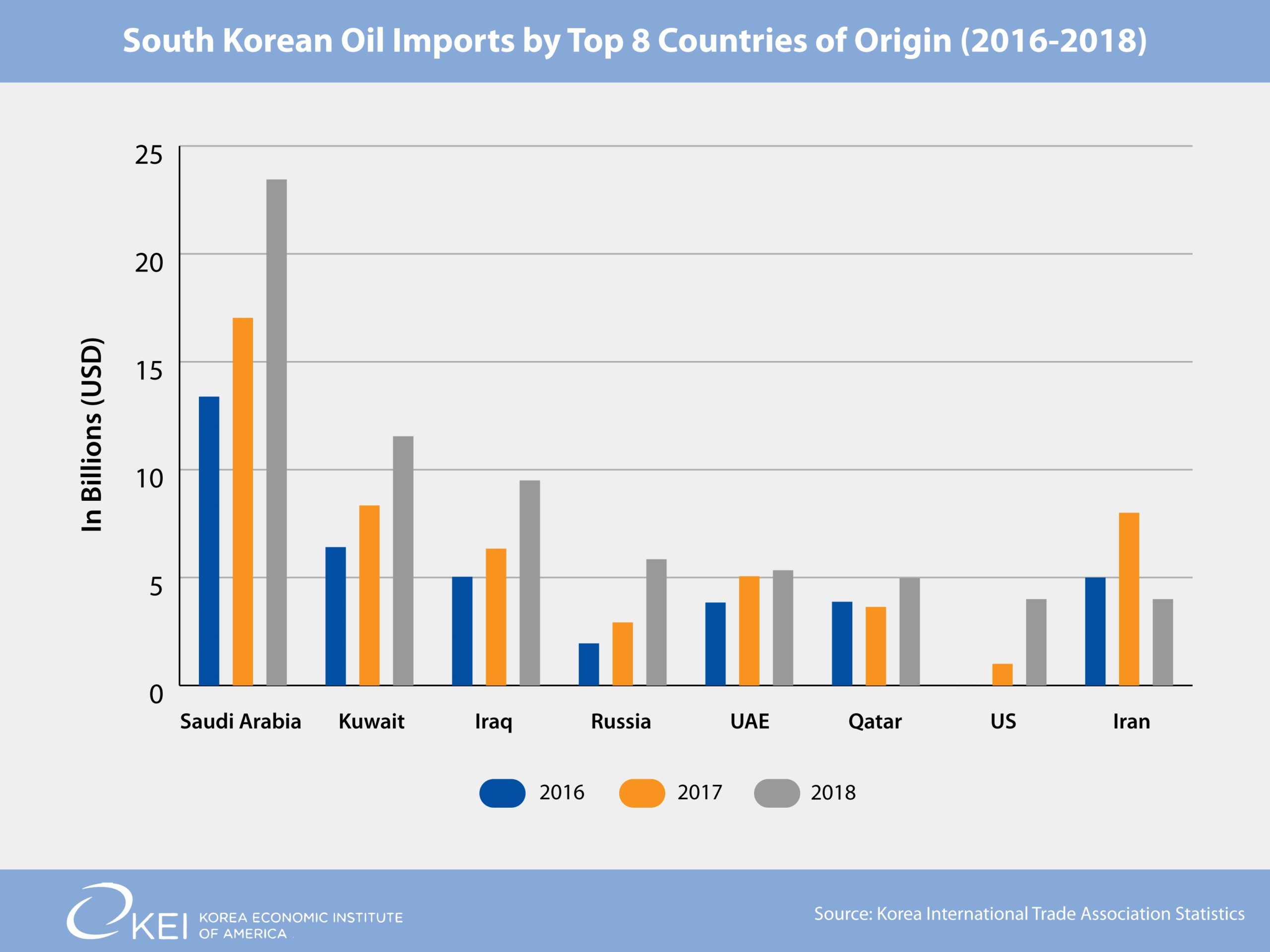

Demand for oil in South Korea has been growing in recent years, all of which must be met with imports. Total crude oil imports grew over from $44.3 billion in 2016 to $80.3 billion in 2018, making South Korea the fifth largest oil importing country last year. This demand has continued into 2019 – the volume of oil imports for the first three months this year is higher than it was during the same period last year.

Before the U.S. withdrawal from the Joint Comprehensive Plan of Action last spring, Iran was South Korea’s third largest source of oil. In 2017, Iran’s $7.5 billion in crude oil exports to South Korea were only behind Saudi Arabia’s $17 billion and Kuwait’s $8.3 billion. However, from September to December, 2018, Seoul cut off oil from Iran in response to Trump’s decision to reintroduce sanctions on Tehran. As a result, Iranian exports to South Korea last year only totaled $3.9 billion, dropping it down to the eighth largest provider of oil to South Korea.

Seoul has reopened the spigot since January, but the flow of Iranian oil has been relatively modest. From January to March, South Korea imported $1.2 billion in oil from Iran. The April imports will likely provide the final figure for the year, but, even with numbers suggesting a last big push before the May deadline, it seems unlikely to come close to last year’s total.

During the period of Iran’s diminishing exports, no other county among the largest exporters of oil to South Korea gained as much as the United States. The $4.5 billion in U.S. oil exports to South Korea last year was a 520% jump from 2017. The numbers for 2019 continue to be promising as the $1.8 billion in U.S. oil exports through March already represents an over 360% increase from the same period last year.

U.S. Secretary of State Mike Pompeo’s remarks that the U.S., Saudi Arabia, and the U.A.E will help to offset the losses from Iranian trade further provides reason to be bullish on U.S. oil exports to South Korea, but there also limitations.

Iranian and American crude oil are not perfect substitutes. There are some American sources that produce oil similar to that from Iran, but at a much lower rate. These may also be needed for more domestic consumption in the U.S. in the face of limited oil supply from Mexico and Canada and the now completely cut off supply from Venezuela after new sanctions enacted in in January. That many South Korean refineries are set up to specifically process Iranian oil will also add to the cost of the adjustment.

Still, the growing demand for oil in South Korea and the removal of a major competitor from the field – irrespective of the politics behind the decision – bodes well for American producers, now churning out more oil than any country thanks to the Shale Revolution.

Kyle Ferrier is the Director of Academic Affairs and Research at the Korea Economic Institute of America. The views expressed here are the author’s alone.

Photo from Enrico Strocchi’s photostream on flickr Creative Commons.